Market Focus

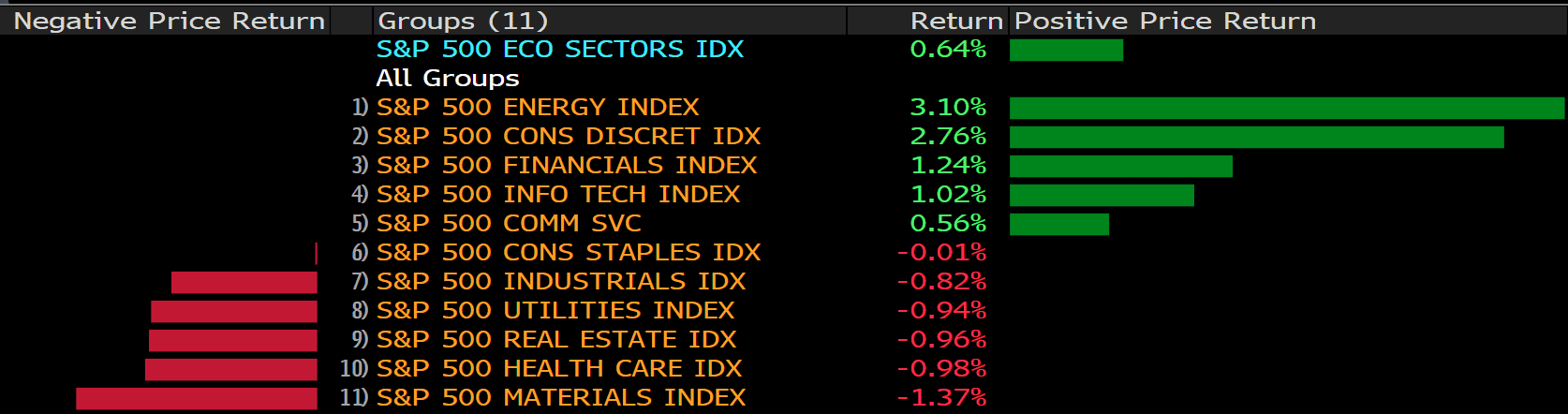

The broad U.S. equity market kicked off 2022 with modest gains. The Dow Jones Industrial Average closed 0.68% higher to close at 36585.06, the S&P 500 gained 0.64% to c;pse at 4796.56, and the Nasdaq composite advanced 1.2% to close at 15832.8. TSLA and many Chinese EV companies enjoyed strong gains as EV delivery figures pleasantly surprised market participants; while vaccine shares, such as MRNA (Moderna) and other bio-tech firms suffered as market participants reassess COVID threats.

The Federal reserve is expected to enact its first rate increase in roughly two months. The sudden increase in the U.S. 10 year treasury yield over yesterday’s trading showed early signs of how markets could move once the world enters Fed’s rate increase environment. As of writing, the U.S. 10 year treasury yield sits at 1.623%. Among commodities, Gold suffered the most as it dropped more than 1% against the Greenback.

Main Pairs Movement:

Strong U.S. equity markets performance, combined with large yield increases, strengthened the Greenback against other major currency pairs. The Dollar Index advanced more than 0.5% over the course of yesterday’s trading.

Cable lost more than 0.4% over the course of yesterday’s trading as the Dollar gained demand. RSI for Cable remains strong at 59. Further bearing sentiment surround the pair, however, as the Dollar continues to rise against other currencies.

The Euro suffered against the Dollar as well. With the ECB’s unwillingness to increase interest rates to control inflation, the Dollar shall continue to gain against the Euro as the Fed begin to increase interest rates towards the end of Q1.

Gold dropped more than 1% over the course of yesterday’s trading. The flash drop caught investors off guard overall market sentiment remains somewhat risk off. As of writing, Gold has gained back some lost ground, but the precious metal has resumed trading around the 1800 region.

Technical Analysis:

Cable surprisingly plummeted at the first trading day of the year as the greenback soared amid a sudden rise of the US Treasury yields. The GBP/USD pair failed to hold above 1.3500 and tumbled, reaching 1.3430, the lowest level since last Wednesday. Cable remains near the daily low, under pressure of a stronger US dollar across the board.

On the technical front, Cable has clearly broken the key 1.3500 level and probably opened another downtrend if it doesn’t bounce back at the end of the day. The RSI indicator slipped sharply from near the overbought level to approaching the average line, showing that a strong selling power is oppressing the pair’s recovery attempts; however, the price action remains above the 20 and 50 DMA, added that the key 1.3400 has proven robust in the previous tests, there are still chances that the Cable’s overall rebound will continue.

Resistance: 1.3500, 1.3570, 1.3670

Support: 1.3400, 1.3180

EURUSD (Daily Chart)

Like Cable, the EUR/USD pair experienced a flash drop amid the first half of the American session, but unlike its British peer, the shared currency didn’t regain its lost ground in the short run. Even worse, EUR/USD continues to fall as the inflation fears are more worrisome on the mainland amid ECB’s dovish stance toward its monetary policies.

On the technical, the price action of the pair retreated back below all of its major moving averages. The RSI indicator also fell under the average line, indicating a bearish sentiment weighing on. The next support level lies at 1.2000, still 86 pips ahead. On the flip side, the pair must breached 1.1400 resistance to prove a convincing comeback.

Resistance: 1.1400, 1.1620, 1.1700

Support: 1.1200, 1.1000, 1.0780

Gold plummeted at the start of the year as the revived risk-on sentiment shown in Monday’s equity tradings. The price of the yellow metal plunged over $20 ahead of the Wall Street opening and soon slid another $10 as the US Treasury yields continued to rise. At the moment, XAU/USD settles around the key level $1800, losing most of the gains from the previous days and waiting for further catalyst.

As to technical , gold seems to lose directions as it went back to $1800, where most its moving averages lie and away from either its resistances or supports. The RSI indicator went back to the average line, showing the lack of momentum in the price action. Looking forward, the looming rate hike has been a huge headwind weighing on Gold, the yellow metal will have to breach the long-term downtrend to prove a upward traction is still available.

Resistance: 1830, 1860, 1900

Support: 1765, 1725, 1680

Economic Data:

|

Currency |

Data |

Time (GMT + 8) |

Forecast |

|

|

USD |

ADP Nonfarm Employment Change (Dec) |

21:15 |

400K |

|

|

USD |

Crude Oil Inventories |

23:30 |

-3.400M |

|