Market Focus

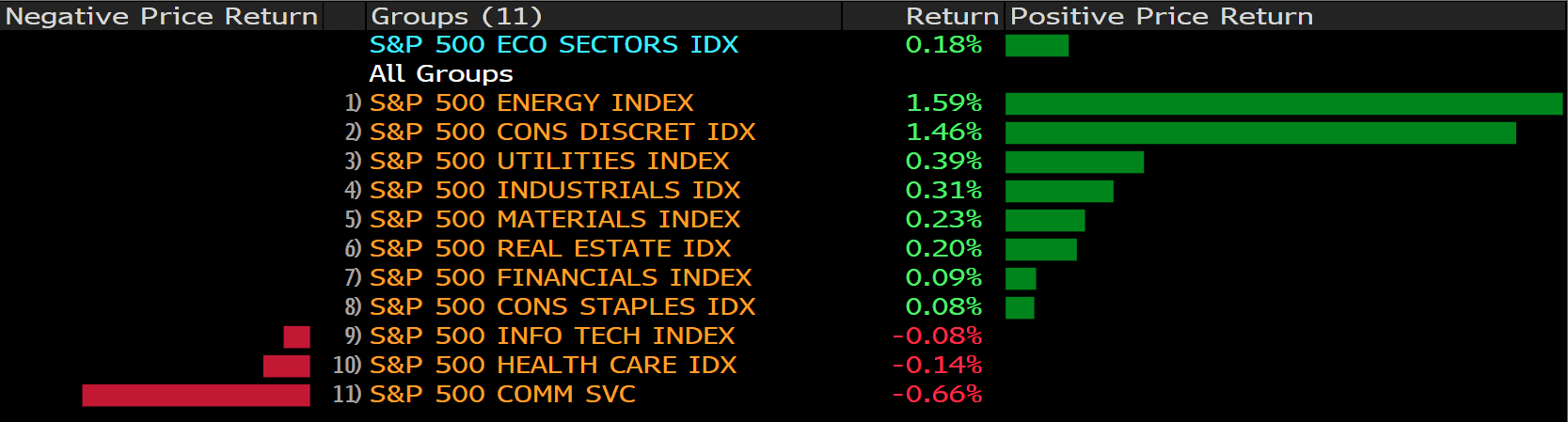

Wall Street stocks rose slightly on Monday, continuing the recent record gains of major stock indexes. The S&P 500 Index rose 0.2%, the Dow Jones Industrial Average rose 0.3%, and the Nasdaq Index rose 0.6%. The gains pushed the three indexes above the all-time highs set on Friday. As U.S. crude oil prices rose 0.6%, more than 65% of the S&P 500 stocks rose, and energy companies led the gains, with a year-to-date increase of more than 75%. Exxon Mobil rose 1.8%. Companies that rely on consumers to directly consume goods and services constitute a large part of the index’s earnings. Tesla rose 8.5% and Starbucks rose 3.5%.

More than half of the companies in the benchmark S&P 500 index have already announced their results. Analysts expect that by the time the report is completed, overall profits will increase by 36%. Another 167 companies in the index will report their performance this week. Investors will also pay attention to another Fed policy meeting, which is considering how to end the special support measures for the economy. The central bank will issue its latest statement on Wednesday. Besides, Investors will also get another update on the job market when the Bureau of Labor Statistics releases its report for October on Friday.

Main Pairs Movement:

Compared to the last trading of October, most currency pairs got some respite on Monday. The benchmark 10-year U.S. Treasury bond yield is trading sideways at around 1.5%, but investors are still concerned about the flattening yield curve.

The EUR/USD faced heavy bearish pressure last Friday and erased all gains after the European Central Bank (ECB) meeting on Thursday. On Monday, the currency pair finally found support near the 2021 low of 1.1524 in early October, and rebounded by about 0.58%, breaking through the 1.16000 level.

The cable traded around 1.3660, the lowest level since mid-October, and was pressured by the renewed concerns about Brexit and the overall strength of the U.S. dollar.

Technical Analysis:

The pair EUR/USD advanced on Monday, ending its slide that happened last Friday. The pair was trading lower in early Asian session and dropped to a daily low under 1.155 area. But the bearish momentum didn’t persist as the pair rebounded back above 1.157 level during European session. The recent strength witnessed in EUR/USD is manly due to weaker US dollar across the board, as the risk-on market sentiment put some pressure around the safe-haven US dollar and assisted the EUR/USD pair to move higher.

For technical aspect, RSI indicator 44 figures as of writing, suggesting tepid bear movement ahead. But for the MACD indicator, the negative histogram starts to diminish which indicates a possible upward trend for the pair. If we take a look at the Bollinger Bands, the price rises from the lower band after touching it, so the price might move up toward the moving average, which means that the bullish momentum is likely to persist. In conclusion, we think market will be bullish as long as the 1.1546 support holds. The pair is now heading to test the 1.1624 resistance line.

Resistance: 1.1624, 1.1669, 1.1692

Support: 1.1546, 1.1524

The pair AUD/USD advanced on Monday, attracting some dip-buying and trading around daily tops at the time of writing. The pair was trading lower in early Asian session, but then started to see some buying and climbed toward 0.752 area. The US dollar struggled to preserve its modest intraday gains and pulled back below 94.00 level, which underpinned the riskier aussie and assisted the AUD/USD pair to find support. AUD/USD was last seen trading at 0.7533, posting a 0.21% gain for the day. Market focus now shifts to RBA’s interest rate decision, which is scheduled to release on Tuesday.

For technical aspect, RSI indicator 56 figures as of writing, suggesting tepid bull movement ahead. As for the MACD indicator, the negative histogram starts to diminish which indicates a possible upward trend for the pair. Looking at the Bollinger Bands, price is rising from the lower band and crossing above the moving average, as a result, the upper band becomes the profit target. In conclusion, we think market will be bullish as the pair is heading to test the 0.7556 resistance, a break above that level will open the door for additional near-term profits.

Resistance: 0.7556, 0.7618

Support: 0.7454, 0.7379, 0.7227

The pair USD/CAD declined on Monday as investors looked past Friday’s downbeat Canadian GDP print for August. The pair was trading higher during Asian session, but failed to preserve its bullish momentum. USD/CAD was surrounded by selling pressure and dropped to a daily low in American session. The higher oil prices continue to support the pair with expectations that OPEC+ will slowly increase oil production. On top of that, a more hawkish Bank of Canada pulled forward its expected timeline for interest rate hikes, acting as a tailwind for the domestic currency.

For technical aspect, RSI indicator 44 figures as of writing, suggesting tepid bear movement ahead. As for the MACD indicator, the negative histogram starts to diminish which indicates a possible upward trend for the pair. As for the Bollinger Bands, price dropped below the moving average and moved toward the lower band, which indicates a bear market. In conclusion, we think market will be bearish as long as the 1.2432 resistance line holds.

Resistance: 1.2432, 1.2499, 1.2648

Support: 1.2288, 1.2013

Economic Data

|

Currency |

Data |

Time (GMT + 8) |

Forecast |

||||

|

JPY |

BoJ Monetary Policy Statement |

07:50 |

|||||

|

AUD |

RBA Interest Rate Decision (Nov) |

11:30 |

0.10% |

||||

|

AUD |

RBA Rate Statement |

11:30 |

|||||

|

EUR |

German Manufacturing PMI (Oct) |

16:55 |

58.2 |

||||