October 11, 2021

Market Focus

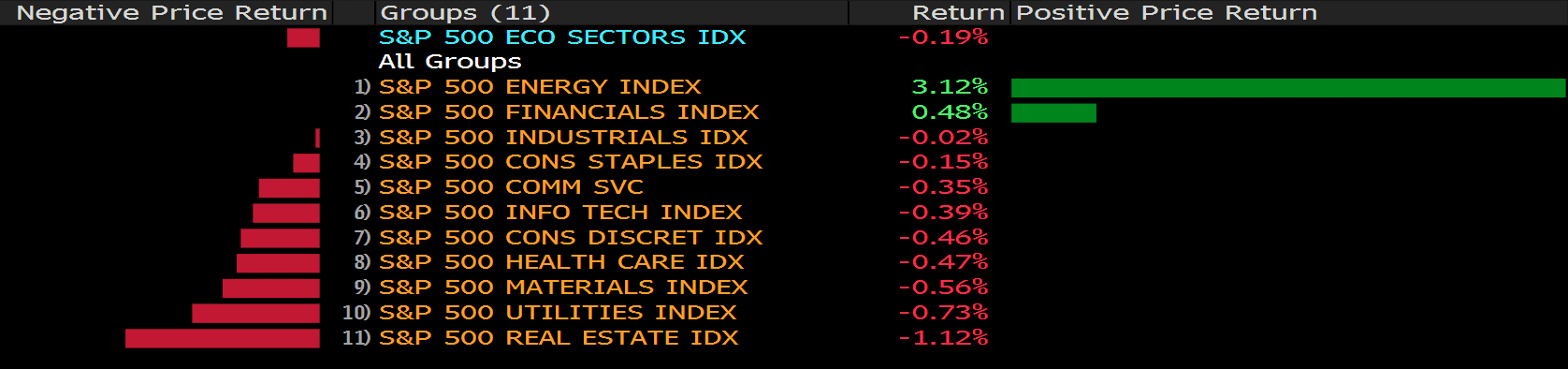

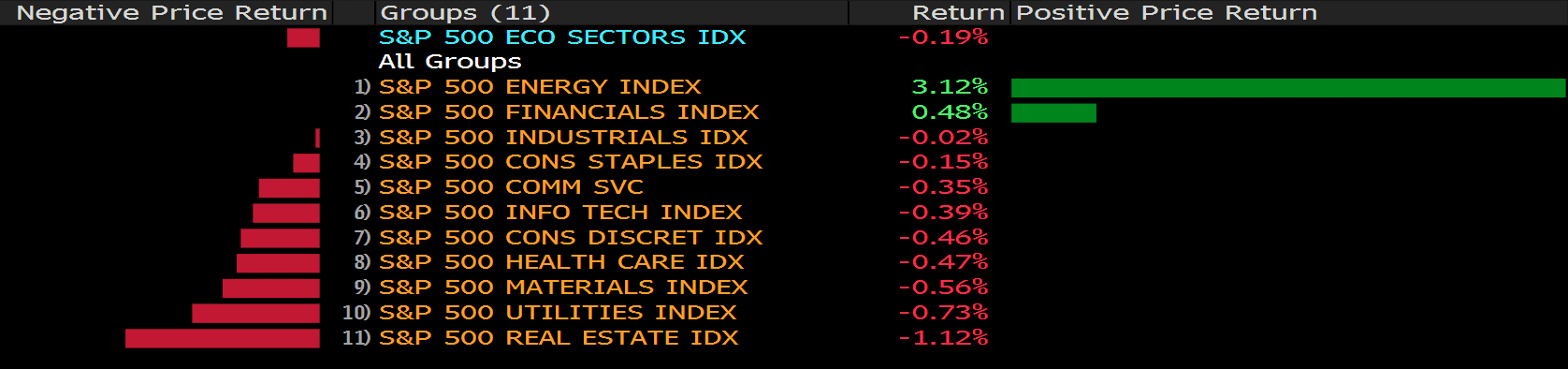

The broad U.S. equity market closed lower on Friday’s trading, but most indices closed the week with gains. The Dow gained 0.8% over the week, the S&P 500 gained 1.2% over the week, and the Nasdaq gained 0.1% over the week. Despite the Senate passing a short-term extension to the debt limit on Thursday, market participants are still affected by the looming concerns over inflation and soaring short term U.S. treasury yields.

Cotton and oil prices have soared over the past week. Cotton have been trading at their highest levels in about a decade, while oil prices has spiked to a seven year high. Soaring commodity prices will weigh on inflation concerns. On the other hand, the U.S. 10-year yield has advanced through 1.6% during Friday, triggering bearing sentiment across markets.

