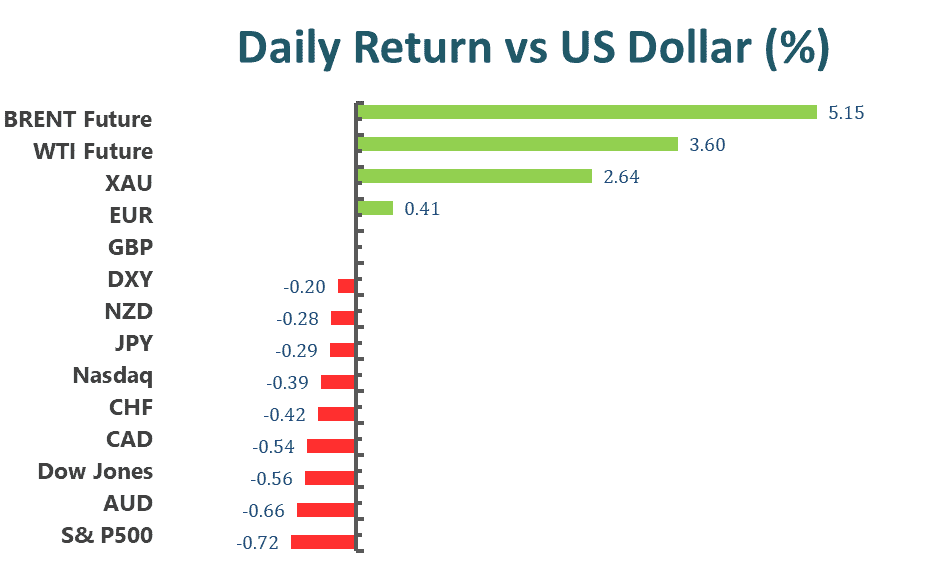

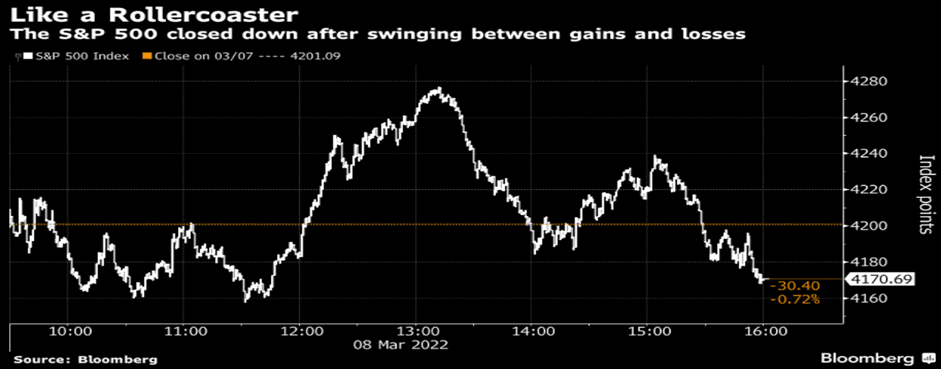

The US equities declined on Friday, notching the fifth straight week of losses as the war between Russia and Ukraine continues. The three major indices went positive during the European trading session following the comment from Russian President Putin, saying that the talks occurred to be positive; however, indices ended with negative as a ceasefire had not been negotiated. The Dow Jones Industrial Average fell 0.69% while the Nasdaq Composite was down 2.2%. The S&P 500 dropped 1.3%, dropping 12% from its peak and declining 9% since the headline of Russia and Ukraine.

Following the restriction of importing Russian energies imposed by the US, Britain, Germany, and France warned Russia over the weekend that an almost- completed nuclear deal with Iran could potentially collapse on Russian demands of oils. If the agreement can be reached, then it could help to offset a disruption to supplies from Russia’s war in Ukraine.

The US Federal Reserve’s first interest rates hike is expected to be announced this week while the uncertainty over Ukraine’s crisis continues to hang. In the meanwhile, the Fed also should reveal new forecasts for the US economy. Besides the FOMC interest rates decision, there are also a few economic reports coming this week, including Producer Price Index, retail sales, and existing home sales.

Main Pairs Movement

Gold stayed deep below $2,000, trading at $1,988 on Friday with the 10 year Treasury bond yield gaining nearly 2%. Gold price is on the defensive side following the ECB’s hawkish stance; at the same time, the Fed is expected to embark on its tightening policy despite Ukraine’s crisis.

EURUSD was down 0.66%, trading at 1.09107. The markets weighed the US dollar over the eurodollar despite the ECB showing its hawkish action. The ECB is expected to wait until Q1 2023 to raise the rates, but by then, the Fed will possibly have already raised by 25 bps.

AUDUSD retreated from weekly tops on Friday, trading around 0.72896. The Australian dollar failed to gain traction amid the positive market mood. For mostly the same reason, the US dollar was more preferable from the markets’ perspective as the markets were expecting the Fed to raise the rates.

