On Wednesday, the Dow Jones Industrial Average ended a three-day losing streak as Treasury yields pulled back from multiyear highs. The Dow gained 0.39%, while the S&P 500 and Nasdaq also showed positive performances. Notable sector performances included the consumer discretionary sector, boosted by Tesla and Norwegian Cruise Line, and the energy sector, which suffered due to a drop in crude prices. These market movements followed the release of weak private payrolls data, raising concerns about higher interest rates and their impact on the economy. Currency markets saw a decline in the US dollar as Treasury yields and oil prices retreated, adding to uncertainty in the market. All eyes were on Friday’s jobs report for insights into the labor market and the direction of equities and interest rates.

Stock Market Updates

On Wednesday, the Dow Jones Industrial Average snapped a three-day losing streak in response to a pullback in Treasury yields, which had reached multiyear highs. The 30-stock index gained 127.17 points, or 0.39%, closing at 33,129.55. The S&P 500 also showed a positive performance, increasing by 0.81% and closing at 4,263.75, while the Nasdaq Composite surged by 1.35% to close at 13,236.01. Notable among sector performances within the S&P 500 was the consumer discretionary sector, which stood out as the best performer, with a rise of approximately 2%. This boost was primarily attributed to strong gains from Tesla, up by 5.9%, and Norwegian Cruise Line, up by 3.8%. In contrast, the energy sector was the worst-performing sector for the day due to a significant drop in crude prices. Devon Energy and Marathon Oil both saw declines of around 5%, while SLB and Halliburton dropped more than 4%.

These market movements came after the release of new jobs data, which revealed that only 89,000 private payrolls were added in the previous month, significantly below the Dow Jones forecast of 160,000 and even lower than the upwardly revised figure of 180,000 payroll additions for August. Consequently, Treasury yields pulled back slightly from their 2007-level highs, with the 10-year Treasury yield trading at 4.735%. The market has been grappling with concerns over higher interest rates, which have raised fears of a potential recession and pushed mortgage rates to nearly 8%, causing mortgage demand to plummet to its lowest levels since 1996. Investors are eagerly awaiting the release of September’s nonfarm payrolls data on Friday, hoping for more insights into the labor market’s strength and the future direction of equities and interest rates. The recent divergence between fixed income and equities has left investors on edge, and the market is being heavily influenced by movements in interest rates.

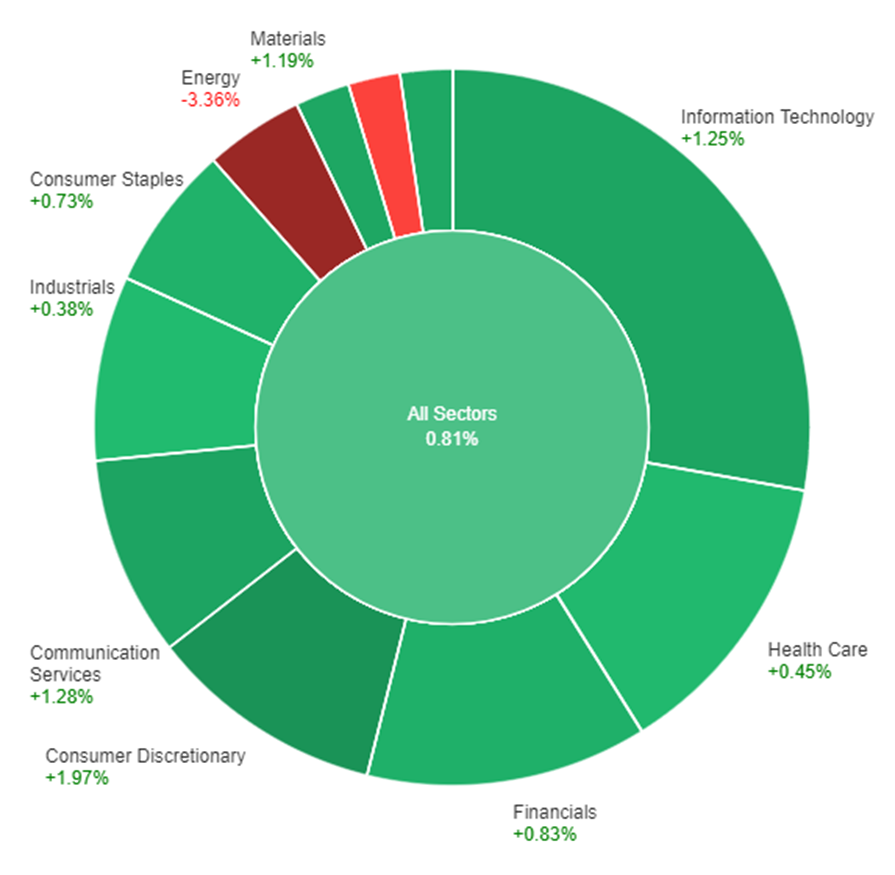

Data by Bloomberg

On Wednesday, across all sectors, the market experienced a positive trend with a gain of 0.81%. The sectors that performed particularly well include Consumer Discretionary (+1.97%), Communication Services (+1.28%), Information Technology (+1.25%), Materials (+1.19%), Real Estate (+1.13%), and Financials (+0.83%). On the other hand, some sectors had a less favorable day, with Consumer Staples (+0.73%), Health Care (+0.45%), Industrials (+0.38%) recording more modest gains. Utilities (-0.09%) saw a slight decline, while Energy had a significant decrease of -3.36%.

