Daily Market Analysis

Market Focus

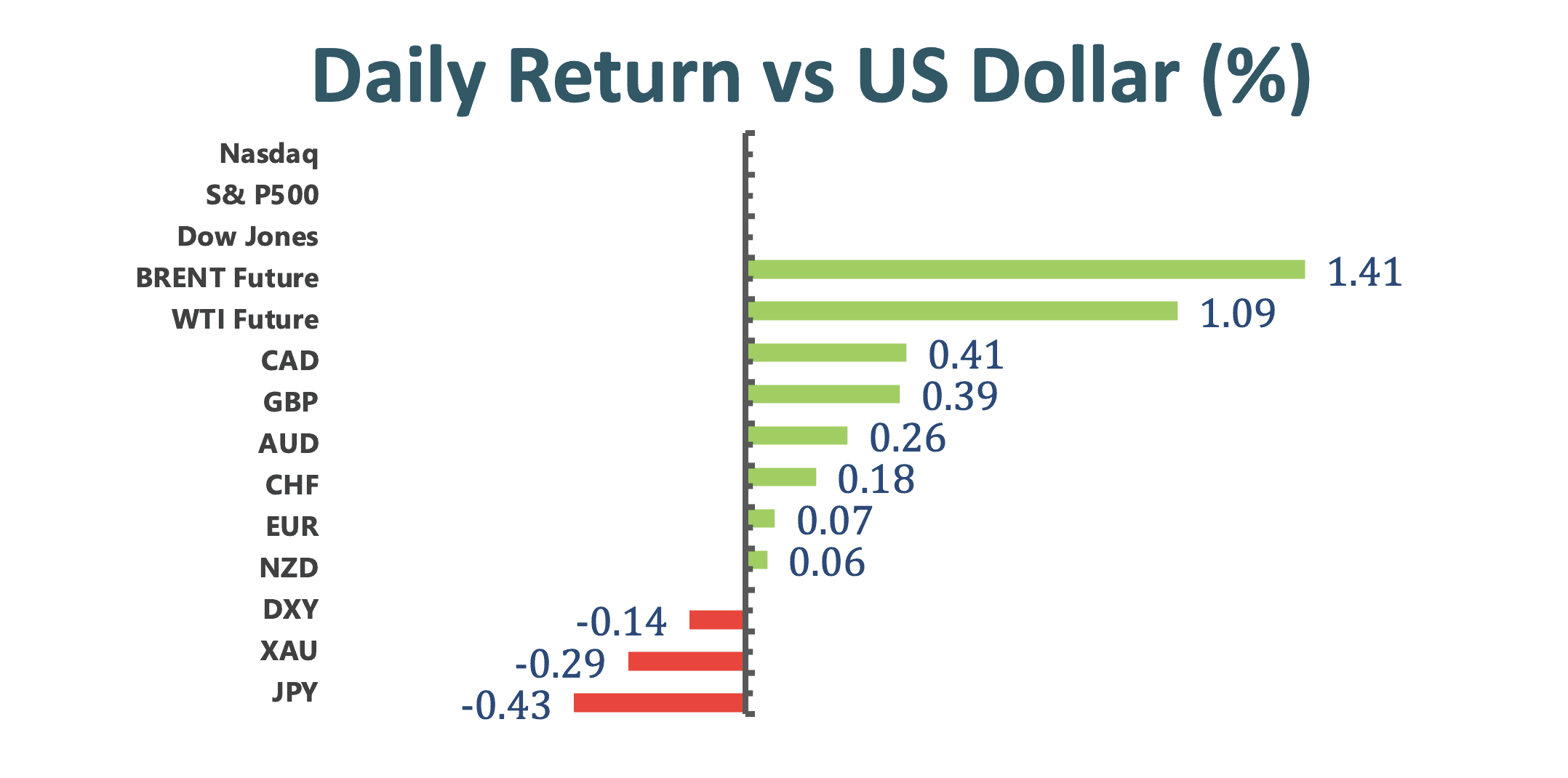

Global stocks and US equity futures rallied as investors took comfort in progress on the Covid-19 vaccine rollout, while freezing temperatures in Texas and across the American South roiled energy markets. The dollar weakened, and US and Canadian stock markets were closed for national holidays.

The FTSE 100 Index finished up 2.5% and the pound strengthened after the UK recorded 15 million vaccinations against coronavirus. Japan’s Nikkei 225 Stock Average topped 30,000 yen for the first-time since August 1990 on data showing the economy is charging ahead.