This week’s economic docket is packed with important data releases from Britain and the U.S. The U.K. unemployment rate and monthly GDP will be released during Tuesday and Wednesday, respectively; meanwhile, the U.S. will be releasing CPI and PPI figures over Wednesday and Thursday, furthermore, FOMC minutes will be released on Wednesday as well.

Main Pairs Movement:

The highly-anticipated US Nonfarm Payrolls (NFP) rose by 194,000 in September, missing the market expectation of 500,000 by a wide margin. The greenback came under modest selling pressure after the report released. US dollar index posted a daily low at 93.940.

On a positive note, August’s print of 235,000 got revised higher to 366,000. Further details of the publication revealed that the Unemployment Rate declined to 4.8% from 5.2% in August, compared to analysts’ estimate of 5.1%. Additionally, the Labor Force Participation Rate edged lower to 61.6% from 61.7% and the wage inflation, as measure by the Average Hourly Earnings, rose 4.6% on a yearly basis as expected.

The mixed US data did little to the dollar’s strength. Most of the main pairs remain on the familiar levels, except for USD/CAD plummeting amid the surging oil price, and USD/JPY rising due to the so-called ‘Kishida Shock’, which refers to the Japanese new president Fumio Kishida and his redistribution policies.

XAU/USD lingered around $1750-60 almost a whole day. Though once gold price surged to $1781 right after the NFP released, it was soon back to the thin price range, trading at $1758.20 as of writing. WTI climbed nearly 1% today, once bounced off $80.00, the first time since October 2014. The 10-year US Treasury Yield rose around 2% and breached the 1.600 threshold.

Technical Analysis:

USDJPY (Daily Chart)

Fed’s looming bond taper and the resulting higher Treasury rates are the main order of market business. The USD/JPY will continue to rise as long as Treasury yields push higher. Despite the dismal September job numbers, markets remain convinced that the Fed will keep its word and begin a bond program reduction this year.

The USD/JPY is close to the top of its three year range. Except for the February and March 2020 panic spikes, and a few days in April 2019, the last time the pair spent any time above 112.00 was in the second half of 2018. The area above 112.00 has no recent technical impediments to a rise in the USD/JPY. However, on the flip side, we have an instant support for the pair at 112.00, followed by 110.65, strong resistence during July and Augest, then 109.15, robust support of the pair since June.

Resistance: 114.55 (Oct. 2018 high), 118.60 (Jan. 2017 high)

Support: 112.00, 110.65, 109.15

EURUSD (4 Hour Chart)

The euro is attempting to bounce up from 14-month lows at 1.1535 reaching session highs at 1.158 favored by a weaker than expected U.S. Nonfarm payrolls report. The pair, however, remains on the defensive, after having deprecated about 0.5% in a three-day decline. The greenback is pulling back against its main peers on Friday, weighed by a worse-than-expect in U.S. private employment as well. Furthermore, the unemployment rate declined to 4.8% from 5.2% in Aug.

On the technical, RSI continuing to trim the weakness to higher stage and close around 49, suggesting a neutral market movement ahead. On average side, 15-long indicator has turned it slide to uptrend while 60-long remaing decending movement. For MACD, the indicator keep extend it positive momentum.

On slip side, we expect the last time low, 1.153 level, will give pair a short-term support guidance. If break down the threshold, we foresee the downside support will eye on psychological level at 1.15

Resistance: 1.161, 1.1675

Support: 1.153, 1.15

USDCAD (4 Hour Chart)

Loonie plummet during the New York session, is trading at 1.2475, down 0.58% in the day market, touched lowest stage since July 30 after job report showed that the country has now recovered all of the 3 million jobs lost during the pandemic. Meanwile, the West Texas Intermediate crude oil futures hit $80 per barrel for the very first time since November 2014, whereas the U.S. 10-year Treasury yield is rising and sitting 1.6% as of writing.

From a technical perspective, RSI index has slipped into over sought territory where sitting 24.3 as of writing, suggesting overly sell off sentiment at the moment. On moving average indicator, 15- and 60-long indicator still retaining downside movement.

Since loonie rapidly break through a critical support at 1.25, we expect next downward support will be last July low at 1.2425. On up side, psychological level at 1.25 will turn into a pivotal resistance for short-term, 1.256 behind.

Resistance: 1.25, 1.256

Support: 1.2425, 1.23

Economic Data

|

Currency

|

Data

|

Time (GMT + 8)

|

Forecast

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|