US stock rallied on Friday, with investors assessing whether an inflation slowdown could soon make the Federal Reserve reduce the pace of its most-aggressive tightening campaign in decades and prevent a hard landing. The next few weeks will be crucial in determining the sustainability of the rally. As the earnings season is almost over, economic reports are mixed at best and many Fed speakers are unwilling to sound too dovish. Apart from that, data Friday indicated that US consumer sentiment climbed to a three-month high on firmer expectations about the economy and personal finances. Inflation expectations were mixed, with consumers boosting their long-term views for prices slightly while reducing their year-ahead outlook for costs.

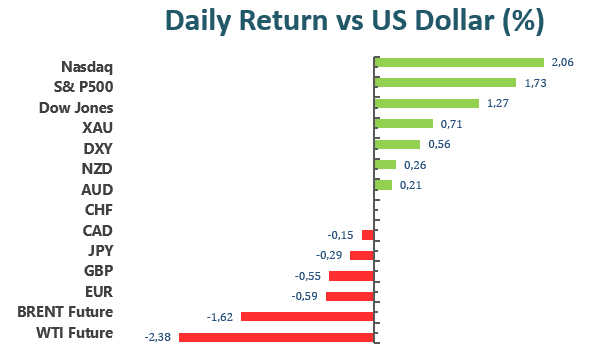

The benchmarks, S&P500 and Dow Jones Industrial Average both advanced on Friday, as S&P500 had a fourth straight week of gains, the longest such run since November. All eleven sectors stayed in positive territory, with Consumer Discretion, Information Technology, and Communication Service performing the best among all groups, rising 2.30%, 2.07%, and 2.02% respectively. Dow Jones Industrial Average rose 1.3%, Nasdaq 100 surged by 2.1% on daily basis, and the MSCI World index increased 1.1%.

Main Pairs Movement

US dollar advanced with a 0.56% gain on daily basis on Friday, as U.S. import prices declined for the first time in seven months on lower costs for both fuel and non-fuel products in the third report this week to hint inflation may have topped out. The DXY index witnessed fresh transactions and touched a daily high level above 105.8 during the US trading session, then lost bullish momentum and closed around the 105.7 level.

GBP/USD declined with a 0.55% loss on daily basis for the day, amid a strong pickup in USD demand. Moreover, the Preliminary GDP report showed that the UK economy contracted by 0.1% in Q2 as compared to the 0.8% rise in the previous quarter. Under such pressures, the cables dropped from 1.220 level to a level around 1.210 ahead of the US trading session. Meanwhile, EURUSD dropped and touched a daily low level below 1.024, and the pair fell 0.59% on Friday.

Gold rallied with a 0.71% gain on daily basis for the day, amid an upbeat market mood due to lower US inflation data. The XAUUSD observed fresh upward tractions and reached a daily -high level above $1802 marks during the US trading session. The WTI and BRENT oil dropped dramatically on Friday, falling 2.38% and 1.62% respectively.

Technical Analysis

EURUSD (4-Hour Chart)

The EUR/USD pair declined on Friday, coming under selling pressure and dropped to a daily low near the 1.027 mark heading into the US session amid the recovery witnessed in the US dollar. The pair is now trading at 1.02762, posting a 0.40% loss daily. EUR/USD stays in the negative territory amid a stronger US dollar across the board, as the mixed market mood helps the safe-haven greenback to find demand and undermined the EUR/USD pair. Moreover, The US Consumer Confidence Index improves to 55.1 in August, providing some support to the US dollar. For the Euro, the Eurozone Industrial Production rises 0.7% MoM in June, which surpassed the market’s expectations but failed to lift the shared currency higher.

For the technical aspect, the RSI indicator is 48 as of writing, suggesting the pair’s bearish outlook in the near term as the RSI falls below the mid-line. As for the Bollinger Bands, the price witnessed fresh selling and dropped below the moving average, therefore the downside momentum should persist. In conclusion, we think the market will be bearish as the pair is heading to test the 1.0246 support line. Additional losses toward 1.0158 could be witnessed if the pair dropped below that support.

