On Friday, the Dow Jones Industrial Average saw an increase, achieving its best monthly performance since January. The blue-chip index finished 0.8% higher, with the S&P 500 and the Nasdaq Composite also recording gains. The Dow rose by 2.5% for April, while the S&P 500 recorded a 1.5% monthly gain. More than half of S&P 500 companies have reported earnings so far, with 80% of those companies beating expectations, according to data from FactSet. As investors prepared for the Federal Reserve’s May policy meeting to begin, stock futures saw modest declines on Monday night.

During the regular trading session on Monday, the Dow, and Nasdaq Composite both experienced losses of about 0.1%, while the S&P 500 finished slightly below its flatline. Investors were focused on the bank sector after JPMorgan Chase won the weekend auction for troubled First Republic Bank. Additionally, investors will be monitoring data related to job openings, factory orders, and light vehicle sales, among other things. Companies such as Uber, Pfizer, and Molson Coors are set to report earnings before the bell, followed by Ford, Starbucks, Advanced Micro Devices, and Caesars Entertainment after the market closes.

Treasury Secretary Janet Yellen warned that the US may run out of measures to pay its debts as early as June 1, which investors are also watching for news on the debt ceiling.

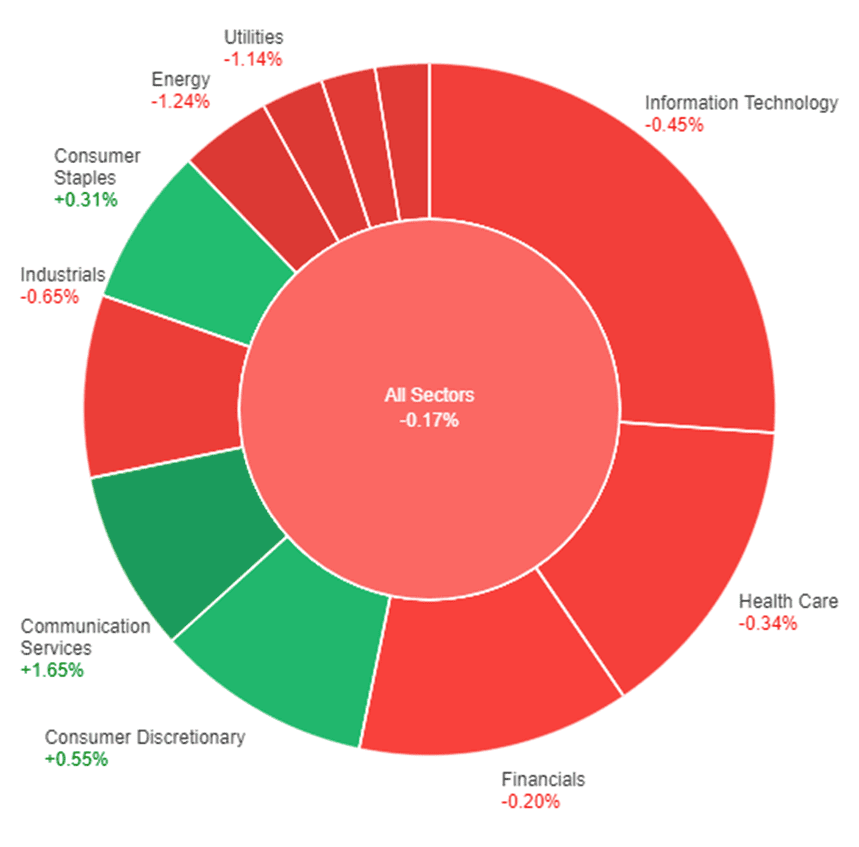

On Monday, there was a slight decline of 0.04% in all sectors of the market, except for Health Care, which saw an increase of 0.59%, and Industrials and Utilities, which both saw a rise of 0.55% and 0.21%, respectively. Information Technology and Consumer Staples also saw minor gains of 0.18% and 0.09%, respectively. However, Real Estate and Consumer Discretionary both saw significant losses of 0.92% and 1.06%, respectively, while Energy experienced the largest decline of 1.26%.

Major Pair Movement

On Monday, the dollar index rose by 0.45% following the release of inflationary ISM data and JPM’s acquisition of FRC, which provided relief for the US bank crisis. This increase in the dollar index has increased the likelihood of a Fed rate hike on Wednesday, with a slightly higher probability of one more in June. This rise in the dollar index has also threatened to reverse the previous downtrend caused by the US banking crisis, which saw USD/JPY rates and risk-off-driven dive. However, USD/JPY soared on Monday, extending sharp gains following Friday’s dovish BoJ meeting.

