On Wednesday, the stock market saw a downturn driven by increasing Treasury yields influenced by robust U.S. economic data. The Dow Jones Industrial Average posted its third consecutive day of losses, dropping by 0.25%, while the S&P 500 and Nasdaq Composite slid 0.56% and 0.59%, respectively. Notable stock movements included a 1.3% drop for Charles Schwab and a 1.3% gain for Boeing. The market reaction was shaped by stronger-than-expected December retail sales data, casting doubt on the need for aggressive rate cuts by the Federal Reserve. The 10-year Treasury yield rose to 4.102%, and traders are estimating a 57% chance of rate cuts in March. In the currency market, the Greenback showed strength, impacting currency pairs like EUR/USD, GBP/USD, and USD/JPY. Gold and Silver prices declined due to the intense dollar rally, while WTI prices rose above $72.00 per barrel amid OPEC’s optimistic report. Traders are eagerly anticipating the EIA’s weekly report on U.S. crude oil inventories for further market cues.

Stock Market Updates

Stocks experienced a decline on Wednesday, influenced by rising Treasury yields following robust U.S. economic data. The Dow Jones Industrial Average marked its third consecutive day of losses, falling by 0.25%, while the S&P 500 and Nasdaq Composite slid 0.56% and 0.59%, respectively. Notable stock movements included a 1.3% drop for Charles Schwab due to mixed quarterly results, while Boeing saw a 1.3% gain, countering recent losses and positioning itself as one of the Dow’s leading gainers.

The market reaction was partly shaped by stronger-than-expected December retail sales data, suggesting a resilient consumer and casting doubt on the need for aggressive rate cuts by the Federal Reserve. Retail sales increased by 0.6% from November, exceeding economist estimates, potentially influencing the Fed’s monetary policy decisions. The 10-year Treasury yield rose to 4.102%, driven by Federal Reserve Governor Christopher Waller’s caution about a slower-than-anticipated easing of monetary policy. Traders, as reflected in CME Group’s FedWatch tool, are currently estimating a 57% chance of the Federal Reserve initiating rate cuts in March.

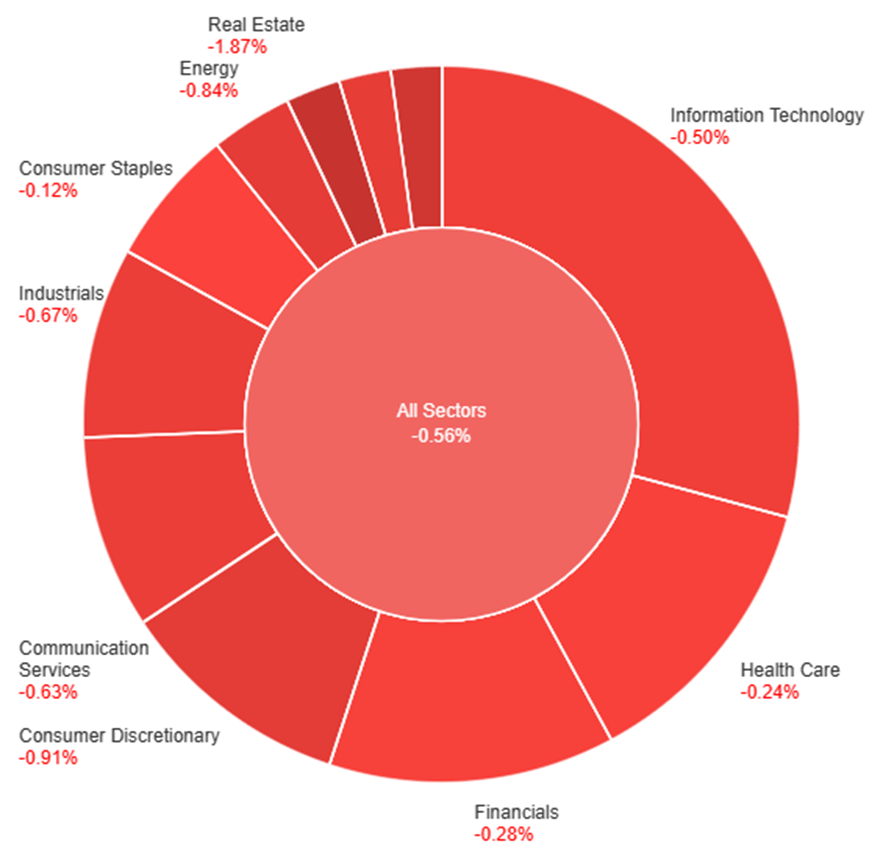

Data by Bloomberg

On Wednesday, across various sectors, the market experienced a downward trend, with the overall performance showing a decline of 0.56%. Notably, Utilities and Real Estate were the hardest hit, witnessing substantial decreases of 1.52% and 1.87%, respectively. Other sectors, including Consumer Discretionary, Energy, and Materials, also faced notable declines ranging from 0.80% to 0.91%. The weakest performers among the major sectors were Communication Services (-0.63%), Industrials (-0.67%), and Information Technology (-0.50%). The day saw a broad-based negative impact on the market, reflecting a cautious sentiment across various industries.

