Stocks retreated on Tuesday, as a downbeat outlook from a giant chipmaker, Micron, added to recession fears. Investors were unwilling to make any risky moves before Wednesday’s pivotal inflation reading, which is forecasted to cool a bit while remaining at high levels. The report will come on the heels of recent jobs figures underscoring slid wage growth and US productivity data highlighting another surge in labour costs that could further complicate the Federal Reserve’s decision to tame inflation. Timing the peak of inflation is difficult, especially after June’s CPI print turned out to be hotter than expected. It’s also worth noting that Bitcoin resumed its slump, ending a four-day winning streak as volatility continued to whipsaw the crypto world.

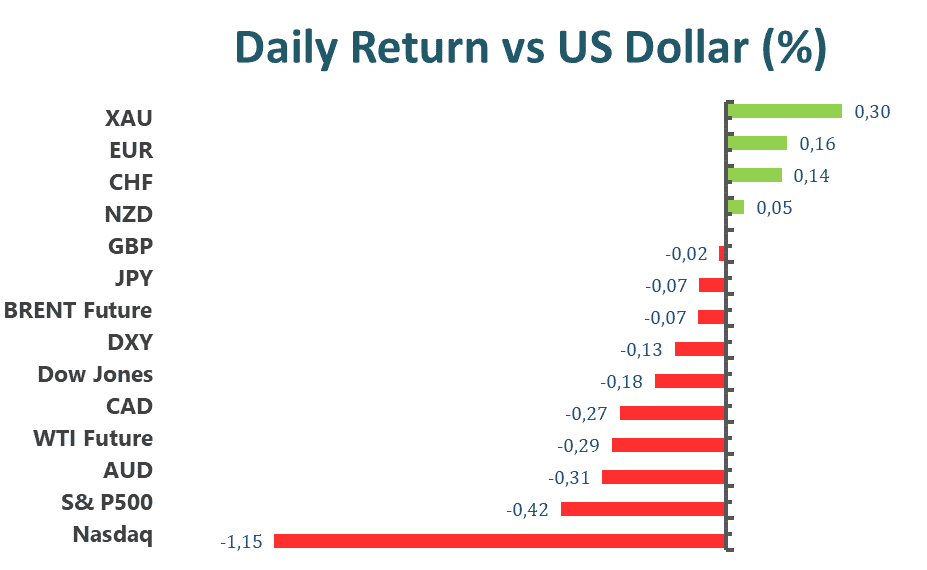

The benchmark, S&P 500 and Dow Jones Industrial Average both slid on Tuesday, amid undermining risk sentiment ahead of the release of a key consumer index. Seven out of eleven sectors stayed in the negative territory, as Consumer Discretion and Information Technology performed worst among all groups, fell with 1.54% and 1.00% losses respectively on Tuesday. However, Energy and Utilities sectors outperformed all the other groups, rising 1.77% and 1.06% respectively for the day. The Dow Jones Industrial Average declined 0.2%, Nasdaq 100 dropped 1.1%, and the MSCI world index fell 0.5%.

Main Pairs Movement

US dollar changed a little bit down on Tuesday, as thin summer trading and risk appetite dwindled ahead of critical inflation figures that could offer clues on how hawkish the Federal Reserve will be in its interest rate hike in September. The DXY index had drifted lower from the start of the trading session, but then rebounded to oscillate in a range of 106.1 to 106.4 level as stock markets slid on profit warnings, inflation concerns and data showed US worker productivity fell sharply in the second quarter.

The GBPUSD remained almost unchanged for the day. The cables edged higher amid some greenback selling in the first half of Tuesday, then faced selling pressure and lost all the gains earlier as pessimism in UK economic data and the hawkish stance of the Fed. Meanwhile, EURUSD attracted fresh transactions and touched a daily high level of nearly 1.025 as a weak US dollar across the board during the Asia trading session, then corrective pullback to 1.021 ahead of the CPI index. The pairs advanced with a 0.16% gain on a daily basis on Tuesday.

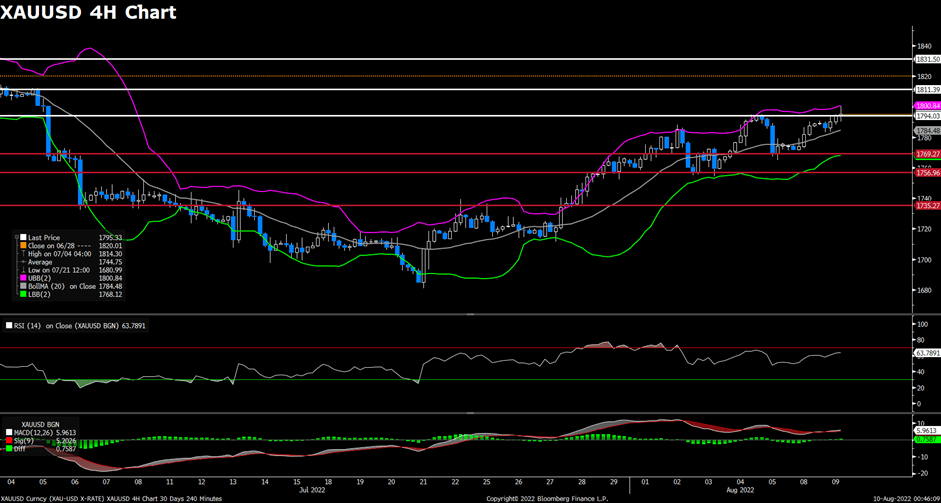

Gold surged on Tuesday, as global recession concerns weigh on investors’ sentiment and benefit safe-haven metal. XAU/USD touched a one-month high of US$1800 during the US trading session as bad news was announced from US stock markets and investors remained cautious ahead of the CPI report.

