The markets witnessed a surge as major indices edged closer to historic peaks in the final week of the year. The S&P 500, Nasdaq Composite, and Dow Jones Industrial Average all marked significant gains, with the Nasdaq 100 hitting a new all-time high. Wall Street’s bullish run continued, fueled by optimism stemming from encouraging inflation data aligning with the Federal Reserve’s targets. Meanwhile, the USD/JPY pair saw movement, while the Australian Dollar stood strong against a subdued US Dollar, influenced by potential central bank stances. Furthermore, developments in China’s industrial profits hinted at a slowdown, impacting trade relations and currency movements. In the currency markets, the EUR/USD pair maintained stability, influenced by data-driven decisions by the ECB and prevailing market sentiment, as economic data remained minimal.

Stock Market Updates

Stocks surged at the onset of the final week of the year, propelling major indices closer to historic peaks. The S&P 500 escalated by 0.42% to reach 4,774.75, nearing its all-time high of 4,796.56 from January 2022. Similarly, the Nasdaq Composite surged by 0.54% to settle at 15,074.57, while the Dow Jones Industrial Average gained 159.36 points, closing at 37,545.33, marking a 0.43% increase. The Nasdaq 100 notably climbed by 0.6%, achieving a new all-time high and ending at 16,878.46.

The market’s bullish trajectory persisted as the S&P 500 approached record levels, merely less than 1% away from its previous peak. Wall Street sustained this momentum, with the S&P 500 marking its eighth consecutive weekly advance, the lengthiest streak since 2017, and similar winning streaks observed in the Dow and Nasdaq Composite. Investor optimism soared following encouraging inflation data indicating a closer alignment with the Federal Reserve’s 2% target. Moreover, the anticipation of potential rate cuts in the upcoming year further bolstered equities, contributing to recent weeks’ market upswings.

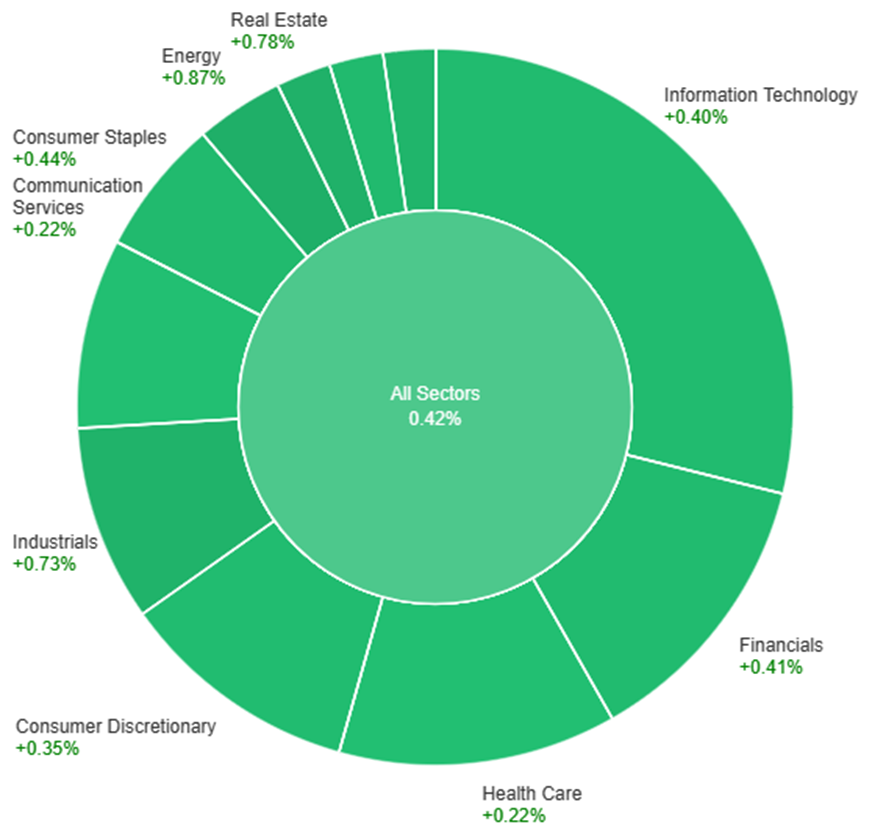

Data by Bloomberg

On Tuesday, across various sectors, the market saw a positive trend with a general increase in most sectors. Energy stood out with a notable rise of 0.87%, leading the charge, followed closely by Real Estate at 0.78% and Industrials at 0.73%. Utilities and Materials showed moderate gains at 0.65% and 0.44% respectively, aligning with Consumer Staples also at 0.44%. Financials and Information Technology both saw increases of around 0.4%, while Consumer Discretionary showed a slight uptick of 0.35%. Communication Services and Health Care trailed the pack with a smaller increase of 0.22% each. Overall, the market demonstrated positive momentum, particularly in the Energy and Real Estate sectors on Tuesday.

