US stock rebounded slightly after falling as much as 2.2% on Tuesday as fears of a globalized recession take their toll on financial markets. The talks of easing tariffs on China imposed by the former administration failed to appease recession fears as concerns about a potential US recession and stubborn inflation remained, despite the reducing tariffs on imported Chinese goods could impact consumer prices in the US. The release of the FOMC minutes in today’s session will remain in focus, providing a detailed view of Federal Reserve policymakers on supporting the Fed’s 75 basis points interest rate hike. In the Eurozone, German Economy Minister Robert Habeck noted that the energy industry crisis could hurt financial markets as Russia has curbed its gas flows to the country. Market participants expect the European Central Bank to hike rates by 130 bps by year-end.

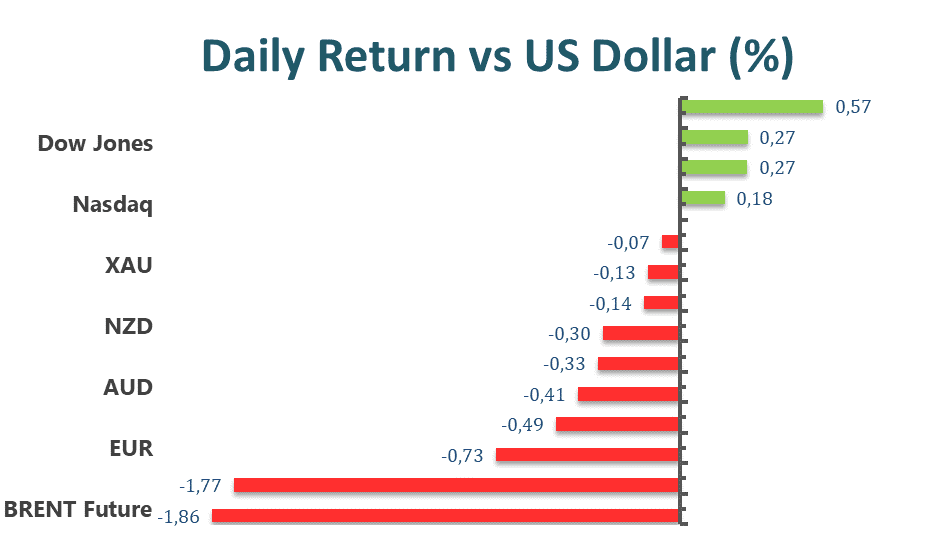

The benchmarks, S&P 500 and Nasdaq 100 both rose on Tuesday despite the safe-haven US dollar taking advantage of the risk-aversion and risk-off market mood. S&P 500 was up 0.2% daily and the Nasdaq 100 also advanced with a 1.7% gain for the day. But eight out of eleven sectors stayed in negative territory as the energy and utilities sectors are the worst-performing among all groups, losing 4.01% and 3.43%, respectively. The Dow Jones Industrial Average meanwhile declined with a 0.4% loss on Tuesday and the MSCI World index rose 0.3%. Global equity markets remain under pressure as investors rushed to the dollar’s safety recently.

Main Pairs Movement

The US dollar advanced and surpasses the 106.00 level to touch a new cycle high on Tuesday. The US dollar soared over 1.3% due to the fears of a globalized recession, continuing to find demand amid risk-averse scenarios. According to analysts, the risk of a US recession is above 70%.

EUR/USD was surrounded by bearish momentum, The EUR/USD pair fell to a 20-year low of 1.0236, recovering some ground later in the day but still hovering below the 1.0300 thresholds. Economic reports show that EU growth slowed to a 16-month low, while Germany struggles to get gas amid gradually increasing tensions with Russia. German Economy Minister Robert Habeck said that the energy industry crisis could hurt financial markets. He did not rule out intervening gas prices. Russia curbed its gas supplies to the country, Germany, therefore, fears a complete blackout of provision, as Russia will temporarily shut down the NordStream-1 pipeline on July 11 for annual maintenance. By contrast, the risk-off dollar seems more attractive to the Euro. Meanwhile, GBP/USD slumped as well yesterday. The pair was down 1.41% for the day.

The gold price plummeted over 2.4% on Tuesday, and rebounded back slightly after touching a daily low below $1764 in the late European session, now hovering slightly below 1770.

Technical Analysis

USDJPY (4-Hour Chart)

USDJPY gains positive traction for the second consecutive day as the risk sentiment favours the US dollar at the time of writing. The outlook of USDJPY consolidates in between 134.89 and 137.00 ahead of the FOMC meeting. However, the divergent monetary policies between the Fed and the BOJ should limit the downside of USDJPY. USDJPY has breached the resistance level of 135.7, suggesting an upside momentum in the near- term. To the upside, if the immediate support can sustain and hold, then it would possibly contest the peak at 137.00. On the flip side, if the support fails to defend, then USDJPY is expected to consolidate.

Resistance: 135.70, 137.00

Support: 134.89, 134.24, 133.59

GBPUSD (4-Hour Chart)

GBPUSD renews multi-year lows in March 2020. The outlook of GBPUSD remains bearish as the pair continues to trade below the descending trend line; in the meantime, the bearish momentum is supported by the double-top formation. At the time of writing, GBPUSD is contesting the immediate support level of 1.1899. If the pair can recover at this stage, then it could potentially attract some dip-buying buyers, but bears are still in charge. On the downside, if the support cannot hold, then the pair would accelerate further south. At the moment, the selling pressure seems to moderate a bit as the RSI has reached the oversold condition and the MACD has turned upside.

Resistance: 1.208, 1.2192, 1.2283

Support: 1.1899

Gold (4-Hour Chart)

Gold slides sharply below $1,770 following the extra pace and renewed upside momentum of the safe- haven, the US dollar. The intraday decline is supported by multiple factors, including a stronger US dollar and a hawkish Fed expectation ahead of the FOMC meeting. From the technical perspective, gold is facing strong selling pressure, suggesting that gold is in the bearish mode. Dropping below the descending channel has brought further gold south. Breaking the channel has accelerated the bearish momentum toward the support level of $1,765. If the support fails to defend, then gold would confront another fresh selling pressure. In the meantime, the double-top formation has been constructed, meaning that gold is in the situation of bears. The current support level might be able to stop the bears a bit as the RSI indicator has reached the oversold territory. Further price action eyes on the upcoming FOMC meeting.

Resistance: 1791.85, 1818.39, 1821.76

Support: 1765.11

Economic Data

| Currency | Data | Time (GMT + 8) | Forecast |

| USD | FOMC Meeting Minutes | 02:00 | |

| EUR | ECB Publishes Account of Monetary Policy Meeting | 19:30 | |

| USD | ADP Nonfarm Employment Change (Jun) | 20:15 | 200K |

| USD | Initial Jobless Claims | 20:30 | 230K |

| CAD | Ivey PMI (Jun) | 22:00 | |

| USD | Crude Oil Inventories | 23:00 | -0.569M |