EUR/USD fell by 0.4% after testing the 21-day moving average on Friday and last week’s lows. If the U.S. JOLTS and Wednesday’s ISM non-manufacturing and ADP reports favor a more hawkish Fed, there is an increased risk of an overbought top triggering a more significant correction of the March-April bank crisis-driven rally. Sterling experienced a 0.6% loss, but it remained above Friday’s lows by the 21-DMA. Meanwhile, IMM specs are the most net long EUR/USD since November 2020, expecting Fed rate cuts to begin while the ECB continues to hike later this year.

Technical Analysis

EUR/USD (4 Hours)

The EUR/USD pair experienced fluctuations on Monday and closed lower near an intraday low of 1.0963. The US dollar gained support from rising government bond yields and positive macroeconomic figures, including the April ISM Manufacturing PMI improving more than anticipated. Wall Street also saw gains, following news that JP Morgan rescued First Republic Bank assets with approval from the US regulator. Germany will release March Retail Sales and the Eurozone will unveil the preliminary estimate of the April Harmonized Index of Consumer Prices. The week will continue with the Fed and ECB’s monetary policy decisions and end with the US Nonfarm Payrolls report.

Based on the technical analysis, the EUR/USD pair has moved lower and broken below the 1.1000 level. Currently, the price has moved slightly higher after reaching the lower band of the Bollinger band, with expectations of moving higher and targeting the middle band. It is anticipated that the EUR/USD will reach the resistance level at 1.1013. The Relative Strength Index (RSI) is currently at 47, indicating that the market is neutral for the EUR/USD.

Resistance: 1.1013, 1.1068

Support: 1.0962, 1.0913

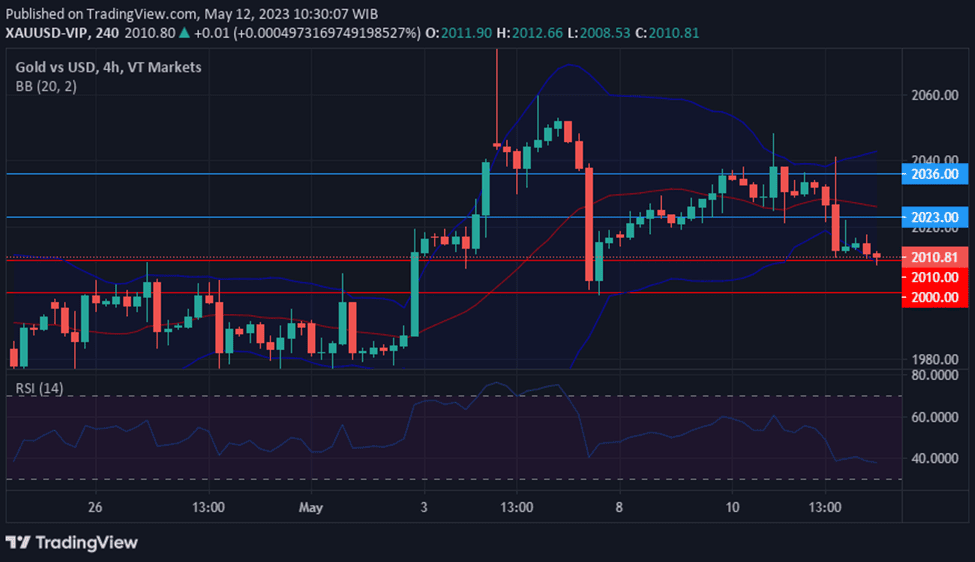

XAU/USD (4 Hours)

Gold (XAU/USD) prices were volatile on Monday, falling to $1,977 per troy ounce during the Asian session before recovering to $2,005.98 ahead of the US stock market opening. Thin volumes exacerbated movements, with most major financial markets closed for Labour Day. The US Dollar surged during the American session after the US published upbeat data, including March Construction Spending, which rose by 0.3% MoM, and the April ISM Manufacturing PMI, which printed at 47.1, beating expectations despite still signaling contraction. The rising US government bond yields also supported the dollar, with the 10-year Treasury note currently yielding 3.55%.

Meanwhile, the stock markets rose following news that JP Morgan took over the troubled First Republic Bank, which collapsed after customers withdrew over $100 billion in March. The Federal Deposit Insurance Corporation (FDIC) backed the deal, calming fears.

Based on technical analysis, XAU/USD is still moving in consolidation mode reaching the high and low. XAU/USD has the potential to move back higher as the price is moving toward the middle band after getting the lower band of the Bollinger band. The Relative Strength Index (RSI) currently stands at 47, suggesting a neutral trend in XAU/USD.

Resistance: $1,993, $2,005

Support: $1,977, $1,969

Economic Data

| Currency | Data | Time (GMT + 8) | Forecast |

| AUD | Cash Rate | 12:30 | 3.60% |

| AUD | RBA Rate Statement | 12:30 | 247K |

| AUD | RBA Gov Lowe Speaks | 19:20 | |

| USD | JOLTS Job Openings | 22:00 | 9.74M |