Meanwhile, an Arctic blast in the US threatened to disrupt energy supplies, sending crude oil to a 13-month high. Texas began rolling power blackouts for millions of households for the first time in a decade and traders estimate a few hundred thousand barrels a day of output in the state may be impacted by well shutdowns, traffic jams and power outages. West Texas intermediate futures rose 1.5%.

Several major markets didn’t trade on Monday. The US is shut for the Presidents Day and exchanges in China and Hong Kong were closed for the Lunar New Year Holiday.

Market Wrap

Main Pairs Movement

USDJPY has enjoyed a spell on the bid in a significant retracement of the monthly bearish trend; however, the following is a top-down analysis that illustrates the mountain that the bulls still have to climb.

The Aussie pair trades near 0.7780 as boosted by the broad-based greenback weakness, near multi-year high of 0.7819. RBA’s meeting minutes will shed some light on the latest decision to extend QE.

The Loonie is showing some strong, bullish sign on Monday, largely driven by strengthened crude oil prices, a risk-on sentiment and following strong Canadian economic data.

The barrel of WTI finally breaks above $60.00, risk-on sentiment kept the recent rally rolling. The API, EIA reports are next on tap later in the week.

The DXY begins the week on a soft note, retracing back to the 90.30 level, weighing down by the market expectation of President Biden pushing a huge stimulus bill in the foreseeable future.

Technical Analysis:

EURUSD (Four-hour Chart)

EURUSD remained confined between 1.2116 and 1.2145 on Monday. Optimism surrounding vaccine news and fresh hope on US stimulus kept the market on risk-on sentiment. Although European industrial output missed the market estimates, the market largely ignored the news, and the Fiber pair has been trading solidly above 1.2100 level. From a technical perspective, the bullish momentum of EURUSD is supported by the 15-Day SMAVG and MACD. On top of that, the 50ish RSI indicates that there is still room for the pair to further extend its upward trend. If the EURUSD can penetrate 1.2145 resistance, then the next resistance can be found at 1.2163 and 1.2181. Conversely, the most immediate support levels for the pair are 1.2116, 1.2086, and 1.2060.

Resistance: 1.2145, 1.2163, 1.2181

Support: 1.2116, 1.2086, 1.2060

GBPUSD (Four-hour Chart)

GBPUSD continues to advance further as it has reached a 34-month high above 1.3900 price zone today. The main driver for the Cable’s strong bullish trend is the vaccination milestone that UK just achieved, which is 15 mil people have officially been vaccinated. The broad-based weakness on the greenback also boosted the Cable pair to steady near the multi-year high. USD is struggling to gain demand as the markets are hopeful that US President Biden would pass a large relief package after the trial of former US President Trump ended. The bullish Cable is supported by the 15-Day SMAVG and MACD histogram. However, with a RSI that has topped the overbought region, a downward correction seems likely. If the Cable can find acceptance above the 1.3913 resistance level, the next resistance can be seen at 1.4026. Conversely, 1.3851, 1.3787, 1.3741 are the nearest support for GBPUSD.

Resistance: 1.3913, 1.4026

Support: 1.3851, 1.3787, 1.3741

XAUUSD (Four-hour Chart)

Not only did the risk-on sentiment across the globe continue to weigh down on the yellow metal, but the broad-based greenback weakness also failed to lift XAUUSD above key resistance level near $1830. Given that the markets today have digested and reflected the expectation for a big US stimulus bill, it remains unknown in terms of whether the additional USD flow would push the XAUUSD higher because the broad-based greenback weakness was not reflected significantly on Monday’s price action. From a technical perspective, the bears are taking the advantage now as a death cross has been formed in the past hour, and at the same time, the low 40s RSI reading is suggesting a slightly bearish bias is solidifying. If the bears can break below the key $1815 support that has been tested multiple times since last week, then the next support level can be seen around $1804. Conversely, key resistance awaits at $1828, followed by $1837.

Resistance: 1828, 1837, 1846

Support: 1815, 1804

Economic Data

|

Currency |

Data |

Time (TP) |

Forecast |

||||

|

AUD |

RBA Meeting Minutes |

08.30 |

– |

||||

|

EUR |

German ZEW Economic Sentiment (Feb) |

18.00 |

59.6 |

||||