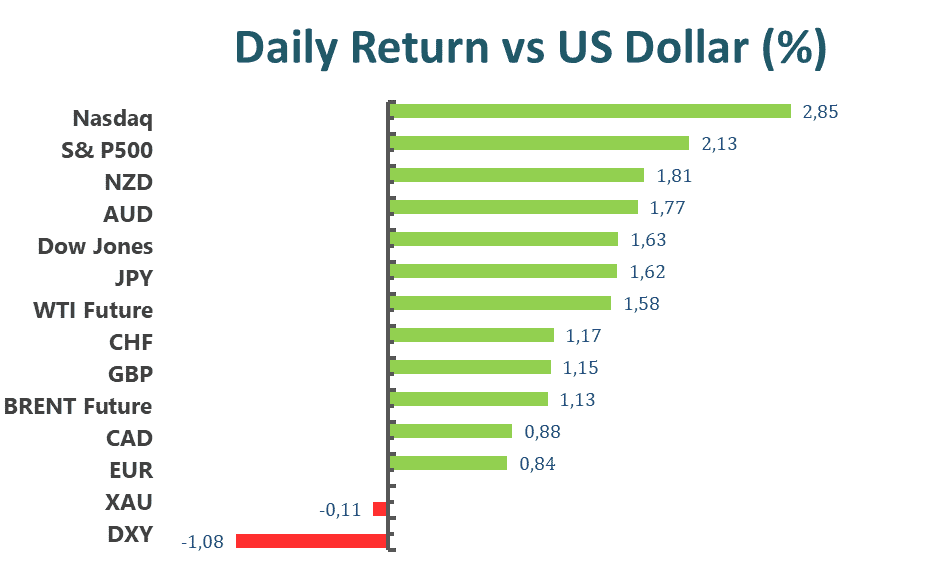

US stock stopped a three-day rally on Monday as hawkish comments from Federal Reserve and data showing slower growth undermined market risk sentiment. Stocks had surged in July on speculation that rampaged inflation may have peaked and the central bank was closed to the end of the rate-hiking cycle on signs. While more than half of the S&P 500 firms’ earnings have exceeded analyst estimates so far, the rate of earnings is still under the 62% average pace set in the last five quarters. Moreover, Fed officials’ suggestion to the central bank pointed out that a more aggressive interest hike is necessary, which brings the market back to the dark from the sunlight in July.

The benchmarks, S&P500 and Dow Jones Industrial Average both slid on Monday. S&P500 declined by 0.28% daily after reaching its best month since 2020. Seven of eleven sectors stayed in negative territory as Energy, Financial, and Real Estate performed worst among all groups, falling 2.18%, 0.89%, and 0.89% respectively, while it’s worth noting that outperforming sector CONS Staples rose 1.21%. The Nasdaq 100 was nearly not changed and the MSIC World index advanced with a

1.2% rally for the day.

Main Pairs Movement

The US dollar declined on Monday, as investors weighed the possibility of the Federal Reserve will not raise interest rates as hawkish as a few months ago. Besides, the jobs data will be announced at the end of this week, which may be confirmed that the improvement in the labour market is a slowdown. The DXY index dropped with a 0.43% loss for the day. However, the greenback has been up roughly 10% for the year so far, triggered by Fed’s aggressive rate hike policy.

The GBP/USD advanced by 0.65% for the day, as the cables witnessed new transactions amid the US dollar under selling pressure caused by dialled-down Fed monetary policy. GBP/USD reached a daily high level above 1.229 in the middle of the US trading session. Meanwhile, EURUSD also touched its daily high level above 1.027 at the beginning of the US session. Nevertheless, the unchanged unemployment rate played a key stuck for European Central Bank(ECB) to push the interest rate hike policy.

