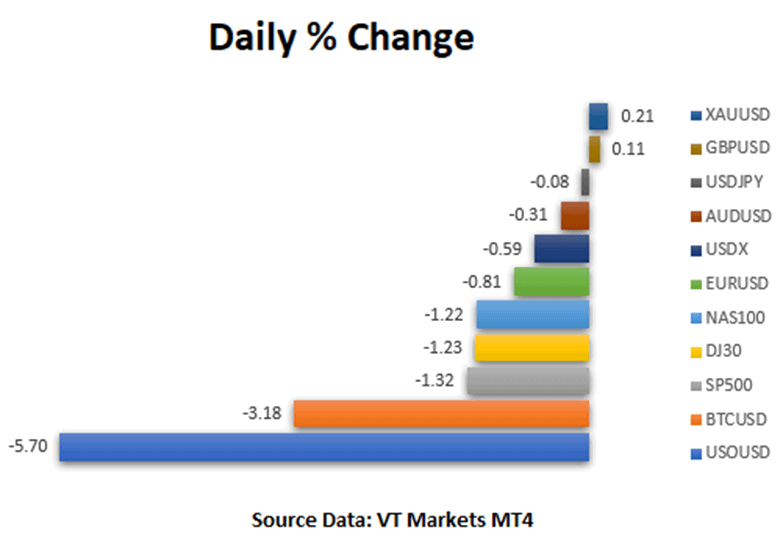

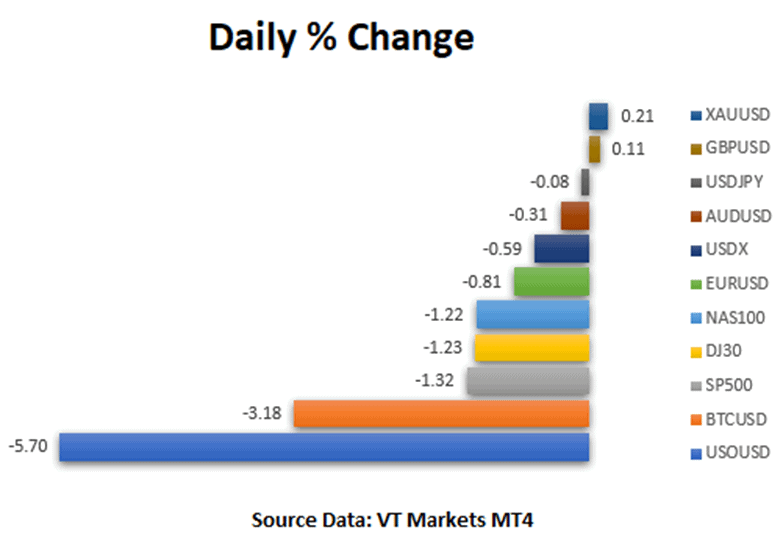

US equity markets remained stable on Friday following the release of US job data, but the NAS100 dipped as some technology firms declined. According to MT4 VT Markets data, the SP500 closed flat at 0.00 percent, the DJ30 gained 0.01 percent, and the NAS100 fell 0.42 percent.

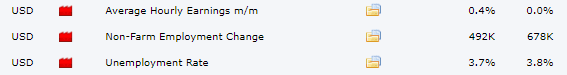

The USD ended the week on a strong note following Friday’s US jobs report. Non-Farm Employment Change increased by 431K, albeit at a slower pace than the previous month’s 750K, while the Unemployment Rate increased by 3.6 percent, above forecasts and the previous month’s figures. The average hourly earnings m/m statistics came in at 0.4 percent, compared to 0.1 percent in the previous month.

This report increases market expectations for the FED to boost interest rates even higher, possibly by as much as 50 basis points.

Main Pairs Movement

AAPL was down 0.59 percent to close at $172.87, while INTEL and NVIDIA were both down, with INTEL down 4.04 percent to $47.80 and NVIDIA down 3.74 percent to $263.27.

With a 1.89 percent loss on Friday, USOUSD (WTI Texas) closed below $100, its lowest in two weeks.

The USDX (USD Index) gained 0.22 percent because of the US jobs data. The US jobs report boosted the USDJPY by 0.76 percent, while the EURUSD declined by 0.16 percent.

