Daily Market Analysis

Market Focus

US equity markets were negative as the bond yields became steady and investors rotated away from the stocks. In the meantime, European markets eked out a gain whilst most Asia shares fell the most in almost three weeks. Among those, Hong Kong equities declined to a 10 correction as it’s decision to temporarily suspend BioNTech vaccines.

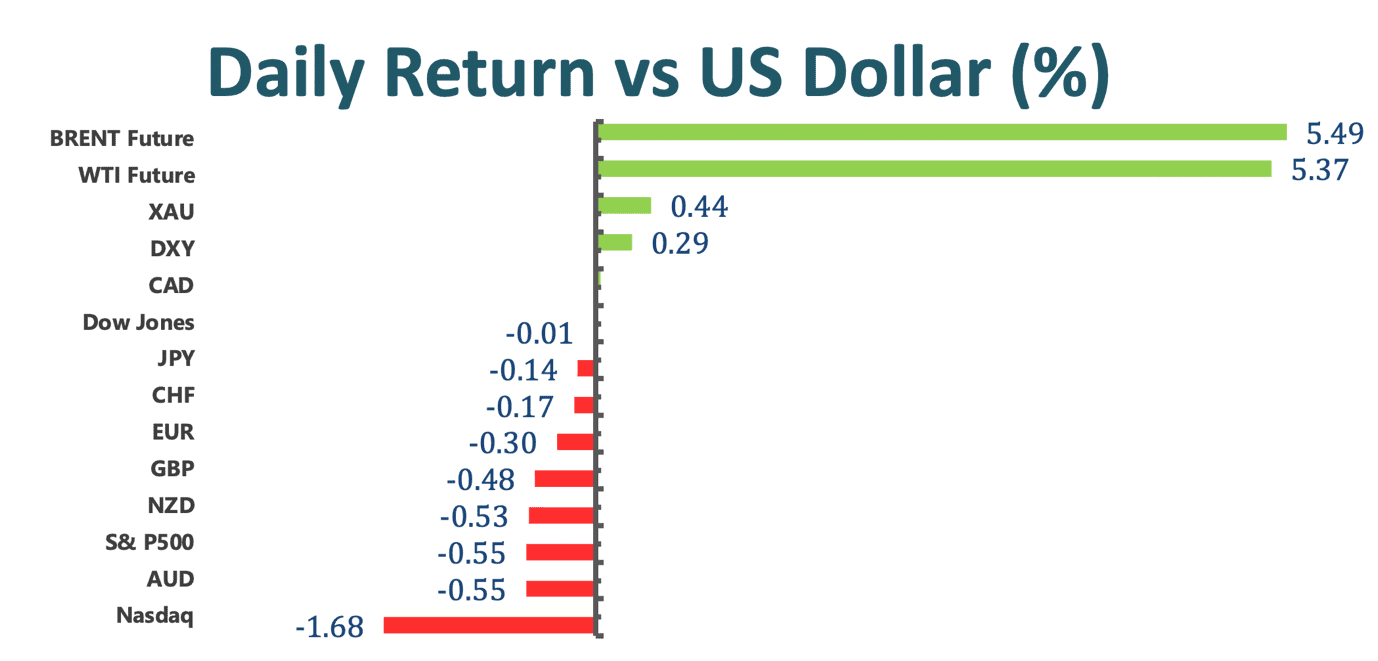

Suez Canal snarled by giant ship has choked the key trade route. As one of the world’s busiest trade routes, it is very vital for the movement of crude oil and consumer goods. According to officials, no progress has been made so far. And the canal may be blocked for days. As around 12% of global trade such as oil shipments need to pass through the canal, this incident may potentially raise oil prices and shipping costs. As a result, oil prices jumped more than 5% today.

German Chancellor Angela Merkel decided to pull the plan for five- day lockdown over Easter. The withdrawal of the lockdown plan essentially meant that Germany remains under restrictions that were loosened before a third wave of infections.

Market Wrap

Main Pairs Movement

Crude Oil gained more than 5% as the blockage of the Suez Canal by a giant container ship is likely to send ripple of disruption through the global energy supply chain. Both US and European refiners that rely on the waterway may need to look for a temporary replacement.

Gold rose with ebbing yields and a disappointing US economic data. The demand for five years notes increased, and it has dropped around 10 basis points this week. With a good bond auction essentially supported gold. As a result, gold climbed about 0.4% today.

The British Pound struggled to close 1.37 against the US dollar as the US dollar gained traction and UK CPI missed estimates about 0.4%; at the same time, the Pound got weakened as the vaccination rollouts could slow down in the UK.

USDCAD declined further south below 1.2576 as oil prices rose above 60 on the back of an improvement in risk sentiment.

Technical Analysis:

USDJPY (Daily Chart)

USDJPY clings to modest daily gains around 108.76, keeping up its momentum within the ascending channel. The pair is confined to a tight range, consolidating in the near -term on the daily chart as it tries to adjust from the recent surge of the US Treasury yields. Since the RSI is still overbought, it is expected to see USDJPY to take a temporary break within the range from 109.45- 107.87. On the upside, the bulls need to contest and penetrate through the resistance of 109.45 to confirm the strength of the recent upside move. To the downside, the bears need to test all the way down to the support of 106.29(Fib. Retracement 33.2% ) in order to break the uptrend. Today, the move of the pair will eye on the US GDP reports and initial jobless claims.

Resistance: 109.45, 111.40

Support: 107.87, 106.29, 104.34

GBPUSD (Daily Chart)

GBPUSD pressures on downbeat mood amid strong US dollar and weak UK CPI report. The pair finally takes a break, trading at 1.37184, but still is in the negative territory after suffering from consecutive days of bearish momentum. On the four hour chart, the RSI is in the oversold consition, below 30, suggesting that it is expected to see a retreat; however, as the MACD indicator is still showing a bearish sign, the pair might continue to trade in the negative mode after the adjustment. To the downside, the bears will confirm if the pair breaks through the next resistance level of 1.3674. On the upside, the bulls need to test all the way up to 1.3868 in order to confirm a bearish- to- bullish momentum.

Resistance: 1.3674

Support: 1.3794, 1.3868, 1.3928

Gold (Daily Chart)

Gold continues to stay in a consolidation phase along with the resistance of 1746.91. The move of gold is likely to be determined whether the resistance level can be broken through. At this point, gold has hovered around the area for more than 5 trading sessions, thus expecting to see a breakthrough as bullish momentums are very strong at this point. At the same time, the MACD indicator also lends support to the bulls while the RSI is still neutral, giving gold rooms to move forward.

Resistance: 1746.91, 1790.23, 1825.24

Support: 1676.89

Economic Data

|

Currency |

Data |

Time (TP) |

Forecast |

||||

|

CHF |

SNB Interest Rate Decision |

16:30 |

N/A |

||||

|

CHF |

SNB Monetary Policy Assessment |

16:30 |

N/A |

||||

|

GBP |

BoE Gov Bailey Speaks |

17:30 |

N/A |

||||

|

EUR |

ECB President Lagarde Speaks |

17:30 |

N/A |

||||

|

USD |

GDP (QoQ) (Q4) |

20:30 |

4.1% |

||||

|

USD |

Initial Jobless Claims |

20:30 |

730 k |

||||