US stocks edged higher on Thursday, as mixed economic and earnings reports failed to spark a broad conviction trade. The weekly jobless claims data fell for the first time in three weeks, a sign of strength in demand for labour, while a gauge of manufacturing activity in the Philadelphia area unexpectedly expanded in August. Meantime, following the equity rally from June lows, sentiment turned fragile Wednesday after the Fed minutes signalled inflation-busting rate hikes will continue despite a weakening economy. Further clues for policy makers’ views may come at the Fed’s annual symposium in Jackson Hole, Wyoming next week.

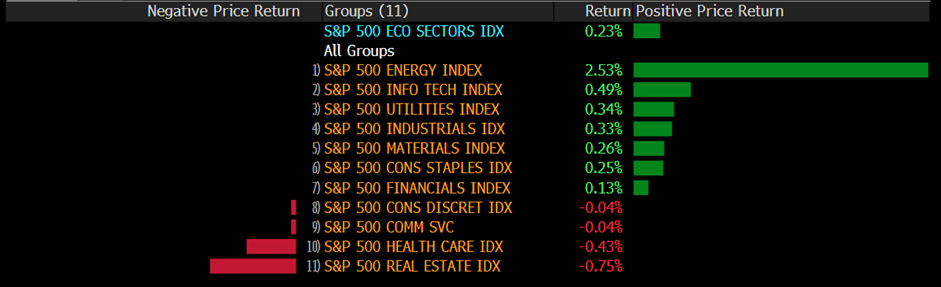

The benchmarks, both S& P500 and Nasdaq 100 advanced after swinging between modest gains and losses on Thursday. Seven out of eleven sectors of S& P500 stayed in the positive territory, as Energy got the best performance among all groups, which rose 2.53% on daily basis, while Real Estate underperformed and slid 0.75% for the day as existing-home sales fell for six straight months, indicating housing market’s rapid decline. The Dow Jones Industrial Average was little changed, the Nasdaq 100 rose 0.3%, and the MSCI World index was little changed on Thursday.

Main Pairs Movement

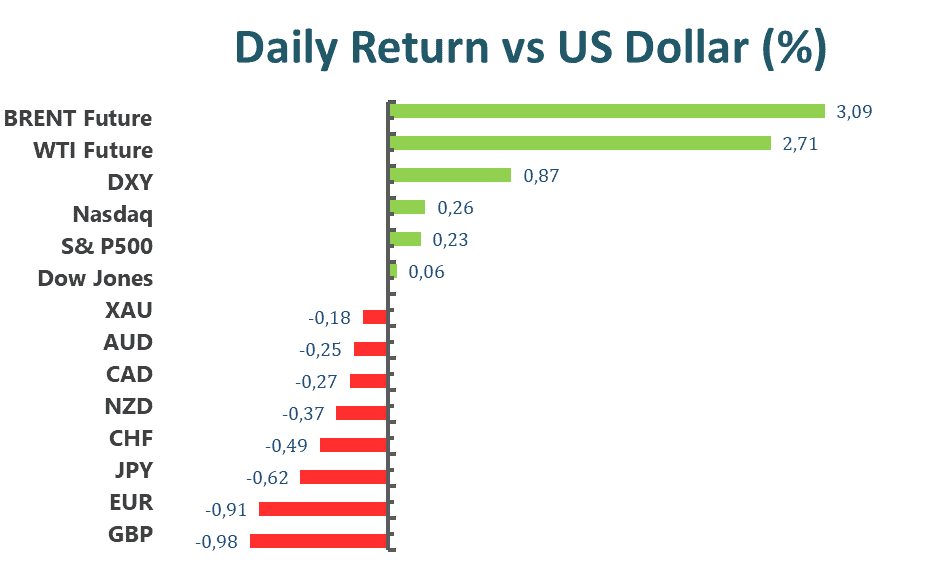

US dollar surged on Thursday, as Federal Reserve officials spoke of the need for further rate hikes, and investors need to reevaluate minutes from the US central bank’s July meeting on Wednesday as being more hawkish. The DXY index gained bullish momentum during the US trading session and broke through to a month-high level above 107.5 amid a cautious market mood.

The GBP/USD dropped 0.98% on Thursday, as the strong US dollar across the board was caused by the hawkish speech from Fed officials. The safe-haven greenback has witnessed strong transactions weighting the cables since the US trading session, and the pair touched nearly a month-low level below 1.193. Meanwhile, EUR/USD holds lower ground after refreshing its monthly bottom the previous day and fell to a level below 1.008 at the end of the day. The pair dropped 0.91% daily on Thursday.