XAUUSD (Gold) also decreased by 0.67 percent.

Technical Analysis

GBPUSD (4-Hour Chart)

The GBPUSD dipped slightly on Friday as a result of US employment data. GBPUSD is trading below its recent average level of 1.3126, with a chance of falling to the 1.3080 support level, with resistance levels at 1.3126 and 1.3188. GBPUSD is trading below its 50-day, 100-day, and 200-day simple moving averages on the four-hour chart (SMAs).

Resistance: 1.3126 | 1.3188

Support: 1.3080

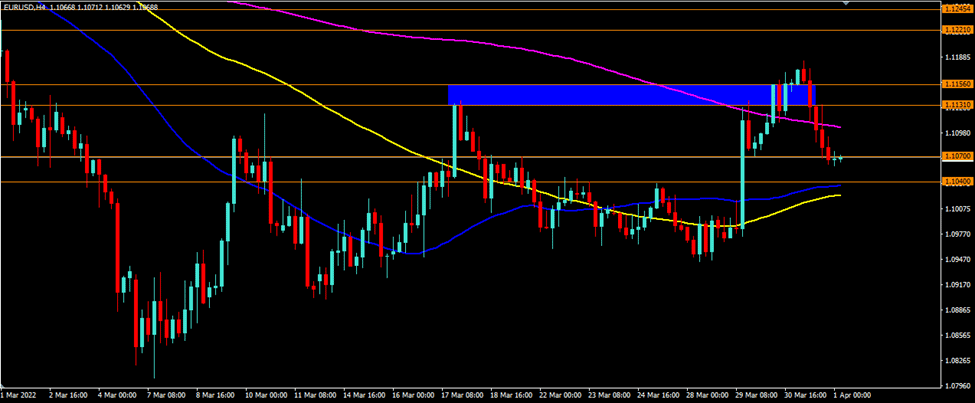

EURUSD (4-Hour Chart)

The EURUSD is still falling, approaching the 1.1040–1.1070 support zone. The EURUSD appears to be capped at 1.1040, but if that level is breached, the next support level is at 1.1000. The resistance level is at 1.1070, with a continuation at 1.1093. The EURUSD is trading above its 50-day and 100-day simple moving averages (SMAs) on the four-hour chart but below its 200-day SMAs (SMAs).

Resistance: 1.1070. 1.1093

Support: 1.1040, 1.1000

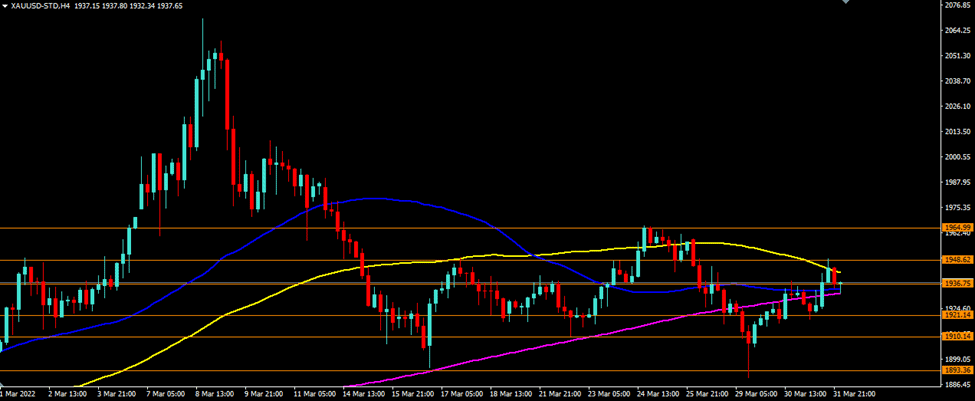

XAUUSD (4-Hour Chart)

On Friday, the XAUUSD fell due to a good market reaction to US job statistics. Currently, XAUUSD is locked around $1921 as a support level, with $1910 and $1893 as the next support levels. The $1936 and $1948 resistance levels are still in play. On the four-hour chart, XAUUSD is currently trading below its 50-day, 100-day, and 200-day SMAs.

Resistance: $1936, $1948

Support: $1921, $1910, $1893