On Tuesday, the Dow Jones Industrial Average faced a 0.62% dip, closing at 37,361.12, influenced by increased bond yields and mixed fourth-quarter earnings. Boeing shares plummeted 7.9% due to a Wells Fargo downgrade, while AMD soared 8.3% on a positive semiconductor demand outlook. Goldman Sachs outperformed profit expectations, boosting its shares, while Morgan Stanley saw a 4% decline despite revenue beats. The USD index rose by 0.75%, driven by higher U.S. Treasury yields and shifting Fed rate expectations. Currency pairs experienced notable movements, with EUR/USD dropping 0.76%, USD/JPY rising by 1%, and GBP/USD weakening. In the cryptocurrency landscape, BTC rose 1.4%, ETH increased by 2.2%, and gold fell 1% following SEC approval of spot ETFs and market focus on ether spot ETF approvals.

Stock Market Updates

The stock market experienced a decline on Tuesday, with the Dow Jones Industrial Average dropping 0.62%, closing at 37,361.12. Bond yields increased, contributing to the negative sentiment as investors examined fourth-quarter earnings. Boeing shares fell sharply by 7.9% following a downgrade by Wells Fargo, citing ongoing issues with its 737 Max 9 model. On a positive note, AMD shares surged 8.3% due to optimistic analyst commentary on semiconductor demand. The benchmark 10-year Treasury note yield rose over 11 basis points to 4.064% after Federal Reserve Governor Christopher Waller hinted at a slower-than-expected easing of monetary policy.

In the banking sector, Goldman Sachs reported better-than-expected profit and revenue, causing a slight increase in its shares, while Morgan Stanley posted a revenue beat but saw a decline of over 4%. Overall, 78% of the roughly 30 S&P 500 companies reporting fourth-quarter results have exceeded earnings expectations. Investors are now anticipating December retail sales data, set to be released on Wednesday, which could impact market sentiment based on U.S. consumer spending trends and concerns about economic growth.

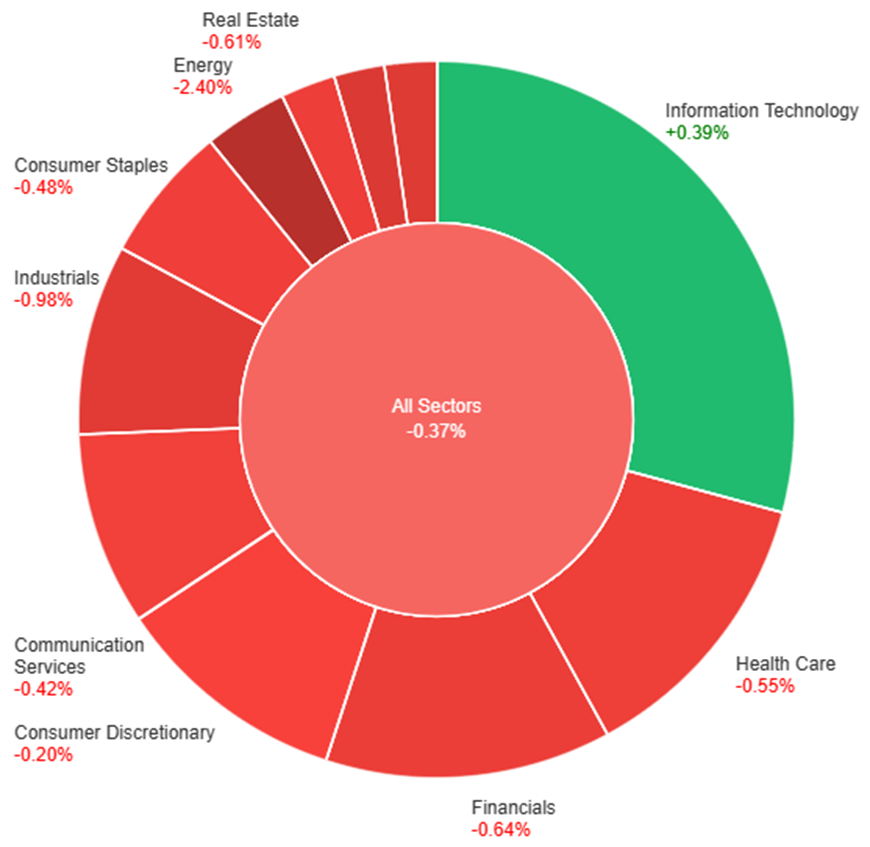

Data by Bloomberg

On Tuesday, the overall market experienced a slight decline of 0.37%. The Information Technology sector saw a positive movement with a gain of 0.39%, while Consumer Discretionary showed a modest decrease of 0.20%. Communication Services and Consumer Staples both experienced declines of 0.42% and 0.48%, respectively. Health Care, Real Estate, and Financials also saw negative trends with decreases of 0.55%, 0.61%, and 0.64%, respectively. Industrials faced a more significant downturn with a decline of 0.98%. The Utilities and Materials sectors both exhibited larger decreases of 1.05% and 1.19%, respectively. Energy witnessed the most substantial decline among all sectors, with a notable decrease of 2.40%.