Gold slid with a 0.18% loss for the day, as a four consecutive days decline. With hawkish Fed speech and fears surrounding China’s recession exert downside pressure. XAU/USD observed fresh tractions during the UK session and touched a daily-high level above $1,772 marks, but then lost upward momentum and dropped to a level below $1,760 marks during the US trading session. WTI and Brent oil surged on Thursday, rising 2.71% and 3.09% respectively.

Technical Analysis

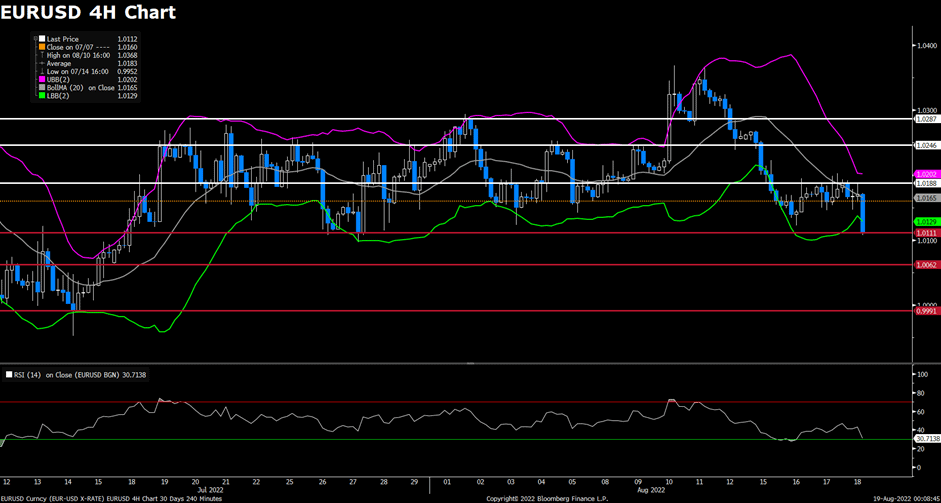

EURUSD (4-Hour Chart)

The EUR/USD pair declined on Thursday, being surrounded by bearish pressure and dropped to a daily low below 1.012 level at the start of the US session amid the risk aversion market environment. The pair is now trading at 1.0134, posting a 0.42% loss daily. EUR/USD stays in the negative territory amid renewed US dollar strength, as the better-than-expected US macro data provide some support to the safe-haven greenback and dragged the EUR/USD lower. The US Weekly Initial Jobless Claims declined to 250K and came in lower than the market expectation of 265K, which underpinned the expectations that the Fed would continue to tighten its monetary policy. For the Euro, the Eurozone inflation arrives at 8.9% YoY in July, meeting the market’s estimates. But the energy supply-related concerns keep being a key factor acting as a headwind for the shared currency.

For the technical aspect, the RSI indicator is 31 as of writing, suggesting that the pair is facing heavy selling pressure as the RSI is approaching the oversold zone. As for the Bollinger Bands, the price has moved out of the lower band so a strong downside trend continuation can be expected. In conclusion, we think the market will be bearish as the pair is testing the 1.0111 support. A break below that level could confirm the bearish bias in the near term and drag the pair lower toward 1.0062.

Resistance: 1.0188, 1.0246, 1.0287

Support: 1.0111, 1.0062, 0.9991

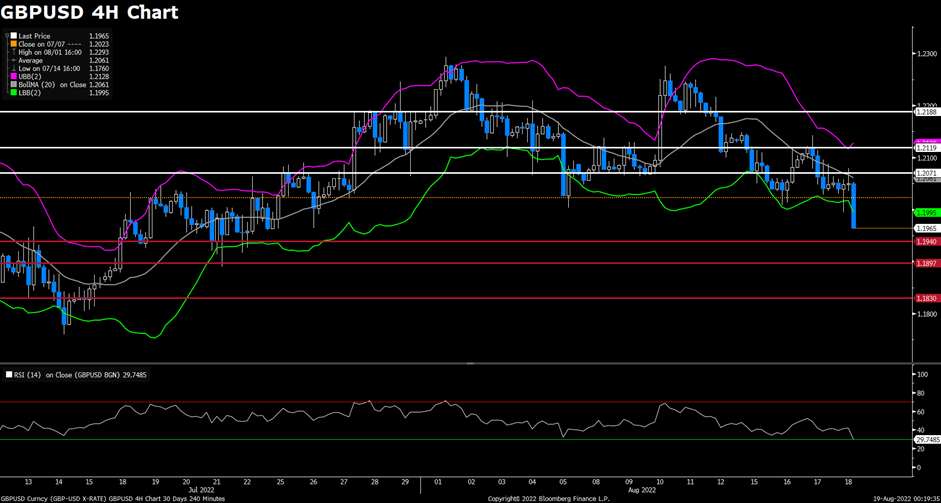

GBPUSD (4-Hour Chart)