Resistance: 1.0347, 1.0438, 1.0484

Support: 1.0246, 1.0158, 1.0111

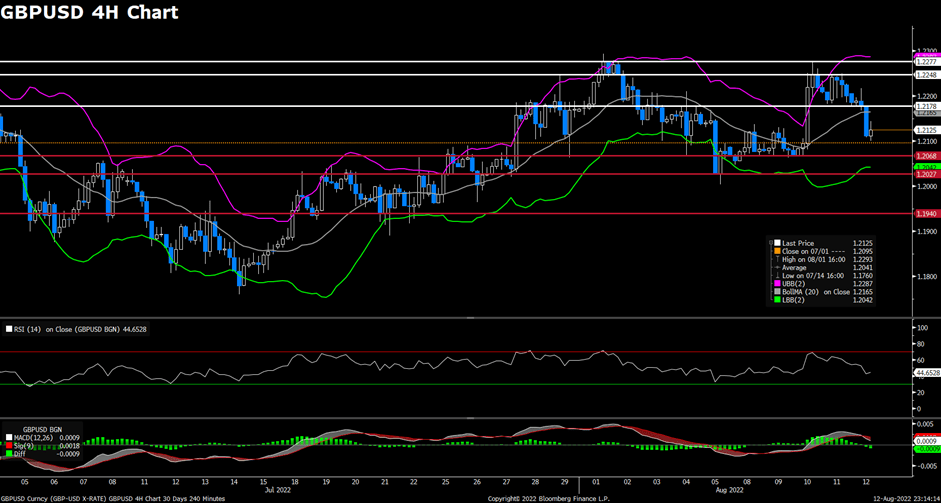

GBPUSD (4-Hour Chart)

The GBP/USD pair tumbled on Friday, being surrounded by bearish momentum and refreshed its daily low near the 1.210 mark during the US trading session amid renewed US dollar strength. At the time of writing, the cable stays in negative territory with a 0.67% loss for the day. The US dollar makes a solid comeback on the last day of the week and moved higher toward the $106 area, as investors are accessing the Fed’s rate hike move in the September meeting. Currently, the markets are pricing in a 60% probability of a 50 bps rate increase next month. For the British pound, the UK Preliminary GDP report showed that the UK economy contracted by 0.1% in Q2, which reinforce the speculations of a possible recession in Q4 and acted as a headwind for the GBP/USD pair.

For the technical aspect, the RSI indicator is 44 as of writing, suggesting that the downside is more favoured as the RSI stays below the mid-line. For the Bollinger Bands, the price dropped below the moving average and remained under pressure, therefore a continuation of the downside trend can be expected. In conclusion, we think the market will be bearish as long as the 1.2178 resistance line holds. Sellers could take action and trigger an extended downward correction if the pair break below the 1.2068 support.

Resistance: 1.2178, 1.2248, 1.2277

Support: 1.2068, 1.2027, 1.1940

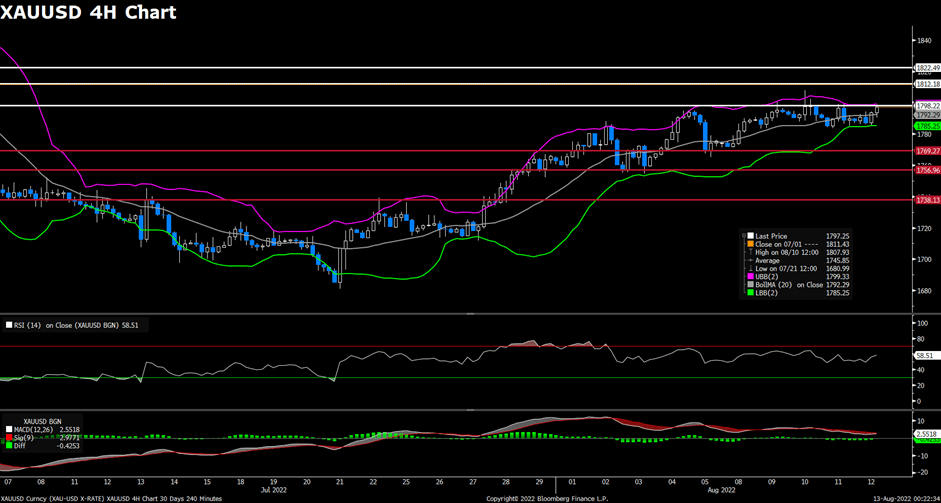

XAUUSD (4-Hour Chart)

Despite the US dollar regaining upside traction amid the mixed market mood and recent hawkish comments by Fed officials on Friday, the pair XAU/USD managed to stay relatively resilient and climbed modestly higher above the $1,795 area during the US trading session. XAU/USD is trading at 1795.01 at the time of writing, rising 0.27% daily. The softer-than-expected US inflation data during the week keeps investors hopeful that the Fed will tighten its policy less aggressively, expecting a 50 bps rate hike by the central bank. However, San Francisco Fed President Mary Daly said that she is open to a bigger rate hike if data warrants it. On top of that, the falling US Treasury bond yields also provided some support to the safe-haven metal.

For the technical aspect, the RSI indicator is 58 as of writing, suggesting that the upside is preserving strength as the RSI keeps heading north. For the Bollinger Bands, the price extended its bullish momentum and climbed above the moving average, therefore the upside traction should persist. In conclusion, we think the market will be bullish as the pair is testing the 1798 resistance line. A break above that level could favour the bull and open the door for additional gains.

Resistance: 1798, 1812, 1822

Support: 1769, 1756, 1738

Economic Data

| Currency | Data | Time (GMT + 8) | Forecast |

| JPY | GDP (QoQ) (Q2) | 07:50 | 0.6% |

| CNY | Industrial Production (YoY) (Jul) | 10:00 | 4.6% |