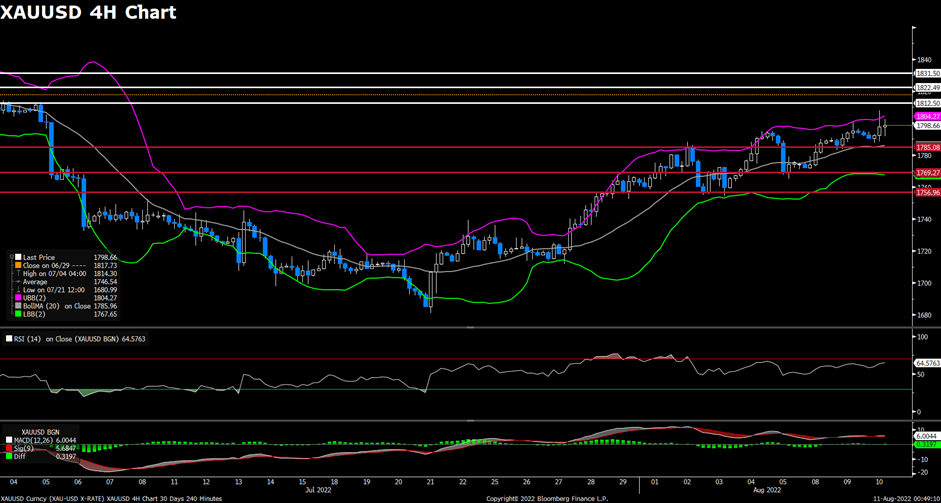

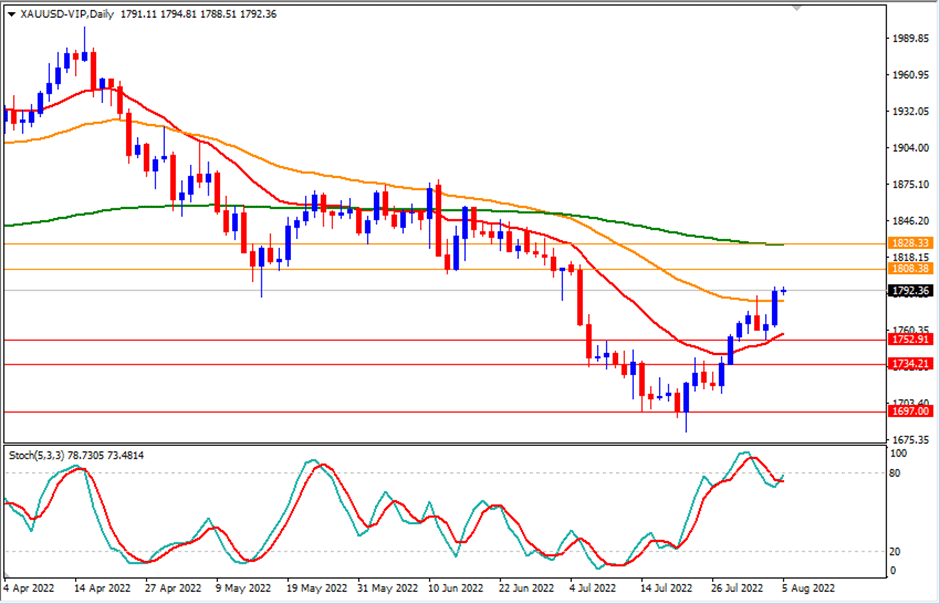

Gold rose 0.35% daily. Ahead of NFP and job data on Friday, XAUUSD witnessed fresh upside traction and touched a daily high above 1774$ mark. Meanwhile, WTI and BRENT dropped 3.79% and 4.80% respectively on Monday.

Technical Analysis

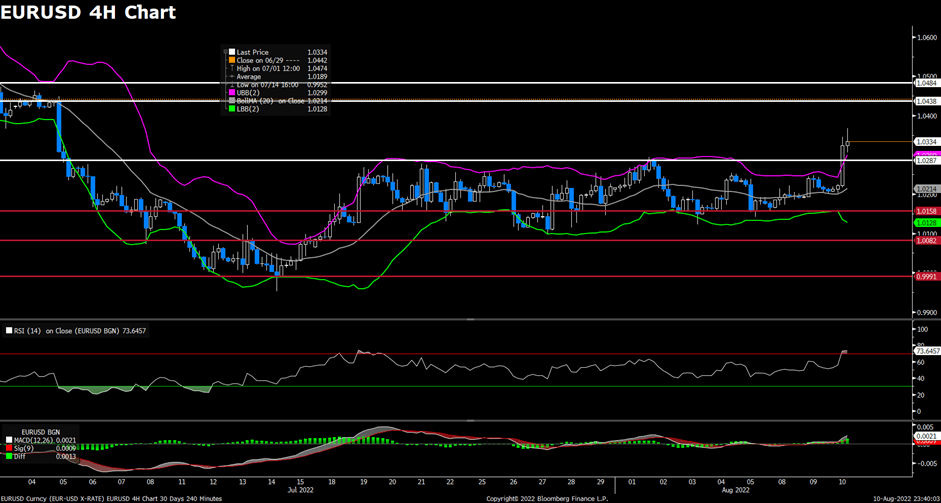

EURUSD (4-Hour Chart)

The EUR/USD pair advanced on Monday, regaining upside momentum and touched a daily high above near 1.027 level after the release of dismal US ISM Manufacturing PMI data. The pair is now trading at 1.0268, posting a 0.41% gain daily. EUR/USD stays in the positive territory amid a weaker US dollar across the board, as the risk-on market sentiment exerted bearish pressure on the greenback and helped the EUR/USD pair to find demand. The US ISM Manufacturing PMI declines to 52.8 in July, which was the lowest reading since June 2020 and showed slowing signs in business activity. For the Euro, investors continued to fuel their speculations of an impending recession in the Eurozone amid the downbeat German Retail Sales data, which plunged the most since 1994 and dropped 8.8% YoY in June.