Technical Analysis

EURUSD

The EUR/USD pair advanced on Tuesday, preserving its bullish strength and extending the previous rebound toward the 1.022 area as investors await the key US CPI data. The pair is now trading at 1.02214, posting a 0.29% gain on a daily basis. EUR/USD stays in the positive territory amid a weaker US dollar across the board, as the sour market sentiment failed to lift the safe-haven greenback higher. Investors remain cautious ahead of the release of the US Consumer Price Index on Wednesday, which would set the tone for the Federal Reserve’s September meeting. For the Euro, the latest news showed that Russia has suspended oil flows via the southern leg of the Druzhba pipeline, which acted as a headwind for the shared currency and limit the upside for the EUR/USD pair.

For the technical aspect, the RSI indicator stands at 55 as of writing, suggesting that the upside is losing strength as the RSI keeps moving toward the mid-line. As for the Bollinger Bands, the price failed to touch the upper band and witnessed some selling, therefore the bearish momentum should persist. In conclusion, we think the market will be bearish as long as the 1.0246 resistance line holds. Technical readings in the chart skew the risk to the upside, as the technical indicators retreated toward their midlines.

Resistance: 1.0246, 1.0287, 1.0438

Support: 1.0150, 1.0111, 0.9991

GBPUSD

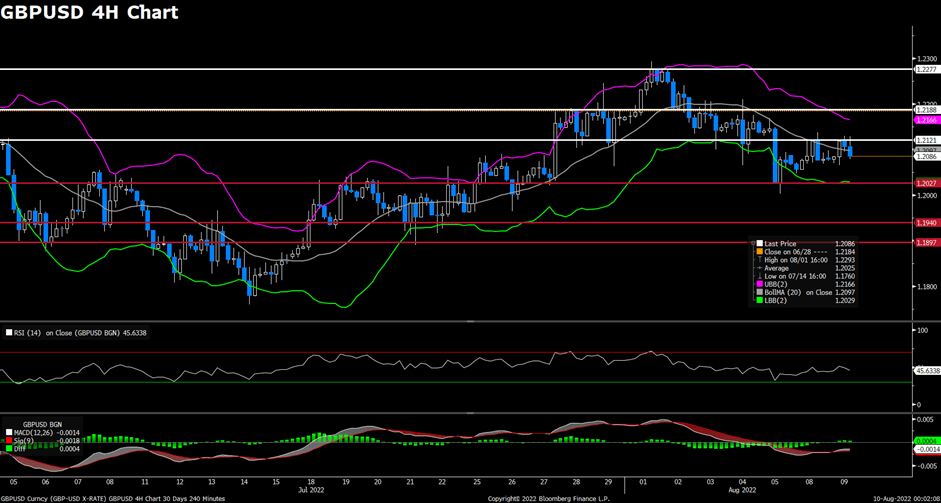

The GBP/USD pair edged higher on Tuesday, failing to extend its upside movements and dropped toward the 1.208 mark to erase most of its daily gains in the US session amid the rebound witnessed in the US dollar. At the time of writing, the cable stays in positive territory with a 0.09% gain for the day. The negative shift witnessed in risk sentiment is helping the greenback to find demand and exerted bearish pressure on the GBP/USD pair. For the British pound, the Bank of England Deputy Governor Dave Ramsden’s hawkish comments on Tuesday have underpinned the cable, as he said that it’s more likely than not that BoE will have to raise bank rate further even if a recession forces it to start lowering the policy rate.

For the technical aspect, the RSI indicator is at 46 as of writing, suggesting that the downside is more favoured as the RSI stays below the mid-line. For the Bollinger Bands, the price lost its upside traction and dropped below the moving average, therefore a continuation of the downside trend can be expected. In conclusion, we think the market will be bearish as long as the pair failed to break above the 1.2121 resistance line. On the downside, sellers could show interest if the pair falls back below 1.2027 support and additional losses could be expected.

Resistance: 1.2121, 1.2188, 1.2277

Support: 1.2027, 1.1940, 1.1897

XAUUSD

As the US dollar remained on the back foot throughout the day despite the cautious market mood on Tuesday, the pair XAU/USD preserved its upside strength and extended the rebound toward the US$1,800 area during the US trading session. XAU/USD is trading at US$1,797.05 at the time of writing, rising 0.44% on a daily basis. The modest US dollar weakness and sour market sentiment both provided support to the dollar-denominated gold, as the growing fears about a global economic downturn continued to weigh on investors’ mood. However, the Fed rate hike expectations might limit the upside for the precious metal as markets are now pricing in a 70% chance for a 75 bps Fed rate hike move at the September meeting following the upbeat US jobs data last Friday.

For the technical aspect, the RSI indicator is at 64 as of writing, suggesting the pair’s bullish outlook in the near term as the RSI indicator remains above the mid-line. For the Bollinger Bands, the price continued to rise toward the upper band, therefore a continuation of the upside trend could be expected. In conclusion, we think the market will be bullish as the pair is testing the US$1,794 resistance line. The pair could likely break above that level and extend its upside movements toward the US$1,811 mark.

Resistance: 1794, 1811, 1831

Support: 1769, 1756, 1735

Economic Data

| Currency | Data | Time (GMT + 8) | Forecast |

| USD | Core CPI (MoM) (Jul) | 20:30 | 0.5% |

| USD | CPI (YoY) (Jul) | 20:30 | 8.7% |

| USD | Crude Oil Inventories | 22:30 | 0.073M |