On Thursday, the S&P 500, Nasdaq Composite, and Dow Jones Industrial Average all saw declines as bond yields surged, with the 10-year Treasury yield increasing over 12 basis points. Federal Reserve Chair Jerome Powell’s remarks on inflation added to the market’s dip. While Disney posted a 6.9% increase in individual stock performance, Arm dipped by 5.2%, and MGM Resorts saw a 1.1% decline. The currency market experienced changes in the US dollar’s value, with anticipation for upcoming CPI and PPI reports. EUR/USD decreased despite weaker Eurozone data, USD/JPY faced resistance, and Sterling saw a decline, all impacted by economic data and central bank policies.

Stock Market Updates

On Thursday, the stock market experienced a reversal of fortune, ending an eight-day winning streak for the S&P 500. The benchmark index, the S&P 500, saw a decline of 0.81%, closing at 4,347.35 points, while the tech-heavy Nasdaq Composite dropped by 0.94% to settle at 13,521.45 points. The Dow Jones Industrial Average also saw a decline of 0.65%, losing 220.33 points to close at 33,891.94. This decline in stocks was largely attributed to a sharp jump in bond yields, with the 10-year Treasury yield increasing more than 12 basis points to 4.634%, and the 30-year bond rate jumping about 11 basis points to 4.772%. The situation was further exacerbated by a weak U.S. Treasury auction. Federal Reserve Chair Jerome Powell’s remarks about the need to address inflation also contributed to the stock market’s dip, despite the recent slowing in the inflation rate, which had been seen as a positive sign for policymakers. The market’s performance for the week showed a mixed picture, with the Dow down 0.5%, the S&P 500 down approximately 0.3%, and the Nasdaq being the only major average in positive territory with a potential 0.3% gain.

In terms of individual stocks, Disney stood out with a 6.9% increase, driven by better-than-expected profit results and an expanded cost-cutting plan. In contrast, Arm dipped by 5.2% following its first quarterly report as a public company, and MGM Resorts saw a 1.1% decline despite posting strong results and announcing a new share buyback program. The prevailing sentiment in the market was that interest rate volatility was taking center stage, with market participants closely monitoring movements in interest rates to determine the market’s future direction.

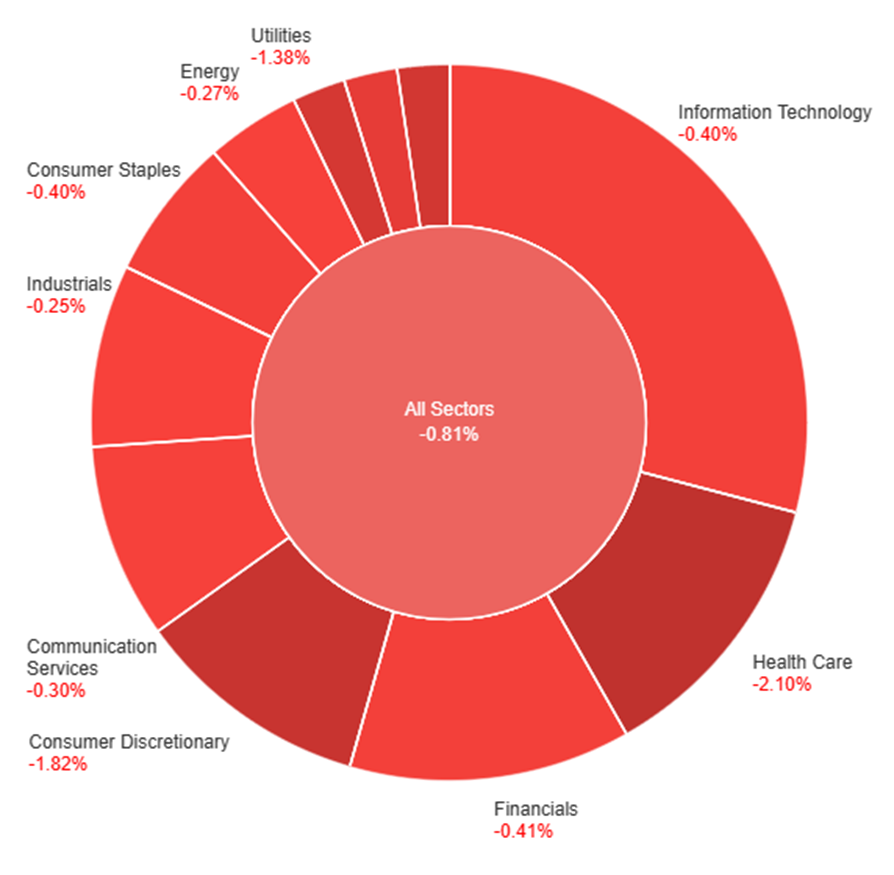

Data by Bloomberg

On Thursday, across all sectors, there was a general decline in the stock market with an overall decrease of 0.81%. The most significant losses were observed in the Consumer Discretionary and Health Care sectors, which experienced declines of 1.82% and 2.10%, respectively. Utilities and Real Estate also saw substantial drops at 1.38% and 1.51%, while Materials exhibited a significant decline of 0.85%. The Information Technology, Consumer Staples, and Financials sectors had relatively moderate decreases, ranging from 0.40% to 0.41%, while the Industrials, Energy, and Communication Services sectors had smaller declines of 0.25%, 0.27%, and 0.30%, respectively.