Currency Market Updates

In the currency market updates, the Greenback exhibited notable strength, propelling the USD Index to new 2024 peaks around 103.70, fueled by rising US yields across various maturities. The EUR/USD pair faced downward pressure, reaching multi-week lows near 1.0840, influenced by persistent dollar strength and ECB officials downplaying expectations of interest rate cuts in H1 2024. Meanwhile, GBP/USD saw support from higher-than-expected UK inflation figures, leading to decent gains, while USD/JPY surpassed the 148.00 barrier, driven by the dollar’s upward momentum and robust US yields. However, the Australian dollar faced continued selling pressure, with AUD/USD sinking to six-week lows near 0.6520, impacted by general dollar dynamics and discouraging results from the Chinese docket.

In the broader market, the intense dollar rally, coupled with rising US yields, adversely affected both Gold and Silver prices. The negative sentiment around Silver was exacerbated by disappointing Chinese data releases. On the energy front, WTI prices rose above $72.00 per barrel, partially reversing recent weakness following an optimistic report from OPEC. Despite challenges from China and a stronger dollar, traders are attentively awaiting the EIA’s usual weekly report on US crude oil inventories for further market cues.

Picks of the Day Analysis

EUR/USD (4 Hours)

EUR/USD Faces Downward Pressure Amid Greenback’s Uptrend and Divergent ECB Signals

In Wednesday’s trading session, EUR/USD encountered downward pressure, briefly touching multi-week lows before rebounding. The prevailing uptrend in the US dollar, fueled by robust December Retail Sales, tempered expectations of a Fed rate cut in March. CME Group’s FedWatch Tool indicated a shift, with the probability dropping to just above 50%. Meanwhile, ECB officials, including Knot and Vasle, highlighted market expectations for rate cuts, emphasizing alignment for a 2% inflation target by 2025. Lagarde hinted at a potential rate cut in the summer. Bond yield increases globally, particularly German 10-year bunds and rising US yields, contributed to the euro’s weakness. Poor Chinese fundamentals added to concerns about delayed economic recovery.

On Wednesday, the EUR/USD moved slightly higher, trying to reach the middle band of the Bollinger Bands. Currently, the price moving just below the middle band, suggesting a potential upward movement to reach above the middle band. Notably, the Relative Strength Index (RSI) maintains its position at 46, signaling a neutral outlook for this currency pair.

Resistance: 1.0954, 1.1000

Support: 1.0863, 1.0814

XAU/USD (4 Hours)

XAU/USD Slumps to Mid-December Lows as Dollar Surges Amidst Global Stock Decline

Spot gold, represented by XAU/USD, experiences a downturn, reaching its lowest point since mid-December. The decline is attributed to the strengthening US Dollar, which advances as global stocks continue to fall. Investors are scaling back expectations for a Federal Reserve rate cut in March, evident in the decreasing probability from 70% to 52% according to the CME FedWatch Tool. Mixed US data, including positive Retail Sales and Industrial Production figures, alongside hawkish sentiments from Fed officials, contribute to the diminishing likelihood of a March cut. Rising government bond yields and a continued slump in Wall Street further compound the challenges for gold in this market environment.

On Wednesday, XAU/USD moved lower and was able to create a lower push to the lower band of the Bollinger Bands. Currently, the price moving just above the lower band suggesting a potential downward movement to create another lower push to the lower band. The Relative Strength Index (RSI) stands at 36, signaling a bearish outlook for this pair.

Resistance: $2,019, $2,035

Support: $2,010, $1,993

Economic Data

| Currency | Data | Time (GMT + 8) | Forecast |

|---|---|---|---|

| AUD | Employment Change | 08:30 | -65.1K (Actual) |

| AUD | Unemployment Rate | 08:30 | 3.9% (Actual) |

| USD | Unemployment Claims | 21:30 | 0.2% |