In a tumultuous day for the stock market, major indexes, including the Dow Jones Industrial Average, S&P 500, and Nasdaq Composite, saw significant declines as corporate earnings reports fell short of expectations. The 10-year Treasury yield reached levels not seen since 2007, signaling rising interest rates, while mortgage rates hit a two-decade high. Individual companies were impacted by their earnings reports, with some facing notable declines and others, like Procter & Gamble, experiencing stock gains. The market’s focus has now shifted to revenue growth during the earnings season, and geopolitical factors, such as the Israel-Hamas conflict and U.S. President Joe Biden’s visit to Israel, also influenced market sentiment. Meanwhile, in the currency market, the U.S. dollar saw a modest increase, driven by losses in the EUR/USD and GBP/USD pairs. The rise in Treasury yields compared to bunds attracted investors seeking safety amid growing geopolitical risks.

Stock Market Updates

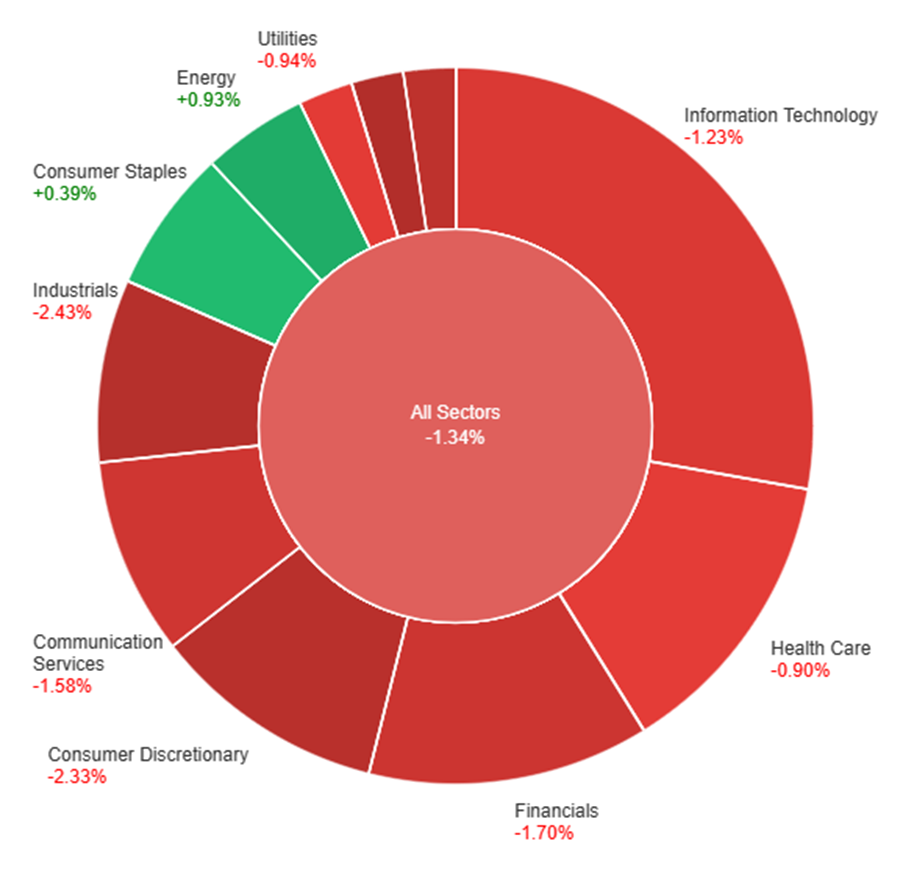

Stocks experienced a decline on Wednesday as corporate earnings reports continued to roll in, and Treasury yields reached multiyear highs. The Dow Jones Industrial Average fell 332.57 points, or 0.98%, to close at 33,665.08. Similarly, the S&P 500 dropped 1.34% to 4,314.60, while the Nasdaq Composite slipped 1.62% to 13,314.30. None of these major indexes traded in positive territory throughout the day. A key development was the 10-year Treasury yield surpassing 4.9%, a level not seen since 2007, signaling rising interest rates. Simultaneously, the average 30-year fixed mortgage rate hit 8%, the highest rate since 2000.

Earnings reports had a notable impact on individual companies’ stock prices. Companies like J.B. Hunt and United Airlines faced significant declines due to disappointing earnings and soft guidance. In contrast, Procter & Gamble’s stock rose after beating analyst expectations. The market’s attention is now shifting to revenue growth during this earnings season, as investors assess which companies are experiencing increased demand and which are merely improving earnings through cost-cutting measures. Additionally, chip stocks faced challenges as restrictions on the sale of advanced artificial intelligence chips to China were announced by the U.S. Department of Commerce, leading to continued selling in the sector. Geopolitical factors, such as the ongoing Israel-Hamas conflict and U.S. President Joe Biden’s visit to Israel, also contributed to market sentiment.

