Market Focus

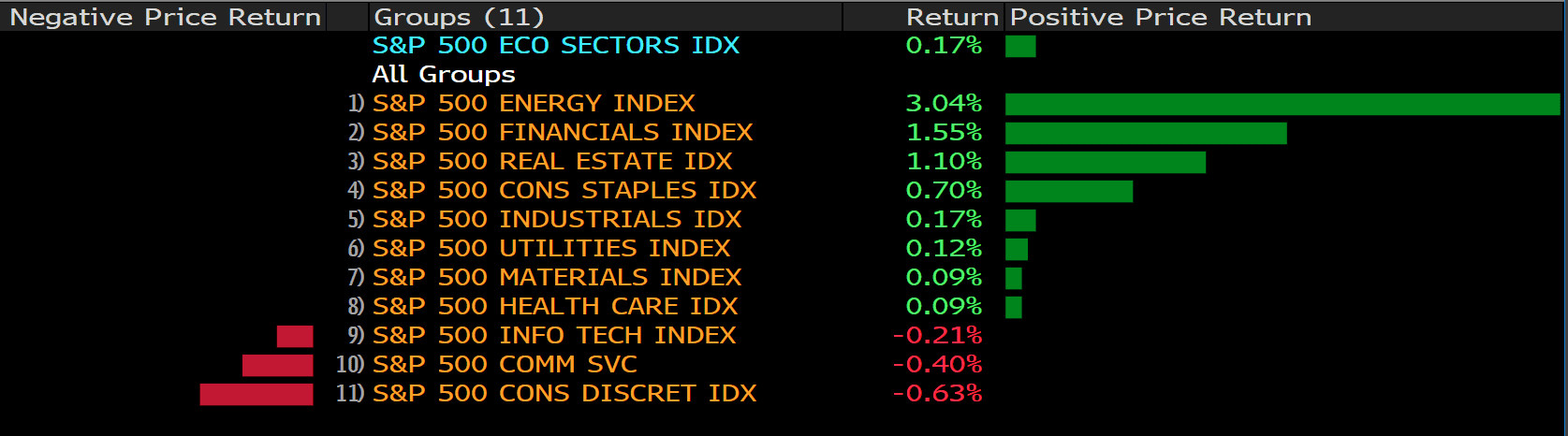

U.S. shares rose on the back of gains in cyclicals, while the technology sector extended losses as rising Treasury yields damped the outlook for growth stocks. The S&P 500 ended the day higher, after swinging between gains and losses in the last hour of trading. The tech-heavy Nasdaq 100 slid, building on Monday’s last-hour selloff. Chinese video meeting corporation Zoom tumbled on signs of slowing growth.

After months of speculation and weeks of apparent hesitation, President Joe Biden has decided to stick with Jerome Powell for the position of the Fed’s chair. He does this despite clear indications that this will anger the left in his party. Some liberals in the closely-divided Senate have already promised to oppose Powell, who was first selected by Donald Trump, when his nomination comes to a vote in the chamber. However, Biden has opted for stability in the Federal Reserve at a time when rising interest rates and continued Covid-related challenges put the US economy in a precarious position.

The president may consider Powell the safe choice, with some Republicans already offering their support. But if Senate Democrats fracture over the nomination, it may make it more difficult for them to stick together to pass Biden’s Build Back Better social spending legislation – a development could have grave political consequences for their party.

Traders pruned bets for a dovish-for-longer Federal Reserve after Jerome Powell was selected for a second term. The chair himself sought to strike a balance in his policy approach, saying the central bank would use tools at its disposal to support the economy as well as to prevent inflation from becoming entrenched.

Main Pairs Movement:

The greenback extended its previous gains, with the dollar index reaching fresh 2021 highs around 96.55. The dismal mood of the equity markets and the higher government bond yields fueled demand for the safe-haven dollar.

EUR/USD bottomed for the day at 1.1226, while GBP/USD fell to 1.3342 amid worrying labor shortage and inflation issues. Bank of England head Andrew Bailey said that the bank may not return to offering a hard form of guidance, according to Reuters. It is not off the table that we give no guidance at all on rates, with decisions to be made meeting by meeting, the governor added, before stating that the UK labour market is very tight.

Commodity-linked currencies performed pretty well on Tuesday with the help of the commodity prices’ rebound. AUD/USD successfully defended its rates against the soaring US dollar, while USD/CAD dropped 0.25% amid a strong pullback of the oil prices.

