The Dow fell Tuesday, wrapping up February with a monthly loss as surging rates battered stocks after a string of data pointing to underlying strength in the economy forced investors to price in higher for longer Federal Reserve interest rates.

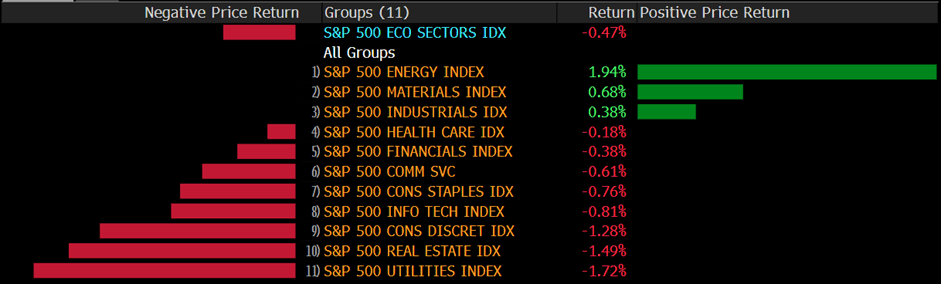

The Dow Jones Industrial Average fell 0.65%, or 214 points, taking losses for February to about 4%. The S&P 500 fell 0.29%, and the Nasdaq Composite was down 0.10%.

Tech, which is down about 5% from its peak earlier this month, pared earlier gains despite a jump in Meta. On the economic front, meanwhile, consumer confidence in February fell to its lowest reading since November, pointing to signs strong consumer spending, which has underpinned strong growth so far this year, may be starting to slow.

The yield on the benchmark 10-year Treasury note was last lower by 1 basis point at 3.912%. Earlier, it touched a high of 3.983%, its highest level since Nov. 10. Meanwhile, the yield on the 30-year Treasury bond rose less than 1 basis point to 3.922%. Tuesday marks the final day of trading in February. The 10-year Treasury yield has advanced more than 50 basis points for the month, and the 2-year yield has gained more than 70 basis points. Those gains come as traders increasingly bet on Federal Reserve rates staying higher for longer, as recent data points to persistent inflation. The core personal consumption expenditures price index rose 4.7% in January from the year-earlier period, beating expectations. The overall PCE index advanced 5.4% year over year, also more than expected.

Main Pairs Movement

DXY bulls flirt with the 105.00 hurdles during Wednesday’s sluggish Asian session, following a stellar rebound marked a few hours ago. In doing so, the US Dollar’s gauge versus the six major currencies portrays the market’s cautious mood as traders brace for the key data/events lined up during the all-important March month, comprising Federal Reserve Chairman Jerome Powell’s speech and Fed’s monetary policy meeting. At the time of writing, the price traded at 105.042.

West Texas Intermediate futures on NYMEX, have corrected firmly after facing firmer barricades above $77.50 in the late New York session. The oil price has dropped $76.60 and is expected to remain on the tenterhooks as investors are awaiting the release of the Caixin Manufacturing PMI data for fresh impetus. At the time of writing, the price is trading at 76.65.

The AUD/USD pair has slipped sharply to near 0.6700 as the Australian Bureau of Statistics has reported mixed Gross Domestic Product (GDP) (Q4) data. The GDP data landed at 0.5% in Q4, lower than the consensus of 0.8% and the Q3 figure of 0.6%. At the time of trading, the price traded at 0.6700.

Technical Analysis

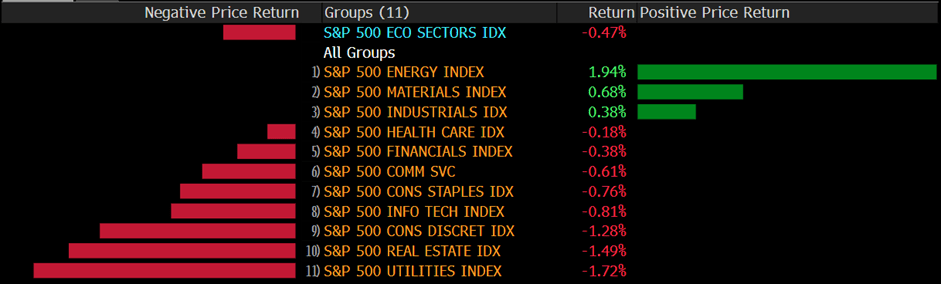

EURUSD (4-Hour Chart)

The EURUSD lost bullish momentum and retreated below the 1.0600 level in the US trading session after touching a daily high of around 1.0650 level. The US Consumer Confidence Survey declined to 6.3% in February from 6.7% in January, however, failing to provide a robust boost for the pair. Now, the effects of rate hikes have not yet shown up because of the usual lags in their impact. This will change and price pressures will then ease noticeably as the year progresses. If this does not happen, and the Fed has not cooled demand sufficiently, then we can expect there will be more rate hikes than previously the market anticipated. In Eurozone, Spanish, and French inflation figures came in above market expectations in February, according to preliminary estimates. At the time being, speculative interest pricing in rate hikes will continue until early 2024, while the ECB’s terminal rate is currently seen at 4%.

From a technical perspective, the four-hour scale RSI indicator slid below the midline, suggesting that bearish momentum triggered by US data failed to sustain in the middle of the US trading hour and also showed that the pair currently have no clear moving path. As for the Bollinger Bands, the pair was capped by the upper band around the 1.0640 level and trading in the upper area, indicating the pair was more favored to hover in a range from 1.0580 to 1.0650.

