Market Focus

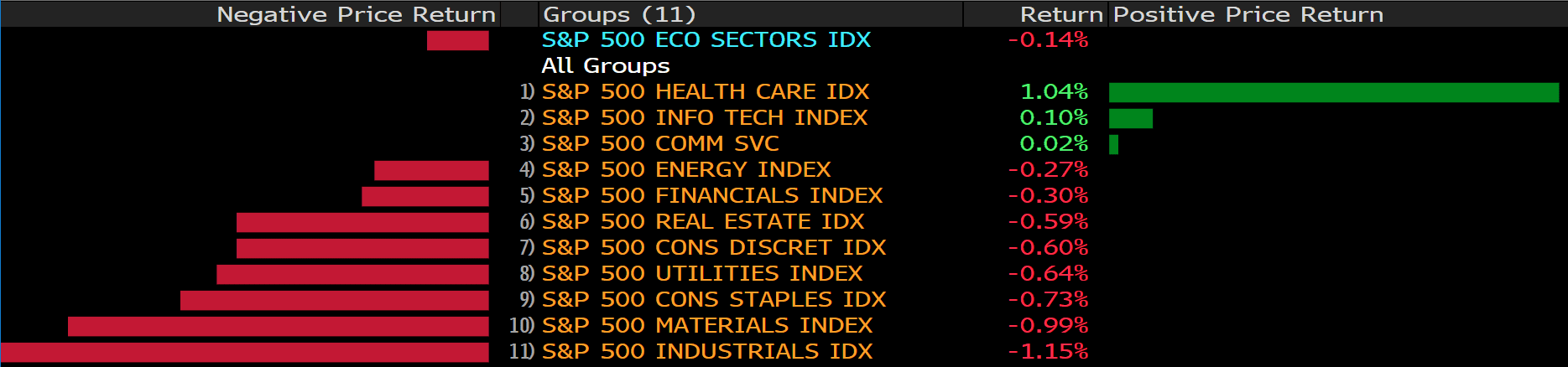

The broad U.S. equity market continued to suffer for the second week of 2022. The Dow Jones Industrial Average lost 0.45% to close at 36068.87, the S&P 500 lost 0.14% to close at 4670.29, while the Nasdaq gained 0.05% to close at 14942.83 and end a 5 day losing streak. The benchmark U.S. 10 year treasury yield remained little changed at 1.769% and the 30 year treasury yield sits at 2.1%.

Federal Reserve chairman Jerome Powell is scheduled to speak on the Fed’s rate hike outlook later today, and the statement is expected to bring volatility to all markets. The health care sector gained the most yesterday, as new mutations of the COVID-19 virus was discovered in Cyprus. The newly discovered “Deltacron” present yet another hurdle to global economic and tourism recovery. Moderna enjoyed a 9.28% gain in share price as market participants reassess pandemic fears and vaccination expectations.

Main Pairs Movement:

The Dollar Index, which measures the Greenback against a basket of major foreign currencies, began recovery over the course of Monday’s trading. Federal Reserve chairman Jerome Powell statement tonight could, however, edge the Greenback even higher as market participants expects continued tightening by the Fed.

Cable retreated 0.07% over Monday’s trading. The stronger Dollar on Monday rejected any upward movement of the Sterling; furthermore, on the technical side, Cable faces strong resistance at the 1.36 price level.

The Euro-Dollar pair lost 0.32% over the course of Monday’s trading. The ECB’s president Lagarde is due for a statement later today.

The precious metal, Gold, found further upward momentum as pandemic fears reignite. Gold continued its two day winning streak and sees solid support near its current price.

Technical Analysis:

GBP/USD consolidated at the start of the week in the Asian and early European session, even once bounced off the 1.3600 strong resistance. However, the pair plummeted at the Wall Street opening, as the fresh fears of the potential new Omicron lockdowns and early US tapering spread, damaging the US equity market and the risk-sensitive Sterling. Cable now trades at around 1.3560, waving back and forth within the 1.3500 and 1.3600 price range.

On the technical front, GBP/USD’s outlook still seems optimistic as the RSI reads 62.16 which is healthy, and the price action remains above the downward trendline. However, the strong 1.3600 threshold is still present. Cable has to stand firmly above it to prove its thorough comeback.

Resistance: 1.3600, 1.3670

Support: 1.3500, 1.3400, 1.3180

Euro price took a roller-coaster ride during Monday’s trading as the EUR/USD pair declined around 70 pips from the start of the day, but then regained over half of the losses after the US equity market opening, as the major indices dropped sharply due to the Omicron fears and rate hike worries. The pair now settles around the 1.1325 level, and investors are all eye on Tuesday’s ECB Chair Lagarde’s speech to see if Europe will catch up on UK and US’s pace to further cuts its pandemic bond buying plans.

On the technical, the Euro pair managed to cling on its 20 DMA at the moment, eyeing the next resistance at its 50 DMA, and then 1.14. The RSI indicator remains around the average line, showing no directions amid a light trading day. As previously mentioned, the pair must breached the key 1.1400 resistance to claim a meaningful rebound. On the flip side, a slip below the 1.1200 support may indicate a resume of the selling streak.

Resistance: 1.1400, 1.1620, 1.1700

Support: 1.1200, 1.1000, 1.0780

Proceeding its Friday’s rally, gold again stepped on the 1800 threshold during the panicking selloff at the start of Monday’s US equity tradings. The pair now trades at $1,801 per troy ounce, advanced a mild 0.2% than its open price. The upside traction of the yellow metal is expected to last in the short term, as the fresh Omicron fears and the unstable stock markets will flock the investors back to the safe assets.

As to technical, gold finally made itself to the $1,800 thanks to yet another day of US market plummet. The fresh risk-off mood further pushes gold toward the next resistance at the 200 DMA, which it failed to breach latter the day as the market mood improved in the second half of the trading period. The RSI for gold remains lingering around the average line, suggesting a lack of direction in this spot. Generally speaking, a firm daily close above the $1,800 resistance, better above the critical 200 DMA, would suggest more gains ahead for the XAU/USD pair. Conversely, if the pair failed to cling on $1,800, a short-term support will appear at $1,785 and the next support level will be at $1,765 once it plummeted further.

Resistance: 1830, 1860

Support: 1785, 1765, 1720

Economic Data:

|

Currency |

Data |

Time (GMT + 8) |

Forecast |

|

|

AUD |

Building Approvals (MoM) (Nov) |

08:30 |

-0.5% |

|

|

EUR |

Unemployment Rate (Nov) |

18:00 |

7.2% |

|