The GBP/USD pair tumbled on Thursday, extending its previous slide and refreshing its daily low below the 1.200 mark heading into the US trading session amid a souring market mood. At the time of writing, the cable stays in negative territory with a 0.49% loss for the day. The hawkish commentary from Fed’s official helped the safe-haven Dollar to find demand, as San Francisco Fed President Mary Daly reiterated that it was way too early to declare victory on inflation in an interview with CNN on Thursday. She also said that either 50 bps or a 75 bps hike would be appropriate. For the British pound, the currency remained under pressure despite the hotter-than-expected UK CPI data, as investors now speculate that an economic downturn might force the BoE to adopt a gradual approach to raising interest rates.

For the technical aspect, the RSI indicator is 30 as of writing, suggesting the pair’s bearish outlook in the near term as the RSI is reaching the oversold zone. As for the Bollinger Bands, the price witnessed heavy selling pressure and dropped below the lower band, therefore the downside traction should persist. In conclusion, we think the market will be bearish as the pair is heading to test the 1.1940 support. Additional losses toward 1.1897 could be witnessed if the pair break below the aforementioned support.

Resistance: 1.2071, 1.2119, 1.2188

Support: 1.1940, 1.1897, 1.1830

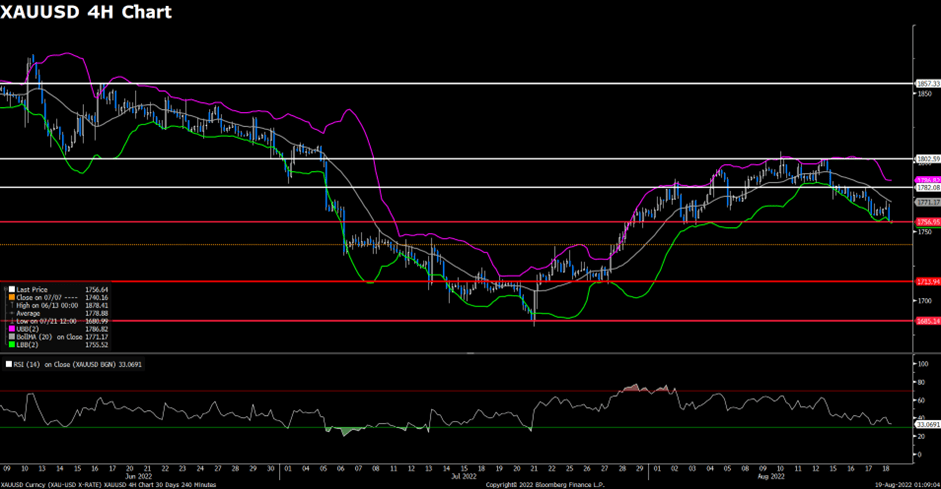

XAUUSD (4-Hour Chart)

Gold gains some positive traction on Thursday, but immediately declined back to the $1,760 level. A stronger US dollar is still weighing on Gold prices.

The dollar surged to a fresh monthly high on firm expectations that the Federal Reserve will continue to tighten monetary policy. Although the FOMC minutes released on Wednesday did not hint at a specific pace of future rate hikes, still show that policy makers remained committed to raising rates to tame inflation, which still supported bullish sentiment around the US dollar.

For the technical aspect, the RSI is 33 as of writing, are still in bearish mode but not reaching the oversold zone. As for the Bollinger Bands, the gold price keeps moving between the moving average and lower bound, forming a clear downward tunnel. The price seems to test support above the $1,757 level. If the price closes with negative price action below the $1,757 level on the 4H chart, it might head to test the next support level at the $1,714 level.

In conclusion, the fundamental background suggests that the most likely path for gold is to the downside. Even from a technical perspective, the recent positive moves are still seen as selling opportunities by investors, gold price, therefore, declined downward on the 4H Chart and hardly gained positive traction. We think the market is still bearish as fundamental background and technical analysis both support downward traction. Now, investors are looking forward to the US economic data, seeking broader risk sentiment which could provide clear direction and fresh momentum for gold prices.

Resistance: $1,783, $1,803, $1,857

Support: $1,757, $1,714, $1,685

Economic Data

| Currency | Data | Time (GMT + 8) | Forecast |

| GBP | Retail Sales (MoM) (Jul) | 14:00 | -0.2% |

| CAD | Core Retail Sales (MoM) (Jun) | 20:30 | 0.9% |