Resistance: 1.0788, 1.0929

Support: 1.0508, 1.0400

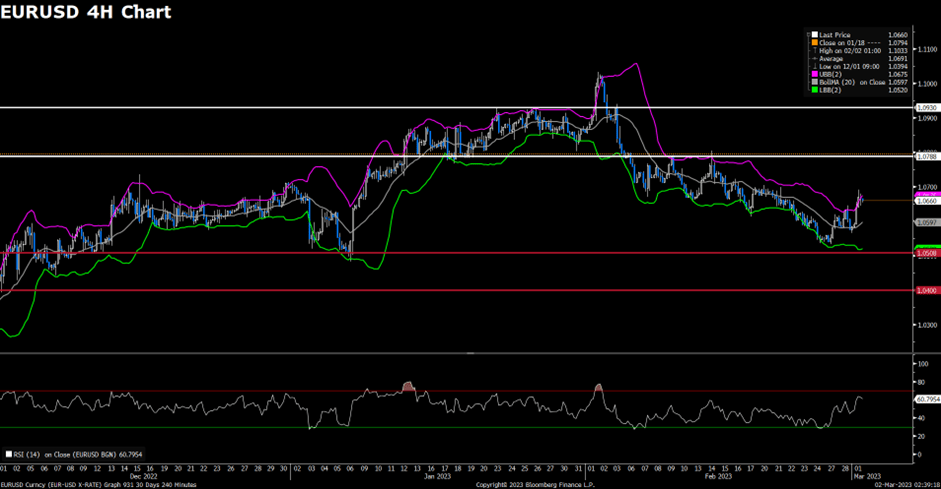

XAUUSD (4-Hour Chart)

The XAUUSD recovered further on Tuesday and was trading around the $1830 mark as of writing, as the US Dollar turned south during the American trading hour. The greenback was hit by the Conference Board Consumer Confidence Index as it fell for a second consecutive month in February, printing at 102.9 against the 108.5 anticipated by market players. Moreover, the Expectations Index fell further to 69.7 from a downwardly revised 76.0 in January. A reading below 80 often signals a recession within the next year, according to the official report. Meanwhile, the US equity market was trading with a mixed tone, the Nasdaq held on to modest intraday gains, while the Dow Jones Industrial Average witnessed heavy selling transactions for a second consecutive day. Meanwhile, US government bond yields ticked north. Early news indicating increased inflationary pressures in Spain and France spurred speculation the European Central Bank (ECB) will maintain its monetary tightening policy until early 2024, while the terminal rate is now seen at 4%.

From a technical perspective, the four-hour scale RSI indicator surged to 58 figures, suggesting that the pair were surrounded by strong bearish traction. As for the Bollinger Bands, the pair was capped by the upper band at the moment of writing, if the price could break through the upper band, the bull could target the next resistance of the $1850 mark.

Resistance: 1850, 1870, 1900

Support: 1820, 1800

Economic Data

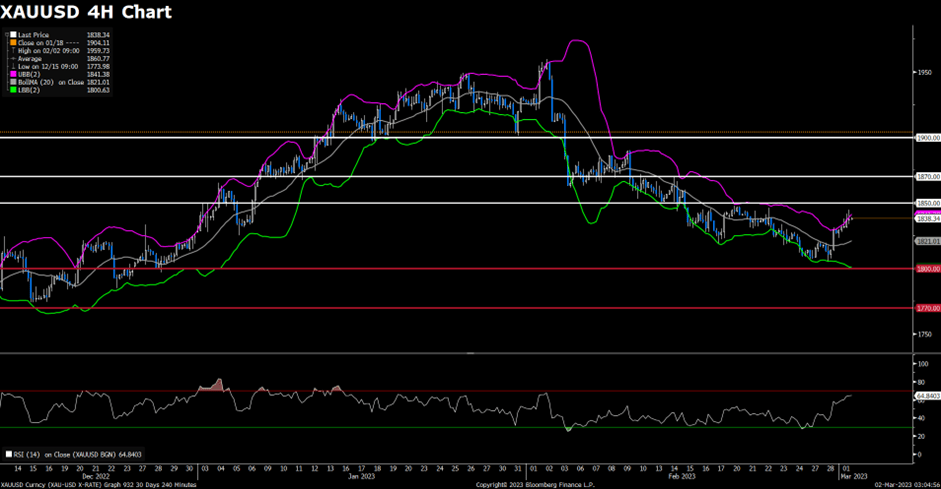

| Currency | Data | Time (GMT + 8) | Forecast |

| AUD | GDP (QoQ) (Q4) | 08:30 | 0.8% |

| CNY | Manufacturing PMI (Feb) | 09:30 | 50.5 |

| CNY | Caixin Manufacturing PMI (Feb) | 09:45 | 50.2 |

| EUR | German Manufacturing PMI (Feb) | 16:55 | 46.5 |

| EUR | German Unemployment Change (Feb) | 16:55 | 9K |

| GBP | Manufacturing PMI (Feb) | 17:30 | 49.2 |

| GBP | BoE Gov Bailey Speaks | 18:00 | |

| EUR | German CPI (YoY) (Feb) | 21:00 | 8.5% |

| USD | ISM Manufacturing PMI (Feb) | 23:00 | 48 |

| USD | Crude Oil Inventories | 23:30 | 0.457M |