Market Focus

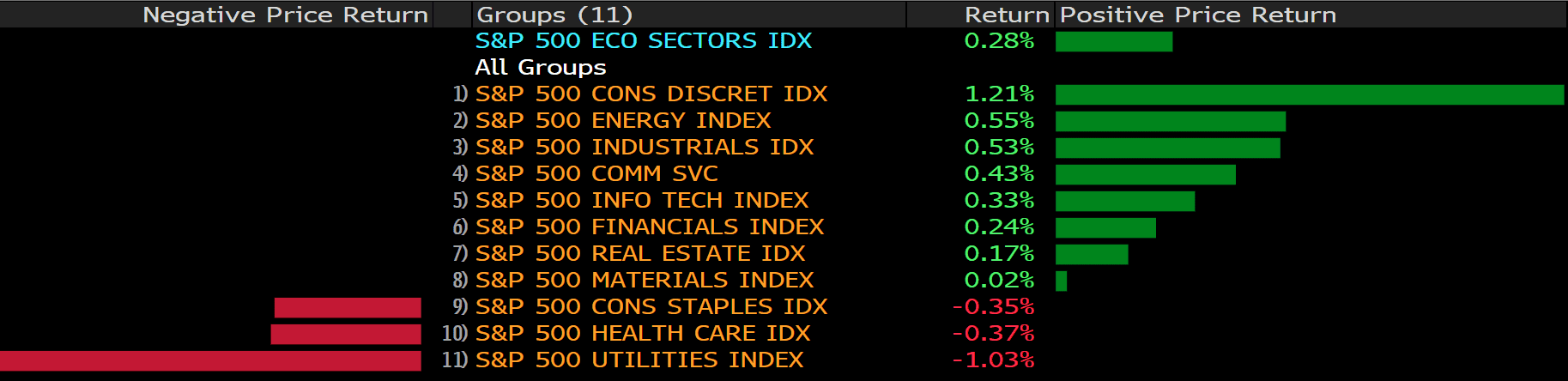

U.S. equity markets experienced a turbulent trading session, all three major equity indices dropped at the bell but all were able to amount an incredible comeback. The Dow Jones industrial average clawed back 0.29% to close at 34,364.5, the S&P 500 gained 0.28% to close at 4,410.13, and the Nasdaq composite gained 0.63% to close at 13,855.13. The Dow Jones industrial average clawed back more than 1000 points after being down 1,115 points mid session. The benchmark U.S. 10 year treasury yield edged higher to 1.774% and the 30 year treasury yield also moved higher to 2.114%.

Earnings season continue as Microsoft Corporation, Johnson & Johnson, and Verizon Communications Inc. are all due to report their 4th quarter earnings after market close of the 25th. Mixed earnings have been reported so far. The financial sector has already report some missed earnings targets, but market participants will continue to monitor earnings from the technology sector, which would be the most impacted sector by an interest rate hike. The FOMC will meet on Wednesday, followed by a press conference where chairman Jerome Powell will provide guidance on the monetary policies ahead.

Main Pairs Movement:

The Dollar Index rallied over the course of yesterday’s trading, but the index pulled back as market participants rotated into equities that fueled the equity markets’ impressive comeback.

Natural gas remained depressed as global demand for the commodity wains. Interest in this commodity remains weak as open interest continues to falter.

The Euro-Dollar pair traded lower amid Dollar strength. EURUSD traded below 1.3 as the American session began but was able to repair loses as market participants saw an opportunity to enter.

Gold ended its two-day losing streak as market participants boost the precious metal above the key resistance level at 1,840.

Technical Analysis:

Open interest in natural gas futures markets shrank for the third consecutive session on Friday, this time by around 2.3K contracts, according to advanced prints from CME Group. Volume reversed two daily builds in a row and went down by around 145.5K contracts.

Friday’s decent gains in prices of natural gas was supported by short covering, as noted by declining open interest and volume. Against this, further gains appear not favoured in the very near term, with the RSI dropped below the average line. The door still open to a visit to the $3.550 region per MMBtu, or December lows.

Resistance: 4.100, 4.800, 5.500

Support: 3.800, 3.550

EUR/USD held up well on Monday despite the market’s deeply risk-off tone, with the pair finding good dip-buying interest when it hit the 1.1300 level earlier in the session and recovering to trade flat on the day in the 1.1320s. As has been the case for the past four sessions, the price action continues, for the most part, to stick between the 20 and 50-day moving averages at 1.1350 and 1.1315 respectively.

As to technical, the shared currency’s price action remains around the 23.6% to 38.2% Fibonacci consolidation range. The RSI indicator reads 47.64, showing slightly bearish tone. As mentioned last Friday, if the pair manages to rise back above 38.2% Fibonacci, then the outlook would improve. On the downside, a solid break under 23.6% Fibonacci should clear the way to more losses and to a test of the bottom of the retracement lines.

Resistance: 1.1380, 1.1440,1.1500

Support: 1.1300, 1.1200

XAUUSD (Daily Chart)

Gold is headed for a positive close on Monday following a heavily risk-off session and a run for safer havens. At the time of writing, gold is up 0.3% after climbing from a low of $1,829.76 and settling around the $1,840 price levels, so far with eyes on the psychological $1,850 level.

From the technical perspective, Gold has achieved to stay above the critical $1,830 price level in the last three trading days. XAU/USD is neutral-upward biased, as portrayed by the major DMAs below the spot price, but its horizontal slope leaves the yellow metal under downward pressure. To the upside, gold’s first resistance would be the robust $1,860, and for cases that breaches the long-lasting downtrend, the pair could reach its last summer’s highs at around $1,900; On the flip side, gold’s first support is at $1,830. A breach of the latter would expose the next support at $1,800, followed by the November lows around $1,765.

Resistance: 1860, 1900

Support: 1830, 1800, 1765

Economic Data:

|

Currency |

Data |

Time (GMT + 8) |

Forecast |

|

|

AUD |

CPI (QoQ) (Q4) |

1.0% |

||

|

EUR |

German Ifo Business Climate Index (Jan) |

94.7 |

||

|

USD |

CB Consumer Confidence (Jan) |

111.8 |

||