The stock market witnessed a strong surge, propelling the S&P 500 close to its all-time high after significant gains fueled by the Federal Reserve’s positive stance on interest rates. The Dow Jones Industrial Average and Nasdaq Composite also experienced substantial increases, while energy stocks, particularly in the S&P 500 sector, saw notable rises due to escalating oil prices. The bullish momentum, backed by the Fed’s indications of potential interest rate cuts in 2024 and favorable market conditions, led to December’s substantial gains across major indices. Concurrently, currency markets saw fluctuations, with the US Dollar Index declining, housing sector data revealing mixed results, and various currency pairs experiencing diverse movements amidst global economic shifts.

Stock Market Updates

The stock market showed a robust uptick, with the S&P 500 nearing its all-time high after a 0.59% gain, coming within 0.6% of its previous record close. This surge was fueled by the Federal Reserve’s dovish stance on interest rates, fostering investor confidence. The Dow Jones Industrial Average climbed by 0.68%, reaching 37,557.92 points, while the Nasdaq Composite surged by 0.66%, breaching the 15,000 mark for the first time since January 2022. Additionally, the Nasdaq 100 hit all-time intraday and closing highs, ascending by 0.49% to 16,811.85. Energy stocks, particularly in the S&P 500 sector, outperformed with a 1.2% rise, propelled by increasing oil prices, with companies like Occidental Petroleum, Halliburton, and Exxon Mobil witnessing significant gains. Moreover, Walgreens Boots Alliance led the Dow with a 4.2% surge, while Enphase Energy and First Solar notably contributed to S&P 500 advances, up by about 9% and 4%, respectively.

The market’s bullish momentum has been amplified by recent Federal Reserve indications of potential interest rate cuts in 2024, along with encouraging signs of moderated inflation and a retreat in Treasury yields. December showcased significant gains across the board, with the S&P 500, Dow, and Nasdaq boasting increases of 4.4%, 4.5%, and 5.5%, respectively, reflecting the market’s strong performance and its longest weekly winning streak since 2017. This rally coincides with the typically robust season for equities, further buoyed by favorable market conditions.

Data by Bloomberg

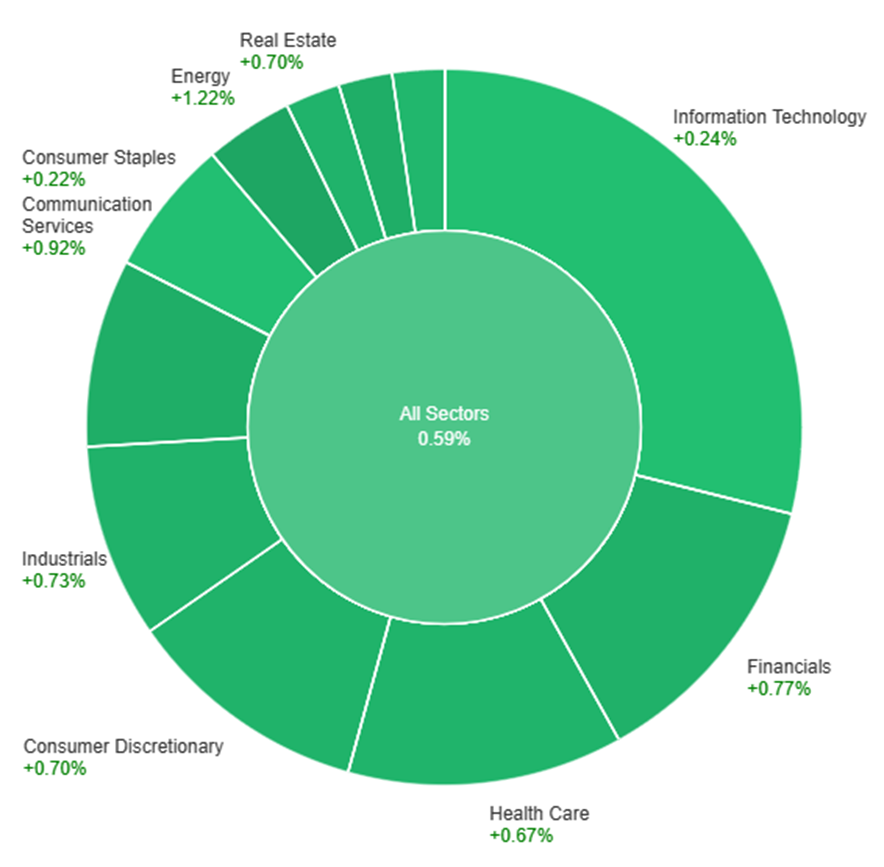

On Tuesday, across all sectors, there was a positive trend with a 0.59% increase. Energy notably surged by 1.22%, leading the gains, followed closely by Communication Services and Materials, both showing strong increases at 0.92% and 0.91%, respectively. Financials, Industrials, Consumer Discretionary, and Real Estate all demonstrated moderate growth between 0.70% and 0.77%. Health Care also contributed positively, rising by 0.67%, while Utilities saw a more modest increase of 0.56%. However, Information Technology and Consumer Staples exhibited lower growth rates, with increases of only 0.24% and 0.22%, respectively, compared to the other sectors.

