Market Focus

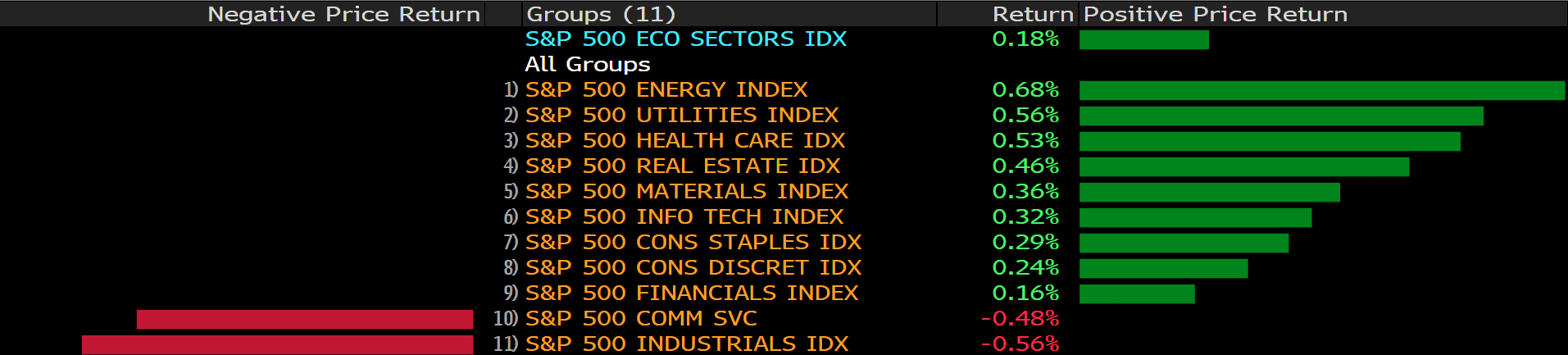

The broad U.S. equity market enjoyed another session of gains fueled by healthy corporate earnings. The S&P 500 and the DJIA notched another record close—the S&P 500 gained 0.18% to close at 4574.79, while the DJIA gained 0.04% to close at 35756.88; on the other hand, the tech heavy Nasdaq gained 0.06% to close at 15235.71. The combination of healthy corporate earnings and rising consumer confidence provides a much needed boost to market sentiments.

Facebook, however, reported earnings that missed analyst estimates. Facebook attributes this quarter’s poor performance to Apple’s revised privacy rules, which have hindered Facebook’s advertisement revenue. Facebook’s share price slid 3.9% after Tuesday’s trading session. Meanwhile, Google reported its highest sales growth in more than a decade and nearly doublings its profit in Q3. Google has attributed strong profit growth to an accounting change that has reduced Google’s depreciation figure thus helping its bottom line.

Coca-Cola, McDonald’s Corp. and Boeing Co. will headline earnings release for 27th.

The U.S. 10 year treasury yield trended lower to 1.618%. The VIX trended slighly higher to 15.98.

Main Pairs Movement:

U.S. consumer confidence rose for the month of October after three straight months of decline. U.S. September new home sales figures also beat analyst estimates and rose for the month of September. The combination of two surprisingly positive economic data has buoyed the Greenback as the Dollar index gained 0.15%.

The Japanese Yen continues to decline against the dollar as market sentiments continue to improve. The Japanese Central Bank’s dovish stance provides no support to the Yen as the Fed continues to turn hawkish. The Euro fared worse against the Aussie dollar as global commodity prices continue to favor the Australian economy. The loonie declined against the dollar as the Greenback gained steam from better than expected economic data.

Technical Analysis:

The USD/JPY pair maintains a moderate bullish momentum on Tuesday, extending its rebound from the 113.40 low hit last Friday. The pair has breached the 114.00 threshold, with the current risk-on mood weighing on the safe-haven JPY, before capped by resistance at 114.30 area.

The Japanese yen has opened the week on a soft tone on the back of a moderate appetite for risk with quarterly earnings reports triggering advances in the world’s major equity markets. Moreover, investors in general don’t hold out much hope on the Bank of Japan’s meetings on Thursday, as their monetary policy policies have long been unchanged. This may further add negative pressure on the yen, especially when it’s compared to the Fed’s hawkish statements.

On the technical front, the daily MACD histogram seesaws around the neutral zone, and the RSI indicator lingers right below the overbought territory, suggesting the upward tractions have encountered some pressures. The key resistance level for further uptrend is at 114.30. If breached, then a fresh yearly high could be anticipated.

Resistance: 114.30, 114.70

Support: 113.02, 111.24, 109.32

The EUR/AUD cross extended its Monday’s loss on Tuesday, and now traded just one step ahead of the key support level 1.5420, where the lows last seen in May sit. After plummeting in the early Asian session, EUR/AUD consolidated drastically within a modest range between 1.5430 to 1.5495. The pair once bounced off the intraday high at 1.5493, but soon failed to find buyers and dipped to the lower price levels amid the American hours.

The market mood remained positive on Tuesday, but leaving some cautious sentiments at the end of the Wall Street trades. Euro posted red against its Australian peers due to the commodities’ price hike. Attentions now shifted to the Australian inflation figures due hours later, and looming ECB meeting on Thursday is also well-anticipated.

On the technical aspect, the MACD histogram remains in the bearish territory, suggesting the selling stream of the cross may proceed. However, the RSI indicator has crossed over the oversold region, indicating a short-term correction may occur before the pair continues its downtrend. On the downside, the May’s low 1.5420 would be a strong support against the bears, followed by 1.5250, the yearly low.

Resistance: 1.5616, 1.5776, 1.5910

Loonie consolidated within the familiar levels on Tuesday, despite the strong demand of the greenback. The pair slid to the daily low at around 1.2350 in the early European hours, but soon bounced back to the 1.2390 level during the American session. Nonetheless, Loonie seems stuck on the levels below the 1.2400 threshold, seeking more catalysts to break through.

The strong US dollar across the board has kept on being the major driver for the rally of Loonie. However, the rising commodity prices are gradually boosting the CAD’s demand and thus weighing on the pair. Looking ahead, Bank of Canada’s rate meetings and the US GDP report are on the table. Investors seem reluctant to place significant bets ahead of the crucial releases.

On the technical front, the daily MACD histogram is almost going to form a golden cross at the moment. The price actions are still hovering around the 61.8% Fibonacci. As above mentioned, some catalysts may be required to break through this awkward situation.

Resistance: 1.2478, 1.2727, 1.2949

Support: 1.2229, 1.2007

Economic Data

|

Currency |

Data |

Time (GMT + 8) |

Forecast |

||||

|

AUD |

CPI (QoQ) (Q3) |

08:30 |

0.8% |

||||

|

USD |

Core Durable Goods Orders (MoM) (Sep) |

20:30 |

0.4% |

||||

|

CAD |

BoC Monetary Policy Report |

22:00 |

|||||

|

CAD |

BoC Interest Rate Decision |

22:00 |

0.25% |

||||

|

USD |

Crude Oil Inventories |

22:30 |

1.914M |

||||

|

CAD |

BOC Press Conference |

23:00 |

|||||