Gold declined for a forth consecutive day, failing to find support at the key level $1800, and now trading at $1792 a troy ounce. The US 10-year benchmark yield soar to its monthly high at 1.685. Crude oil price surged significantly, with WTI up 2.65% to $78.50 a barrel, and Brent up 3.5% to $82.20.

Technical Analysis:

After previous day’s slide to a sixteen-month lows, the pair EUR/USD rebounded moderately and stays in positive territory on Tuesday. The pair climbed higher and touched a fresh daily high in early European session, but then pulled back towards 1.124 area. EUR/USD surrenders its modest intraday gains, currently rising 0.27% on a daily basis at the time of writing. In Europe, the flash German Manufacturing PMI released today came in at 57.6, which is better than market’s expectations. The upbeat data showed that the manufacturing sector activity in Eurozone’s economic continued to expand and therefore underpinned the EUR/USD pair. On top of that, concerns about rising Covid-19 cases and the re-imposition of lockdown measures keep acting as a headwind for the Euro.

For technical aspect, RSI indicator 38 figures as of writing, suggesting bear movement ahead. As for the MACD indicator, a golden cross just formed on the histogram, which means a short-term upward trend for the pair. Looking at the Bollinger Bands, the price rose from the lower band, therefore the upward trend is likely to persist. In conclusion, we think market will be bullish as the pair is eyeing a test of the 1.1374 resistance, but the prospects for an early policy tightening by the Fed might kept a lid on any meaningful recovery for the EUR/USD pair.

Resistance: 1.1374, 1.1464, 1.1609

Support: 1.1226, 1.1168

The pair GBP/USD declined on Tuesday, continuing to stay under pressure for the third day. The pair touched a daily top near 1.341 in early European session, but then failed to preserved its bullish traction and dropped below 1.335 level. At the time of writing, the cable has rebounded slightly amid weaker US dollar across the board, currently losing 0.09% on a daily basis. Despite an upside surprise from the UK flash Manufacturing PMI report, which rose to 58.2 in November, the cable still undermined by the deadlock over the post-Brexit arrangement in Northern Ireland and fishing rights. As UK threatened to trigger Article 16, which may worsen relations with the European Union and potentially leading to a trade war.

For technical aspect, RSI indicator 39 figures as of writing, suggesting bear movement ahead. Looking at the MACD indicator, the MACD is now sitting below the signal line, which means a downward trend for the pair. As for the Bollinger Bands, the price is moving alongside with the lower band, therefore the downward trend could persist. In conclusion, we think market will be bearish as the pair is now testing the 1.3353 support, a drop below that level could extend the recent downfall to under 1.3300 area.

Resistance: 1.3514, 1.3607, 1.3698

Following its previous rebound from two-week lows near 1.25 area, the pair USD/CAD preserved its bullish momentum and advanced on Tuesday. The pair was trading higher to a daily top above 1.274 during European session, but now has pulled back amid renewed US dollar weakness. USD/CAD was last seen trading at 1.2708, currently posting a 0.05% gain on a daily basis. Oil prices climbed higher to the $78.00 level despite the official announcement by the White House that it will release crude oil reserves. The resurging oil prices lend support to the commodity-linked loonie and dragged the USD/CAD pair lower meanwhile offset most of its intraday gains.

For technical aspect, RSI indicator 69 figures as of writing, suggesting that the pair is in overbought zone, a trend reversal could be expected. Looking at the MACD indicator, the diminishing positive histogram indicates that the pair could experience bearish trend. As for the Bollinger Bands, the price moved out of the upper band first, and dropped right back inside the band, therefore the trend is negated. In conclusion, we think market will be bearish as long as the 1.2775 resistance line holds.

Resistance: 1.2775, 1.2849

Support: 1.2585, 1.2493, 1.2387

Economic Data

|

Currency |

Data |

Time (GMT + 8) |

Forecast |

||||

|

NZD |

RBNZ Interest Rate Decision |

09:00 |

0.75% |

||||

|

NZD |

RBNZ Rate Statement |

09:00 |

|||||

|

NZD |

RBNZ Press Conference |

10:00 |

|||||

|

EUR |

German Ifo Business Climate Index (Nov) |

17:30 |

96.6 |

||||

|

USD |

Core Durable Goods Orders (MoM) (Oct) |

21:30 |

0.5% |

||||

|

USD |

GDP (QoQ) (Q3) |

21:30 |

2.2% |

||||

|

USD |

Initial Jobless Claims |

21:30 |

260K |

||||

|

USD |

New Home Sales (Oct) |

23:00 |

800K |

||||

|

USD |

Crude Oil Inventories |

23:30 |

-0.481M |

||||