On Thursday, a positive turnaround in the stock market was driven by strong performances from tech companies, notably Apple, following a buy rating upgrade from Bank of America. The Dow Jones Industrial Average gained 201.94 points, the Nasdaq surged by 1.35%, and the S&P 500 climbed 0.88%. The 10-year Treasury yield rose to 4.14% amid tight labor market conditions, leading to concerns about fewer expected rate cuts by the Federal Reserve. In currency markets, the USD index rebounded, affecting pairs like EUR/USD and USD/JPY. GBP/USD held gains, supported by robust UK data. Commodity-centric currencies rose, while Bitcoin declined 2.75% due to higher global yields, contrasting its recent high on January 11.

Stock Market Updates

On Thursday, the stock market experienced a positive turnaround, with tech companies, particularly Apple, leading the way. The Dow Jones Industrial Average rebounded from an earlier loss, gaining 201.94 points or 0.54%, closing at 37,468.61. The Nasdaq Composite surged by 1.35%, reaching 15,055.65, while the S&P 500 climbed 0.88% to end at 4,780.94, just 0.33% away from its closing record. Apple’s shares saw a significant increase of around 3.3% after Bank of America upgraded the stock to a buy rating, predicting over 20% upside over the next 12 months. Other tech-related stocks, such as Taiwan Semiconductor Manufacturing Co., also contributed to the positive momentum, with the VanEck Semiconductor ETF reaching an all-time high, boosted by strong earnings and revenue results.

Additionally, the 10-year Treasury yield rose to 4.14% as fresh jobs data indicated tightness in the labor market, with first-time unemployment insurance filings coming in at 187,000 for the week ended Jan. 13. This stronger-than-expected labor market, combined with robust consumer spending, has raised concerns among investors about potential fewer rate cuts from the Federal Reserve than anticipated. The market is currently pricing in a roughly 56% chance of a quarter percentage point rate cut in March, according to the CME FedWatch Tool. Atlanta Fed President Raphael Bostic’s statement that he expects the central bank to start reducing rates in the third quarter contributed to the market’s uncertainty, as it deviates from the market’s expectations for a faster rate cut.

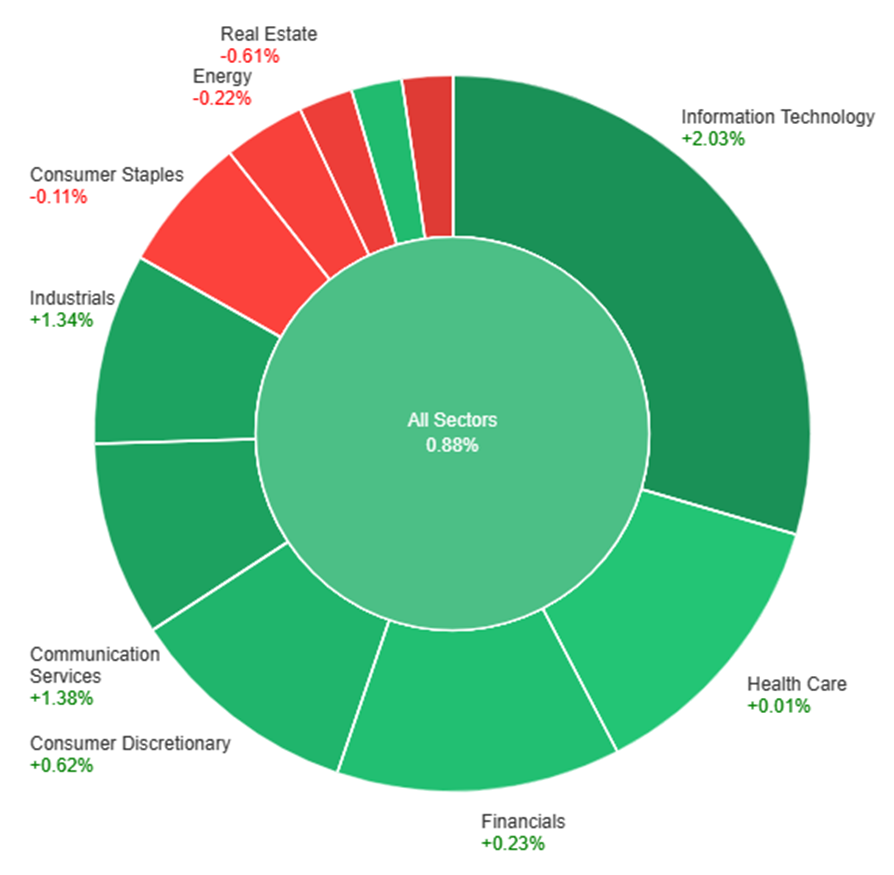

Data by Bloomberg

On Thursday, the overall market showed positive performance with a gain of 0.88%. The Information Technology sector led the way with a notable increase of 2.03%, followed by Communication Services and Industrials, which rose by 1.38% and 1.34%, respectively. Consumer Discretionary and Materials also saw modest gains at 0.62% and 0.39%. However, some sectors experienced declines, including Consumer Staples (-0.11%), Energy (-0.22%), Real Estate (-0.61%), and Utilities (-1.05%). Health Care showed minimal movement with a marginal increase of 0.01%. Overall, the day reflected a mixed performance across various sectors in the market.