Currency Market Updates

In the latest currency market updates, the USD index surged by 0.75%, driven by rising U.S. Treasury yields and a shift in Fed rate expectations. Governor Christopher Waller’s comments acknowledging the potential for rate cuts tempered extreme dovish sentiments, contributing to the rally. The 5-30-year Treasury yields rose, bolstering the dollar, while less-dovish ECB comments and higher Canada CPI played roles in shaping the session. Despite the increase in long-end Treasury yields, there remains a 68% chance of a 25bp Fed cut in March, indicating a nuanced market sentiment. Notably, the EUR/USD pair declined by 0.76% to 1.0870, reflecting the impact of less-dovish ECB central bank comments on the euro, amidst concerns about euro zone growth.

In parallel, other currency pairs saw notable movements. USD/JPY rose by 1% to 147.25, driven by higher Fed rate expectations and a consistently low BoJ rate outlook. GBP/USD weakened due to the less-dovish Fed rate view, although the impact was relatively muted given higher UK inflation and rate expectations. Focus now shifts to the UK CPI data, with potential implications for the BoE’s rate decisions. USD/CAD rose by 0.43%, reaching 1.3484, but gains were tempered by stronger-than-expected Canada CPI, diminishing expectations for an early BoC rate cut. Additionally, AUD/USD fell by 1.2%, influenced by higher rates and concerns about global growth amid doubts regarding China’s recovery. In the broader financial landscape, BTC rose by 1.4% to $43.3k, ETH increased by 2.2%, and gold fell 1% to $2,035, reflecting market responses to SEC approval of spot ETFs and shifting focus to ether spot ETF approvals.

Picks of the Day Analysis

EUR/USD (4 Hours)

EUR/USD Suffers Sharp Decline as USD Gains Momentum Amidst Divergent Central Bank Signals and Strong US Yields

EUR/USD extended its bearish trend, breaking below the critical support level at 1.0900 and hitting a new yearly low near 1.0860. The upward momentum of the US Dollar, driven by a surge in the USD Index to 2024 peaks beyond 103.00, was reinforced by robust US yields as traders returned from the MLK holiday. ECB officials’ comments, though leaning towards rate cuts, clashed with market expectations, leading to a subdued EUR. Despite positive Economic Sentiment indicators in Germany and the Eurozone, the Euro failed to find support, and the probability of a Fed rate cut in March, as indicated by CME Group’s FedWatch Tool, decreased slightly. The decline in the Euro was set against the backdrop of rising yields in both German bunds and US Treasuries.

On Tuesday, the EUR/USD moved lower, able to reach the lower band of the Bollinger Bands. Currently, the price is moving just above the lower band, suggesting a potential upward movement to reach the middle band. Notably, the Relative Strength Index (RSI) maintains its position at 30, signaling an oversold outlook for this currency pair.

Resistance: 1.0895, 1.0954

Support: 1.0814, 1.0742

XAU/USD (4 Hours)

XAU/USD Faces Sell-Off Amid Interest Rate Uncertainty and Inflation Dynamics

Gold prices (XAU/USD) experienced a decline as attempts to surpass the weekly high of $2,060 fell short. This setback was triggered by investors reassessing the Federal Reserve’s potential interest rate adjustments. The release of the December Consumer Price Index (CPI) report, coupled with hawkish statements from European Central Bank (ECB) officials, influenced market sentiment. While expectations for a rate cut in March persist, the Federal Reserve remains cautious, considering the robust consumer price inflation in the U.S. economy, steady labor demand, and low recession risks. As markets await cues from upcoming data such as monthly U.S. Retail Sales, Industrial Production, and the Fed’s Beige Book, the trajectory of gold prices hinges on evolving interest rate outlooks.

On Tuesday, XAU/USD moved lower and tried to reach the lower band of the Bollinger Bands. Currently, the price moving just above the lower band suggesting a potential upward movement to reach the middle band. The Relative Strength Index (RSI) stands at 40, signaling a neutral but bearish outlook for this pair.

Resistance: $2,035, $2,048

Support: $2,023, $2,010

Economic Data

| Currency | Data | Time (GMT + 8) | Forecast |

|---|---|---|---|

| GBP | Consumer Price Index y/y | 15:00 | 3.8% |

| USD | Retail Sales m/m | 21:30 | 0.4% |

| USD | Core Retail Sales m/m | 21:30 | 0.2% |