Currency Market Updates

In recent currency market updates, the US dollar experienced a decline of 0.27% as Treasury yields and oil prices retreated, prompting market participants to contemplate the potential adverse economic consequences and the sustainability of these trends. The uncertainty was evident in the performance of USD/JPY, which had previously witnessed a significant drop from its 2023 peak, ranging from 150.165 to 147.30 on Tuesday, while crude oil prices collapsed. The day’s US economic data, including ADP’s 89,000 employment increase, falling short of the expected 153,000, added to the uncertainty. This was further compounded by the upcoming non-farm payrolls report, with forecasts predicting a decline from 187,000 to 170,000, a key market indicator. ISM services remained on par with forecasts at 53.6, showing a slight dip from the previous month, primarily due to a significant drop in new orders, which fell from 57.5 to 51.8, reaching a nine-month low. Notably, the article highlighted that the eurozone was expected to contract in the third quarter, while the US Q3 GDP forecasts remained optimistic at 4.9% annualized. In terms of monetary policy, the European Central Bank (ECB) was seen as less likely than the Federal Reserve (Fed) to raise interest rates again.

Amid this context, the EUR/USD currency pair saw a 0.37% rise, primarily driven by the broader weakening of the US dollar and a 7-basis point rebound in 2-year bund-Treasury yield spreads. The pair’s rebound from Tuesday’s low of 1.0448 may depend on Friday’s payrolls report echoing the soft ADP data from Wednesday. USD/JPY remained relatively flat within a narrow trading range of around 149, particularly after bouncing back from a notable decline that saw it drop from 150.165 to 147.30 on Tuesday. Concerns over potential Japanese intervention to bolster the yen’s value left the USD/JPY uptrend in a state of uncertainty. Meanwhile, the British pound experienced a 0.5% increase, partly due to a positive revision in the UK’s September PMIs, despite the fact that the PMI figures still indicated contraction below the 50 mark. These market dynamics occurred in the backdrop of 10- and 30-year Treasury yields falling after testing crucial resistance levels earlier on Wednesday. As the week progressed, all eyes were on Friday’s jobs report, which was anticipated to have a substantial impact on the currency markets.

Picks of the Day Analysis

EUR/USD (4 Hours)

EUR/USD Struggles to Hold Ground Against Strengthening US Dollar Amid Rising Yields and Weak Economic Data

The Euro, after recovering from a year-low against the US Dollar, is facing challenges in maintaining its position above 1.0500. Rising government bond yields, with the German 10-year yield hitting its highest level since 2011, are causing concern among investors. Additionally, economic data from the Eurozone, including a negative shift in the Producer Price Index and a decline in Retail Sales, are adding to the Euro’s woes. While the European Central Bank remains cautious about interest rates, the US Dollar continues its upward trend, supported by strong fundamental factors and upcoming employment data releases.

Based on technical analysis, the EUR/USD went up on Wednesday and managed to reach the middle line of the Bollinger Bands. Right now, the EUR/USD is trading above the middle line, which suggests a chance for a small upward move to reach the upper line of the Bollinger Bands. The Relative Strength Index (RSI) is at 53, indicating that the EUR/USD is currently trying to return to a neutral position.

Resistance: 1.0538, 1.0605

Support: 1.0489, 1.0406

XAU/USD (4 Hours)

XAU/USD Holds Steady Around $1,820 as Investors Seek Yield Amid Uncertain Market Signals

Gold prices remained relatively stable on Wednesday, with little movement as they hovered around the $1,820 mark. While initial demand for the precious metal appeared before Wall Street’s opening, it was short-lived, as investors turned to high-yield assets. Financial markets sought direction from government bond yields and US economic data but found few clear signals. The 10-year Treasury note yield reached its highest level since 2007 before easing, while the US Dollar traded near daily lows, reflecting a modest improvement in market sentiment amid mixed economic figures.

Based on technical analysis, XAU/USD exhibited consolidation on Wednesday. It reached the downward-sloping middle line of the Bollinger Bands. Currently, the price of gold is trading around the middle line, indicating the potential for further consolidation throughout the day, given the narrowing of the Bollinger Bands. The Relative Strength Index (RSI) currently stands at 37, signaling a bearish bias for the XAU/USD pair.

Resistance: $1,834, $1,858

Support: $1,809, $1,777

Economic Data

| Currency | Data | Time (GMT + 8) | Forecast |

|---|---|---|---|

| USD | Unemployment Claims | 20:30 | 211K |