Currency Market Updates

In the currency markets, the USD index rebounded from early lows during the North American trading session, gaining 0.23% in the U.S. afternoon. The surge came after jobless claims data came in below expectations, reducing the likelihood of a March rate cut by the Federal Reserve to 60%. This development suggested that the U.S. economy might not be slowing as initially thought. Meanwhile, the EUR/USD pair fell by 0.22% to 1.0858, with traders closely monitoring declining eurozone growth. USD/JPY reversed its overnight low-yield-related weakness, rising to 148.30 after the positive claims data, although it fell short of breaking Wednesday’s high of 148.53. Traders adopted a defensive stance ahead of Japan’s CPI release on Friday, lightening recent long positions in anticipation, even though expectations for the data prompting a shift to higher rates by the Bank of Japan remained low.

In contrast, GBP/USD held a slight gain, increasing by 0.14% to 1.2692 during New York afternoon trading. Despite facing resistance around the 1.27 level, the inability of bears to build on gains above this threshold hinted at an underlying bid near 1.26. The diminished expectations of a Fed rate cut were underscored by UK data, including Wednesday’s CPI, which exceeded forecasts, indicating that the Bank of England was unlikely to pivot to rate cuts in the near term. Other currency pairs, such as AUD/USD, rose by 0.15% to 0.6561, while USD/CAD remained flat at 1.3504. The latter was supported by rising oil and copper prices, benefiting commodity-centric currencies. In the cryptocurrency space, Bitcoin experienced a 2.75% decline, reaching a new one-month low at $41.3k, following its 21-month high at $49k on January 11. The dip in Bitcoin’s value was attributed to higher global yields, which did not bode well for crypto holders despite the coin being only down 1% year-to-date.

Picks of the Day Analysis

EUR/USD (4 Hours)

EUR/USD Holds Near Year-to-Date Lows as Greenback Gains Momentum Amidst Robust US Economic Indicators and Fed Uncertainty

On Thursday, the EUR/USD pair maintained a selling bias, settling around year-to-date lows near 1.0840 before experiencing a slight recovery. The uptrend in the US dollar was fueled by strong labor market results and a rebound in the Philly Fed Manufacturing Index. The USD Index (DXY) retained its bullish stance, supported by comments from Atlanta Fed President R. Bostic, hinting at potential rate cuts before July if inflation slows more rapidly than anticipated. Despite a baseline plan for rate reductions in the third quarter, caution is emphasized to avoid premature cuts. The market currently places a 55% probability of a Fed rate cut in March.

On Thursday, the EUR/USD moved slightly higher, able to reach the middle band of the Bollinger Bands. Currently, the price moving just above the middle band, suggesting a potential upward movement to reach the upper band. Notably, the Relative Strength Index (RSI) maintains its position at 46, signaling a neutral outlook for this currency pair.

Resistance: 1.0954, 1.1000

Support: 1.0863, 1.0814

XAU/USD (4 Hours)

XAU/USD Stabilizes Above $2,000 Amid Economic Uncertainties and Mixed Data

Gold (XAU/USD) has found a foothold around $2,015 per troy ounce after hitting a multi-week low of $2,001.68 earlier in the week. The precious metal rebounded as market sentiment improved slightly, countering the impact of a positive US Dollar driven by concerns over the housing sector and lackluster growth-related data. Despite initial pessimism from Asian shares, optimism grew on Wall Street with better-than-expected US data, including housing starts, building permits, and lower-than-anticipated jobless claims. Federal Reserve officials provided no fresh insights into future monetary policy, leaving investors navigating a landscape of economic uncertainties.

On Thursday, XAU/USD moved higher and reached the middle band of the Bollinger Bands. Currently, the price moving just below the middle band suggesting a potential upward movement to reach above the middle band. The Relative Strength Index (RSI) stands at 48, signaling a neutral outlook for this pair.

Resistance: $2,035, $2,052

Support: $2,010, $1,993

Economic Data

| Currency | Data | Time (GMT + 8) | Forecast |

|---|---|---|---|

| GBP | Retail Sales m/m | 15:00 | -0.5% |

| USD | Prelim UoM Consumer Sentiment | 23:00 | 69.8 |