Currency Market Updates

In the currency market, the US dollar experienced little change at the outset of the week but later saw a rise in value alongside Treasury yields following a 30-year bond auction. Investors were eagerly anticipating the release of CPI and PPI reports scheduled for the upcoming Tuesday and Wednesday, as these reports would provide essential data for the Federal Reserve’s data-dependent policy. However, this came in the wake of the release of Thursday’s continued claims, which showed an unexpected increase, signaling that the October employment report had fallen significantly short of expectations. Despite this, the upward movement in Treasury yields was primarily driven by concerns about rising government debt issuance surpassing demand. The market remained watchful for further developments, especially as the Fed’s next likely move was being priced in as a rate cut in mid-2024, and major gains for the US dollar might hinge on the forthcoming U.S. CPI and PPI data, requiring these figures to be significantly hotter than anticipated.

Meanwhile, in the currency pairs, the EUR/USD exchange rate decreased by 0.15% as it tested recent buying opportunities with the hope that the Federal Reserve’s tightening cycle might start reversing by mid-2024. This occurred despite the Eurozone’s economic data showing persistent weakness compared to that of the United States. The USD/JPY pair registered a slight increase but faced resistance at levels above 151. This resistance came from key weekly range top targets that had not both been closed above since the Federal Reserve’s initial rate hike in March 2022. Sterling also saw a 0.16% decline, even after Bank of England Chief Economist Huw Pill made statements advocating for the maintenance of current interest rates to curb inflation, a change in tone from earlier in the week when he discussed the possibility of cuts next year. The currency market remains highly sensitive to economic data and central bank policies, with the upcoming U.S. CPI and PPI reports poised to have a significant impact on the US dollar’s trajectory.

Picks of the Day Analysis

EUR/USD (4 Hours)

EUR/USD Bears Gain Momentum as Powell’s Remarks Boost US Dollar

The EUR/USD took a sharp downward turn in response to Federal Reserve Chair Jerome Powell’s remarks, establishing a clear bearish trend. While European Central Bank (ECB) officials initially supported the Euro, the market anticipates unchanged rates, with the focus shifting to when the first-rate cut might occur. The US dollar’s strength is bolstered by a strong US economy, as emphasized by Powell, who expressed concerns about inflation and triggered a dollar rally and soaring US bond yields. This shift in sentiment, combined with ongoing market analysis, continues to shape the EUR/USD landscape.

According to technical analysis, the EUR/USD moved slightly lower on Thursday, reaching the lower band of the Bollinger Bands. Currently, the EUR/USD is trading around the lower band, indicating the potential for a consolidating move to try to reach the middle band. The Relative Strength Index (RSI) is at 46, signaling that the EUR/USD is back in neutral bias.

Resistance: 1.0695, 1.0725

Support: 1.0645, 1.0615

XAU/USD (4 Hours)

XAU/USD Rebounds Amidst Cautious Optimism and Fed Officials’ Insights

In the first half of the day, the US Dollar appeared strong, but it changed direction after the American opening, prompting XAU/USD to bounce back from a weekly low of $1,944.71 and trade above $1,960. Financial markets remain cautiously optimistic, anticipating a pause in monetary tightening by central banks. Richmond Federal Reserve Bank President Thomas Barkin’s positive remarks about the economy and inflation progress added to the market sentiment, while Atlanta Fed President Raphael Bostic emphasized the uncertainty of recent policies’ effects. Market participants await US Fed Chairman Jerome Powell’s potential comments on monetary policy during an IMF panel discussion titled “Monetary Challenges in a Global Economy.”

According to technical analysis, XAU/USD moves slightly higher on Thursday and is able to reach the middle band of the Bollinger Bands. Presently, the price of gold is moving just below the middle band, creating a possibility to push lower. The Relative Strength Index (RSI) is currently at 41, indicating a bearish bias for the XAU/USD pair.

Resistance: $1,962, $1,992

Support: $1,945, $1,920

Economic Data

| Currency | Data | Time (GMT + 8) | Forecast |

|---|---|---|---|

| GBP | Gross Domestic Product | 15:00 | 0.0% |

| USD | Prelim UoM Consumer Sentiment | 23:00 | 63.7 |