For the technical aspect, the RSI indicator is 61 figures as of writing, suggesting that the upside is more favoured as the RSI stays above the mid-line. As for the Bollinger Bands, the price preserved its bullish momentum and continued to climb toward the upper band, therefore the upside traction should persist. In conclusion, we think the market will be slightly bullish as the pair tests the 1.0264 resistance line. A sustained strength above that resistance might open the road for additional gains.

Resistance: 1.0264, 1.0438, 1.0484

Support: 1.0177, 1.0153, 1.0111

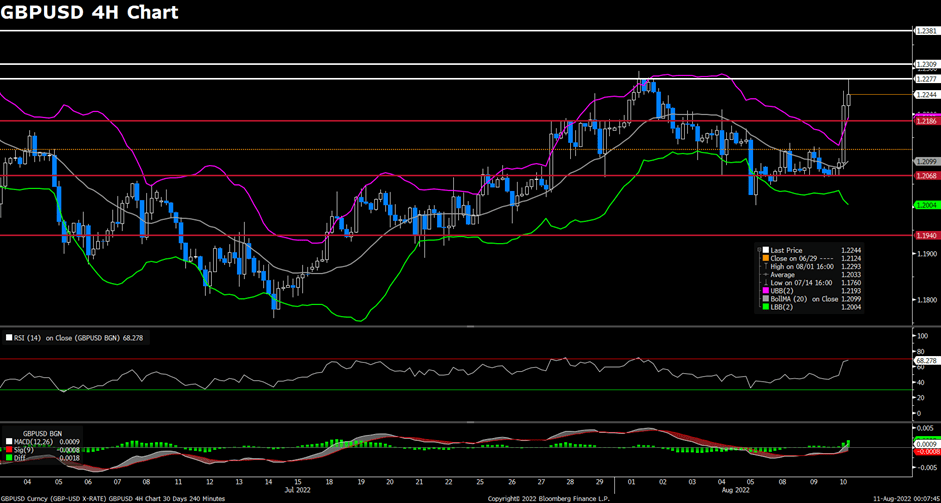

GBPUSD (4-Hour Chart)

The GBP/USD pair surged on Monday, jumping back above the 1.220 mark and kept refreshing its daily high during the US trading session amid renewed weakness in the US dollar. At the time of writing, the cable stays in positive territory with a 0.88% gain for the day. Investors continued to scale back their expectations for more aggressive rate hikes by the Federal Reserve amid the fear of recession, which acted as a headwind for the safe-haven greenback. Markets are now pricing in a 30% probability of a 75 bps Fed rate hike in September. For the British pound, despite the data from the UK showing that the S&P Global Manufacturing PMI fell to 52.1 in July, the cable remained underpinned by the rising bets for a 50 bps rate hike by the Bank of England.

For the technical aspect, the RSI indicator is 70 figures as of writing, suggesting that the pair is facing heavy upside pressure as the pair stays in the overbought zone. For the Bollinger Bands, the price moves out of the upper bands so a strong trend continuation can be expected. In conclusion, we think the market will be slightly bearish as long as the 1.2284 resistance line holds. The pair might witness some short-term technical corrections before climbing higher amid the overbought condition.

Resistance: 1.2284, 1.2317, 1.2381

Support: 1.2218, 1.2200, 1.2115

USDCAD (4-Hour Chart)

Despite the diminishing odds for more aggressive Fed rate hikes continuing to weigh on the US dollar, the pair USD/CAD gained positive traction and rebounded from seven-week lows toward 1.2835 during the US session. USD/CAD is trading at 1.2846 at the time of writing, rising 0.23% daily. Last week, the Fed hinted that it could slow the pace of the rate hike campaign at some point, which continued to undermine the safe-haven greenback. On top of that, the retreating crude oil prices have acted as a headwind for the commodity-linked loonie and pushed USD/CAD higher as WTI slides towards the $96 per barrel area. Oil prices remained under pressure amid a cautious mood ahead of this week’s OPEC meeting.

For the technical aspect, the RSI indicator is 50 figures as of writing, suggesting that there is no obvious direction for the pair now. For the Bollinger Bands, the price regained some bullish strength and crossed above the moving average, therefore the upside traction should persist. In conclusion, we think the market will be slightly bullish as the pair is heading to test the 1.2841 resistance. A break above that resistance could open the road for additional gains.

Resistance: 1.2841, 1.2891, 1.2944

Support: 1.2785, 1.2698

Economic Data

| Currency | Data | Time (GMT + 8) | Forecast |

| GBP | Composite PMI (Jul) | 16:30 | 52.8 |

| GBP | Services PMI (Jul) | 16:30 | 53.3 |

| USD | ISM Non-Manufacturing PMI (Jul) | 22:00 | 53.5 |

| USD | Crude Oil Inventories | 22:30 |