Currency Market Updates

The USD/JPY pair experienced upward movement, reaching 142.84 after the Bank of Japan’s Summary of Opinions release, with the market showing quiet activity amidst the holiday season’s thin trading. The BoJ hinted at potential policy shifts if the wage-price cycle strengthens but has not finalized the timing for such changes. Meanwhile, in the US, the latest Core PCE figures fell slightly below expectations, signaling a 3.2% YoY growth in November, potentially influencing the Federal Reserve’s future interest rate decisions. Amidst these developments, the currency market awaits the US Richmond Fed Manufacturing Index and Initial Jobless Claims for further insights, but their impact might be limited given the prevailing light trading conditions.

Concurrently, the Australian Dollar stood at a five-month high against a subdued US Dollar, backed by the Australian central bank’s potential hawkish stance in early 2024 due to robust inflation. However, China’s reported decline in Industrial Profits for January to November by 4.4% hints at a slowdown, prompting expectations for additional policy support to bolster the second-largest global economy. This slowdown could impact the RBA’s stance, considering the significance of trade relations between Australia and China. The weakening US Dollar Index, influenced by Fed easing speculations and declining Treasury yields, further highlights the prevailing pressure on the Greenback.

On the EUR/USD front, the pair traded near August’s highest level around 1.1040, encountering minimal losses. The Core PCE figures in the US slightly missed expectations, growing 3.2% YoY, while the Eurozone witnessed a consistent ECB policy stance, with no change in interest rates. The ECB’s data-driven decisions, clarified by President Christine Lagarde, and the slightly more hawkish tone from ECB Vice President Luis de Guindos may contribute to lifting the Euro and maintaining stability for the EUR/USD pair. However, with minimal top-tier economic data expected, market sentiment remains a crucial factor influencing the pair’s movement.

Picks of the Day Analysis

EUR/USD (4 Hours)

EUR/USD Sees Mild Losses Amidst Light Trading

The EUR/USD pair hovers near 1.1037, experiencing marginal setbacks amidst subdued trading conditions. The Federal Reserve’s favored inflation metric, the Core PCE, exhibited a 3.2% year-on-year growth, slightly under the anticipated 3.3%, further affecting the US Dollar’s stance. Conversely, ECB statements from President Christine Lagarde emphasized the bank’s data-dependent approach, dismissing market pressures. Eurozone outlook remained cautiously optimistic, with ECB Vice President Luis de Guindos highlighting a reluctance to alter monetary policy prematurely. As economic calendars lack major data releases, the EUR/USD trend hinges on prevailing market sentiment, potentially swayed by upcoming US Richmond Fed Manufacturing Index and Initial Jobless Claims reports, influencing near-term price movements.

On Tuesday, the EUR/USD moved slightly higher and tried to reach the upper band of the Bollinger Bands. Currently, the price moving slightly below the upper band, suggesting a potential upward movement. Notably, the Relative Strength Index (RSI) maintains its position at 64, signaling a neutral but slightly bullish outlook for this currency pair.

Resistance: 1.1042, 1.1138

Support: 1.0946, 1.0852

XAU/USD (4 Hours)

XAU/USD Holds Steady Above $2,060 Amid Dollar Weakness and Easing Speculations

In the early Asian session, Gold (XAU/USD) maintained its position above $2,060 despite a marginal 0.09% dip, set amidst a quiet trading week expected due to light volumes in the final stretch of 2023. The US Dollar weakened against its counterparts, pressing the US Dollar Index (DXY) to its lowest since July near 101.45. As Treasury yields edged lower, resting at 3.89%, expectations of Federal Reserve easing intensified, with the market pricing in potential cuts in January and fully anticipating cuts by March 2024. This dovish stance, alongside recent data showing a softer increase in the Core PCE, has positioned lower interest rates as a potential boon for gold, reducing its opportunity cost as a non-yielding asset. Geopolitical tensions in the Middle East, particularly Yemen’s threat to Red Sea shipping and Iran’s potential actions in the Gibraltar Strait, are adding pressure, potentially elevating gold’s safe-haven appeal. Traders are keenly observing the unfolding geopolitical landscape alongside upcoming economic indicators like the US Richmond Fed Manufacturing Index and Initial Jobless Claims.

On Tuesday, XAU/USD moved slightly higher and tried to reach the upper band of the Bollinger Bands. Currently, the price moving just below the upper band, suggesting a potential upward movement. The Relative Strength Index (RSI) stands at 62, signaling a neutral but slightly bullish outlook for this pair.

Resistance: $2,068, $2,088

Support: $2,048, $2,031