The S&P 500 closed near the flat line on Monday, with investors anticipating crucial inflation readings, including the consumer price index report for April. Despite minor fluctuations, the broad market index ended the session at 4,138.12, reflecting a marginal gain of 0.05%. The Nasdaq Composite performed slightly better, adding 0.18% and closing at 12,256.92, while the Dow Jones Industrial Average slipped 0.17%, shedding 55.69 points to settle at 33,618.69.

Investors eagerly await key data that will influence the Federal Reserve’s future course, starting with Wednesday’s release of April’s CPI report, followed by the producer price index on Thursday. In the banking sector, select bank shares experienced slight gains at the start of the week. PacWest shares rose by 3.6% after the bank announced a dividend cut from 25 cents per share to just 1 cent per share. Western Alliance shares increased by approximately 0.6%, and big banks such as Wells Fargo and JPMorgan Chase also saw their stock prices rise. Additionally, Disney shares rose by over 2% ahead of the company’s upcoming quarterly results report on Wednesday, while Berkshire Hathaway Class A shares saw a 1% increase following the conglomerate’s first-quarter results announcement, which revealed a 12% rise in operating earnings and a cash reserve exceeding $130 billion.

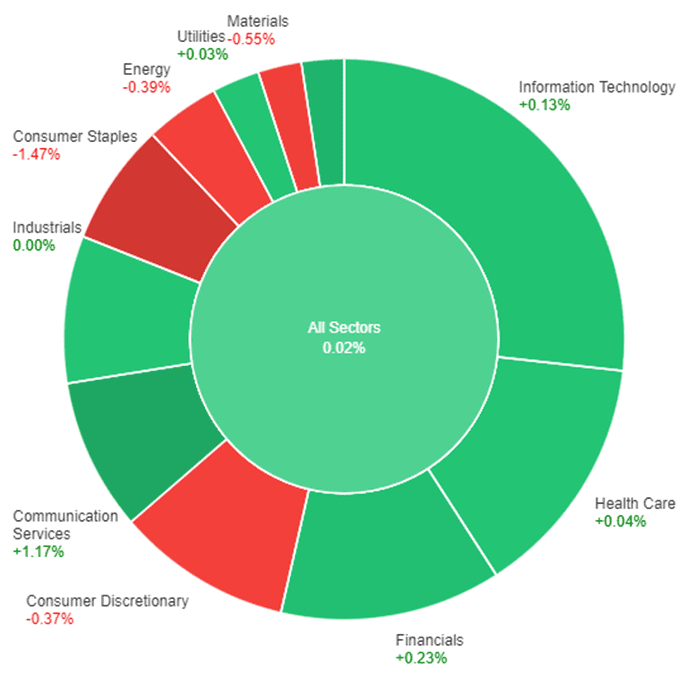

On Monday, the market experienced mixed results with the S&P 500 ending the day with a slight gain of 0.05%. The Communication Services sector saw the highest increase with 1.27%, followed by Consumer Discretionary and Financials with 0.30% and 0.21%, respectively. On the other hand, Real Estate had the largest decline, dropping by 0.69%, followed by Industrials with 0.37%. Health Care, Consumer Staples, Materials, and Utilities also saw negative changes, ranging from -0.22% to -0.33%. Meanwhile, Energy and Information Technology experienced minimal changes, with gains of 0.07% and a slight drop of 0.02%, respectively.

Major Pair Movement

On Thursday, the dollar index remained unchanged, but it gained against the euro and lost to the yen due to increasing banking and recession concerns. Market uncertainty surrounding central bank tightening combined with worries about economic and financial stability were reflected in the decreasing inversion of Treasury and euro zone yield curves. The falling German exports and retail sales and unhealthy US Q1 productivity and labor costs raised further concerns.

The implosion of US regional bank stocks could lead to a decline in rates and risk-driven USD/JPY, pushing it back toward the banking crisis lows of April and March. A full percentage point of Fed rate cuts is being priced in by year-end, while the ECB is only expected to hike 28bp.

On Friday, the focus will be on US employment data, but concerns over banking stress will continue to be in the spotlight.

Technical Analysis

EUR/USD (4 Hours)

The EUR/USD pair has dropped below the psychological support level of 1.1000, indicating weakness as the US Dollar Index (DXY) aims for further gains. US inflation is expected to remain steady, offsetting lower credit from commercial banks with higher household earnings. Meanwhile, the Eurozone economy is facing recession risks due to declining retail demand and higher interest rates from the European Central Bank (ECB). The EUR/USD pair has lost upward momentum, struggling to stay above the resistance level at 1.1033, with the 20-period Exponential Moving Average providing support. The Relative Strength Index suggests a lackluster performance ahead. A break below 1.0942 could lead to further downside, while a recovery above 1.1095 could drive the pair to new highs.

According to technical analysis, the EUR/USD pair is currently trending lower after a period of upward movement. At present, the price targeting the lower band of the Bollinger band. It is expected that the EUR/USD will continue to consolidate and move slightly higher for today. The Relative Strength Index (RSI) is presently at 45, suggesting a neutral trend in the EUR/USD market.

Resistance: 1.1015, 1.1051

Support: 1.0986, 1.0954

XAU/USD (4 Hours)

The price of gold is holding onto its gains near $2,020, but its rise is limited by the strengthening US dollar. Traders are focused on the upcoming release of the US Consumer Price Index (CPI) data, which will impact the Federal Reserve’s interest rate outlook. Initially, there was an improvement in market sentiment, leading to a relief rally in bank stocks globally. This reduced demand for US government bonds and the dollar, but the dollar rebounded as US Treasury bond yields recovered. As a result, gold initially moved higher but failed to sustain its upward momentum as the dollar and bond yields strengthened. Market expectations for Fed interest rates may change based on the CPI data. Traders are also monitoring developments in the US banking sector crisis and statements from Federal Reserve policymakers.

The technical analysis indicates that XAU/USD is moving flat on Monday. The price is currently just below the middle band of the Bollinger Band, indicating the potential for a consolidating movement. Moreover, the Relative Strength Index (RSI) is currently at 53, indicating that XAU/USD is neutral.

Resistance: $2,030, $2,046

Support: $2,015, $2,003