Data by Bloomberg

On Wednesday, the overall market experienced a decline of 1.34%. Among the various sectors, there was a mixed performance. Energy and Consumer Staples saw gains of 0.93% and 0.39%, respectively. In contrast, there were losses in several sectors, with the largest declines in Consumer Discretionary (-2.33%), Industrials (-2.43%), and Materials (-2.58%). Other sectors, including Health Care, Utilities, Information Technology, Communication Services, Financials, and Real Estate, also saw losses ranging from -0.90% to -2.18%.

Currency Market Updates

In recent currency market updates, the US dollar experienced a modest increase, with the dollar index rising by 0.16%. This rise was primarily driven by losses in the EUR/USD and GBP/USD currency pairs. The increase in Treasury yields compared to bunds attracted investors seeking safety amid growing geopolitical risks. However, it’s worth noting that the yen and Swiss franc appreciated more against other currencies than the US dollar did, particularly against high-beta currencies. EUR/USD faced a decline of 0.23% as the spreads between 2-year bund and Treasury yields reached their most negative levels since August. Additionally, 10-year spreads were at their lowest point since May 2022, but a late pullback in Treasury yields may influence the overall trend. Notably, there hasn’t been a close below 1.0500 for EUR/USD since October 3.

The market also observed that concerns over the Israel-Hamas conflict potentially impacting energy supplies posed a greater threat to eurozone countries that rely more heavily on energy imports than the United States. Meanwhile, the rise in 2-year Treasury yields was influenced by stronger-than-expected US economic data and comments from Federal Reserve speakers favoring maintaining higher interest rates for an extended period while monitoring economic indicators. Unless the Fed decides to raise rates again in January, which is currently priced at a 50% probability, there may be limited upside left for 2-year yields. Other notable movements included a decline in the British pound (GBP) as risk-off sentiment prevailed, though gilt-treasury yield spreads rebounded slightly due to above-forecast UK inflation data. The Australian dollar and other risk-sensitive currencies also fell, while the Chinese yuan slipped following brief gains on above-forecast Chinese data. Upcoming economic events include jobless claims, existing home sales, and comments from Federal Reserve Chair Jerome Powell.

Picks of the Day Analysis

EUR/USD (4 Hours)

EUR/USD Slips Below Key Moving Average as US Dollar Strengthens Amid Geopolitical Concerns and Soaring Treasury Yields

EUR/USD dropped below the 20-day Simple Moving Average (SMA) as it faced resistance at 1.0600, primarily due to the US Dollar’s overall strength driven by deteriorating market sentiment and rising Treasury yields. The initial boost in market sentiment from positive Chinese growth data was short-lived, with geopolitical concerns taking center stage and further supporting the US Dollar. The 10-year Treasury yield reached its highest level since 2007 at 4.92%, adding to the Greenback’s momentum. The upcoming economic data releases and a speech by Federal Reserve Chair Powell, underscore the continuing bearish trend for the EUR/USD pair due to favorable fundamentals for the US Dollar.

Based on technical analysis, the EUR/USD was slightly lower on Wednesday, pushing towards the middle band of the Bollinger Bands. Currently, the EUR/USD is trading just below the middle band, suggesting the potential for another lower movement. The Relative Strength Index (RSI) stands at 44, indicating that the EUR/USD is still in neutral bias.

Resistance: 1.0573, 1.0616

Support: 1.0502, 1.0460

XAU/USD (4 Hours)

XAU/USD Surges to Two-Month High Amid Escalating Middle East Tensions

Gold (XAU/USD) made a strong resurgence, hitting a fresh two-month high at $1,962.62 per troy ounce as Middle East tensions escalated. Despite some mid-American session retracement to around $1,949, XAU/USD maintained its gains, partly due to the U.S. Dollar’s uptick following a decline in stock markets. Meanwhile, President Joe Biden’s brief visit to Israel further heightened the geopolitical situation in the region. Mixed macroeconomic data, including robust Chinese growth and higher-than-expected UK inflation, added to market uncertainty, leading to a 0.52% decline in the Dow Jones Industrial Average amid a challenging day for earnings reports.

Based on technical analysis, XAU/USD is moving slightly higher on Wednesday and is able to reach the upper band of the Bollinger Bands. Currently, the price of gold is moving just below the upper band, suggesting a possible correction to reach the middle band. The Relative Strength Index (RSI) currently registers at 69, indicating a bullish bias for the XAU/USD pair.

Resistance: $1,952, $1,962

Support: $1,939, $1,928

Economic Data

| Currency | Data | Time (GMT + 8) | Forecast |

|---|---|---|---|

| AUD | Employment Change | 08:30 | 6.7K (Actual) |

| AUD | Unemployment Rate | 08:30 | 3.6% (Actual) |

| USD | Unemployment Claims | 20:30 | 210K |