Currency Market Updates

In the latest currency market updates, the US Dollar Index (DXY) continued its downward trajectory, slipping by over 0.30% and approaching the 102.00 mark, albeit remaining above December lows. Wall Street stocks surged, pushing the Dow Jones to a fresh all-time high close, while the 10-year Treasury yield hovered around 3.90%. Mixed data from the US housing sector revealed an unexpected rise in Housing Starts to 1.56 million, surpassing predictions, while Building Permits slightly declined to 1.46 million, below the anticipated figure. Wednesday’s focus will be on further housing data release with Existing Home Sales and the CB Consumer Confidence survey.

Meanwhile, the currency pairs saw notable movements: EUR/USD displayed an upward bias but struggled to reclaim the 1.1000 mark, hovering around 1.0970. GBP/USD trimmed gains and dipped towards 1.2700, encountering resistance near 1.2800, ahead of significant UK consumer and wholesale inflation figures due on Wednesday. The Japanese Yen weakened sharply following a “dovish hold” by the Bank of Japan, impacting USD/JPY, which initially spiked before retracing amidst a weaker US Dollar and declining global yields. USD/CHF hit four-month lows under 0.8600 and is expected to test the 2023 low around 0.8550, with the Swiss National Bank’s quarterly bulletin due.

Additionally, the Canadian Dollar (CAD) strengthened across the board after the Consumer Price Index rose 0.1% in November, contrary to expectations of a 0.2% decline. This led USD/CAD to its lowest daily close since early August below 1.3350, ahead of the Bank of Canada’s (BoC) Summary of Deliberations. On another front, AUD/USD broke above 0.6730 and surged to 0.6774, marking its highest level in nearly five months, driven by US Dollar weakness, improved risk appetite, and support from rallying commodity prices. Meanwhile, Gold prices struggled to sustain gains above $2,040, while Silver, despite reclaiming $24.00, faced challenges holding above the 20-day Simple Moving Average, aiming for a breakthrough at $24.30 for substantial advances in XAG/USD (Silver/US Dollar).

Picks of the Day Analysis

EUR/USD (4 Hours)

EUR/USD Surges Amid Dollar Weakness Despite Euro’s Mixed Signals

The EUR/USD pair rallied for a consecutive second day, edging closer to the 1.1000 mark and November’s peaks, buoyed by a faltering US Dollar amidst growing risk appetite. Despite the Dollar’s downturn, the Euro’s outlook remains uncertain, highlighted by Eurostat’s revised downward November inflation figures, tempering optimism. As the Federal Reserve and European Central Bank officials push against market expectations, the interest rate market hints at probable rate cuts by April, pressuring the Dollar amid ascending equity and commodity prices. Mixed US housing sector data added to the complex market landscape, with Housing Starts surpassing forecasts while Building Permits fell short. The upcoming data on Wednesday, including Current Account, Construction Output, and Consumer Confidence figures, further intensifies the intricate dynamics influencing the EUR/USD pair.

On Tuesday, the EUR/USD moved higher trying to reach the upper band of the Bollinger Bands. Currently, the price moving slightly below the upper band, suggesting a potential upward movement. Notably, the Relative Strength Index (RSI) maintains its position at 65, signaling a neutral but still bullish outlook for this currency pair.

Resistance: 1.1017, 1.1138

Support: 1.0946, 1.0830

XAU/USD (4 Hours)

XAU/USD Holds Steady Amidst Dollar Weakness and Equities’ Optimism

Gold (XAU/USD) maintained a resilient stance, hovering around $2,040 as the US Dollar weakened, buoyed by a positive equities market driven by robust risk appetite. The Nasdaq Composite achieved consecutive record highs, reinforcing the sentiment inspired by central banks. Compounding the USD’s pressure were sliding Treasury yields, hitting lows unseen since July. Despite a relatively quiet US macroeconomic calendar, attention is fixated on Friday’s release of the Core PCE Price Index, the Federal Reserve’s favored inflation gauge, keeping speculative interests keenly attuned to potential market shifts.

On Tuesday, XAU/USD moved slightly higher and reached the upper band of the Bollinger Bands. Currently, the price moving just below the upper band, suggesting a potential upward movement. The Relative Strength Index (RSI) stands at 62, signaling a neutral outlook for this pair.

Resistance: $2,050, $2,068

Support: $2,031, $2,008

Economic Data

| Currency | Data | Time (GMT + 8) | Forecast |

|---|---|---|---|

| GBP | CPI y/y | 15:00 | 4.3% |

| USD | CB Consumer Confidence | 23:00 | 104.6 |

| USD | Existing Home Sales | 23:00 | 3.77M |