Technical Analysis

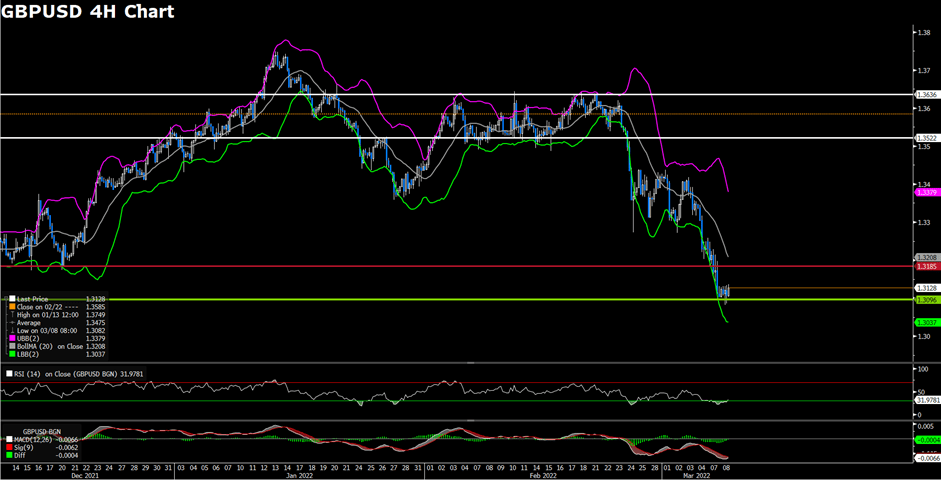

GBPUSD (Daily Chart)

The British Pound met further selling pressure after a turbulent early trading session. The British National Statistics revealed a better than expected economic growth rate of 0.8%. Despite a positive economic outlook, the Pound fared worse against the Dollar as market participants continue to demand the Greenback over any other currency. The benchmark U.S. 10 year treasury yield topped 2% once again as market participants rotate into U.S. equities.

On the technical side, Cable is attempting to regain support at the 1.3096 price level, but this support level could soon turn into a resistance level should Cable fail to consolidate around this price point. At the time of writing, RSI for Cable is at 32.7. Cable is currently trading below its 50, 100, and 200 days SMA.

Resistance: 1.3185

Support: 1.2998, 1.2876

EURUSD (4-Hour Chart)

Despite a shift in tone from the ECB, EURUSD still faced strong selling pressure as trading began on the 12th. With ECB president Christine Lagarde reiterating that the central bank would not begin hiking interest rates any time soon, market participants sold off the Euro. The Dollar was buoyed by the rising short-term treasury yield and a reviving equities market.

On the technical side, EURUSD continues to fall from the previous day’s close. The support level at 1.0839 remains firm. On the 4 hour chart, a new short-term support level seems to have formed at around the 1.0893 price region. RSI for EURUSD is at 43.5, as of writing. EURUSD is currently trading below its 50, 100, and 200 days SMA.

Resistance: 1.1127

Support: 1.0893, 1.0845

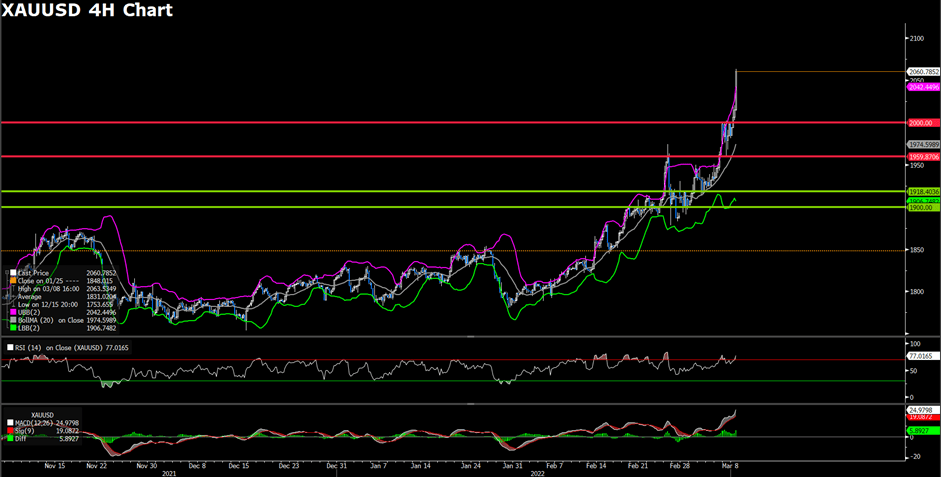

XAUUSD (4-Hour Chart)

Gold faced fresh selling pressure as the U.K. trading session began. The precious metal dropped as low as $1958 per ounce during the day, but it met strong buying as the U.S. trading session began. As of writing, Gold is trading at $1983 per ounce. With global countries mounting sanctions on Russia, market participants will continue to closely observe Russian President Vladimir Putin’s response.

On the technical side, XAUUSD’s previous support level at $2000 per ounce seems to have disappeared and is now transformed into a solid resistance level. RSI for the precious metal currently sits at 49.09. XAUUSD is trading above its 50, 100, and 200 days SMA.

Resistance: 2000

Support: 1961, 1918

Economic Data

| Currency | Data | Time (GMT + 8) | Forecast |

| No Events |